Ethereum holders prepare for Shanghai hard fork, will Ethereum token unlock be delayed?

- Ethereum blockchain’s Shanghai hard fork is scheduled to take place on April 12.

- Shanghai upgrade will automatically unlock ETH rewards for validators, but staking pools and services can determine when to release them.

- Ethereum price reclaimed a key support zone between $1,700 and $1,780 on Wednesday; holders are bullish given the lack of resistance.

Ethereum Shanghai hard fork is planned to go live on April 12. This is the most significant event since the altcoin’s transition to Proof-of-Stake, widely known as the Merge. While Shanghai will unlock the staked ETH for validators, users of a staking service or pool will have to wait until the project decides to release the unlocked tokens to them.

ETH holders anticipate a delay in token unlock post the Shanghai hard fork

Also read: Ethereum price targets rally to $2,000 ahead of ETH token unlock

Ethereum Shanghai hard fork going live on April 12

Ethereum Shanghai hard fork is upon us and validators are awaiting the ETH token unlock with much anticipation. Validators that have been part of Ethereum’s security mechanism will be able to withdraw their ETH holdings for the first time since the ETH2 deposit contract went live.

Analysts on crypto Twitter have speculated for a long time whether there will be a spike in selling pressure on the altcoin. There are two key points here:

- Validators who withdraw a portion of their stake can do so immediately

- Validators who wish to unlock their entire 32 ETH stake need to wait one to 36 days to do so.

The delay in withdrawal is likely to dampen the potential sell pressure. ETH token unlocks are therefore likely to be delayed for those who staked their ETH with staking services or pools. Different staking providers have announced their timeline for ETH token unlock and withdrawals over the past few weeks.

Coinbase announces withdrawals will be enabled within 24 hours of upgrade

Coinbase runs a staking service and the exchange announced in March that it will process withdrawal requests about 24 hours post the completion of Shapella.

The exchange platform’s tweet reads:

All unstaking requests are processed on-chain, and we’ll pass the unstaked funds and staking rewards to you once released by the Ethereum protocol.

Lido users to wait for ETH withdrawal until mid-May

Lido, one of the largest liquid staking protocols in the crypto ecosystem, informed its users that holders of stETH (staked ether) need to wait until mid-May. stETH holders need to wait until the protocol goes through a scheduled upgrade, till the platform completes requisite security checks.

In addition to this, stETH withdrawals won’t launch on mainnet until all audits concerning on-chain code are completed (expected end of April).

— Lido (@LidoFinance) March 14, 2023

Adding another 2 weeks as a safety margin, the current expectation is for mainnet withdrawals to be live around mid May.

Ethereum price continues to tackle the selling pressure in the ecosystem and reclaimed a key crucial support zone on Wednesday.

Ethereum climbs above crucial support zone; here’s what to expect

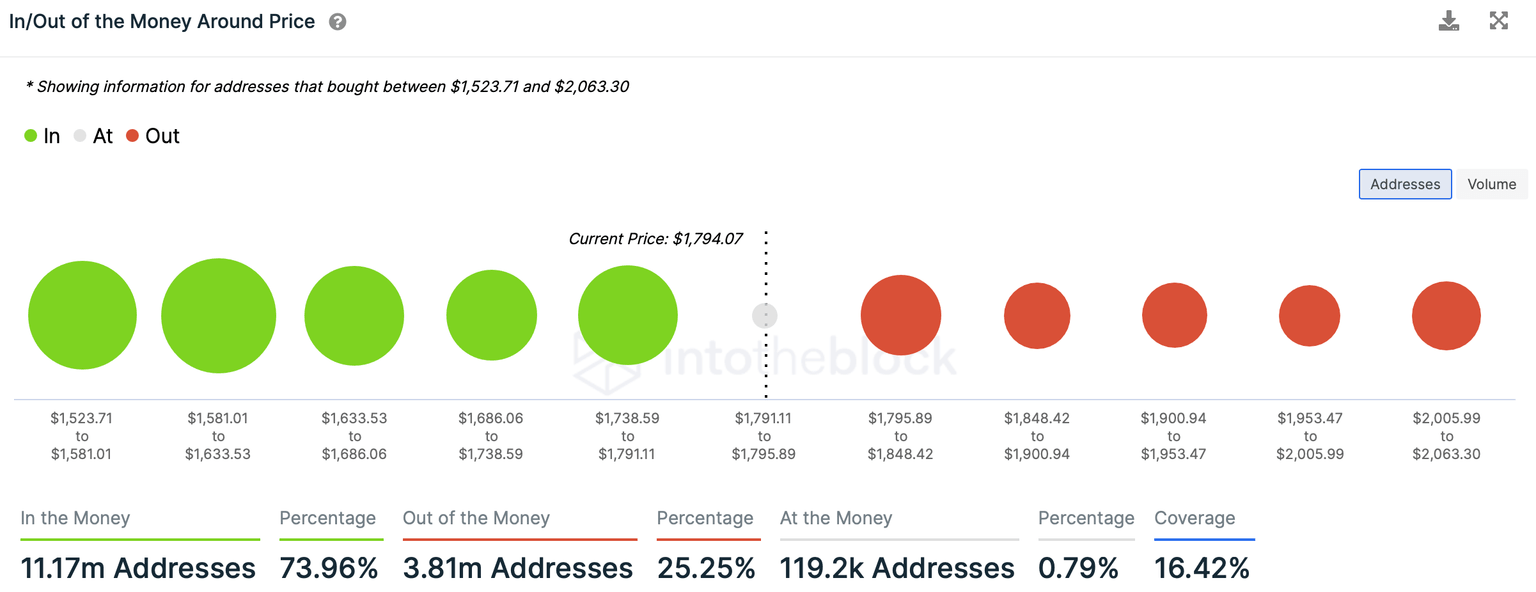

With the altcoin’s price back above the support area between $1,700 and $1,780, where 1.41 million addresses that bought 6.48 million ETH, experts predict further upside in the altcoin.

Ethereum price crosses crucial support at $1,780

As long as Ethereum price holds above the $1,780 level, it is reasonable to expect a rally in the second-largest cryptocurrency, given the lack of resistance until the big psychological resistance at $2,000. This is a key level for ETH to hold, bulls are likely to defend $1,780 and support a run up to the $2,000 level.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.