Analysts turn to Ethereum rivals hunting for next altcoin with 2x gains

- The crypto analyst who called the 2018 Bitcoin bottom is bullish on two altcoins that are poised for a breakout.

- Crypto market participants are hunting for the next 2x altcoin, after Bitcoin and Ethereum yielded massive gains over the past week.

- The expert argues that the ETH/BTC bottom is either in or extremely close, this is conducive to altcoin price rallies in the short term.

A crypto analyst who rose to fame for timing the 2018 Bitcoin bottom accurately, @Bluntz_Capital believes Ethereum alternatives and rival altcoins could yield 2x gains in the short term. The expert’s top picks are Fantom (FTM) and Frax Share (FXS), and he has identified bullish potential in these altcoins.

Also read: Ethereum Layer 2 rat race intensifies, here's how to benefit

Crypto analyst identifies altcoins primed to offer 2x gains

A crypto expert who gained popularity after predicting the 2018 Bitcoin bottom that the asset formed prior to its 2019 bull run. In the year 2018 when financial institutions like the US Federal Reserve were easing interest rates, Bitcoin price broke out higher after a bottom formation.

The 2018 Bitcoin bottom was therefore key to traders who booked profits in the asset’s 2019 bull run. Bluntz_Capital, a crypto expert and analyst recently noted that ETH/BTC bottom is either in or extremely close and informed his 221.9K followers that Ethereum is in the “buy zone” now.

In a 2022 tweet, the expert argued that if ETH/BTC ratio gets to 0.062 in Q1 2023, it affirms that the altcoin is in the buy zone. Typically, when an ETH/BTC ratio gets close to the bottom, there is a subsequent rally in altcoins, as seen in previous market cycles. This supports Bluntz_Capital’s bullish thesis for altcoins.

eth/btc 0.062 ✅

— Bluntz (@Bluntz_Capital) March 21, 2023

Q1 ✅

Bluntz now an ETH maxi ✅ https://t.co/nUf0Q1ApGx

Bluntz_Capital shared his optimism on Ethereum and his two altcoin gems with bullish potential. The analyst believes that Fantom (FTM) and Frax Share (FXS) are the two altcoins that are most likely to witness a bullish breakout in the short-term.

Why FTM and FXS?

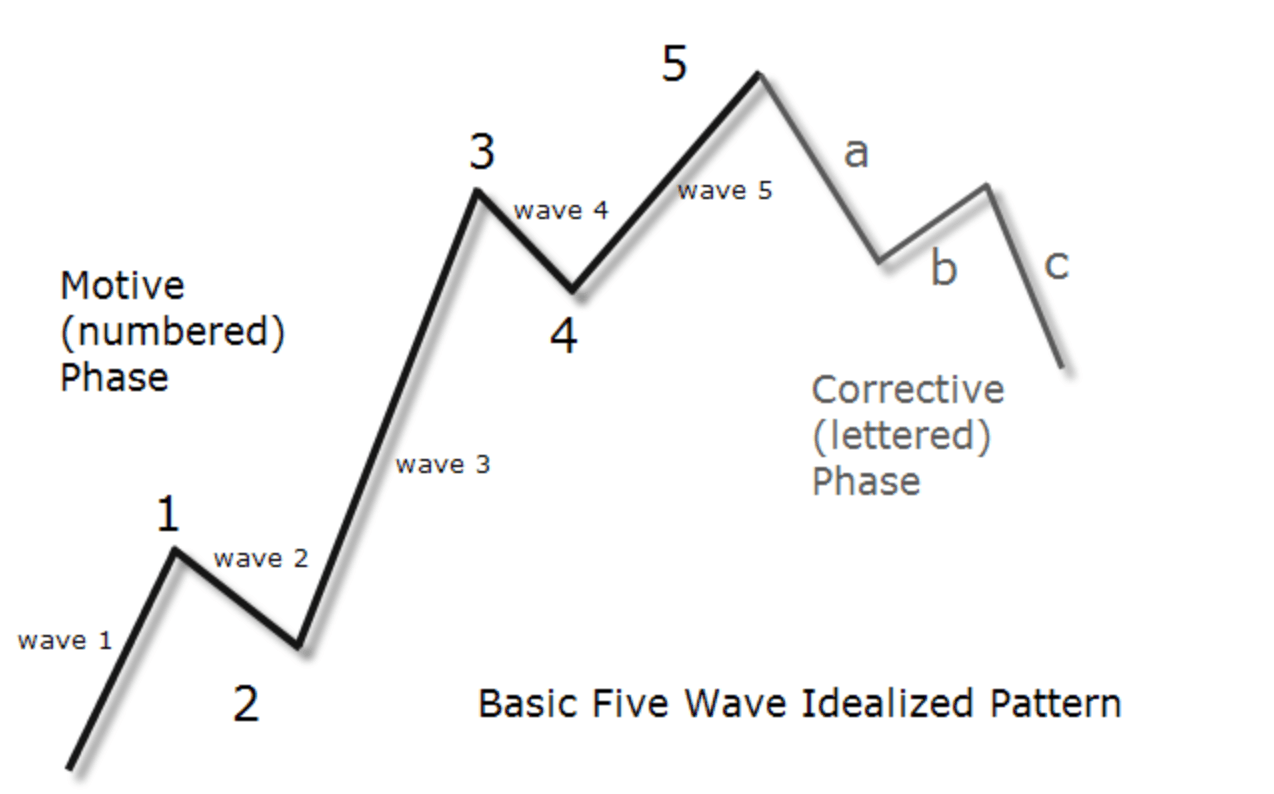

The technical expert uses Elliott Wave (EW) analysis to identify altcoins that have bullish potential. According to EW, a trending market moves in a five-three wave pattern, the first five waves are in the direction of the larger trend. After completion of five waves in one direction, a larger corrective move is expected in three consecutive waves. The second set of waves (corrective ones) are represented using letters and the first five using numbers.

Basic Elliott Wave Pattern

The analyst applied EW to FXS where five waves rose from the lows and three moved back down to the 61.8% Fibonacci Retracement level. Bluntz_Capital expects a trend continuation in FXS, upwards of 40% gains in the altcoin.

FXS/ USDT price chart

In the case of FTM, the expert recommends a long position in altcoin after noting a 17% dip, as seen in the price chart below.

FTM/USDT price chart

FTM completed its Elliot Wave pattern and the expert predicts a rally in the Ethereum rival in the short-term.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.