Ethereum ETFs receive approval in Canada as ETH price looks to retest all-time highs

- Canada’s Ontario Securities Commission approved three Ethereum ETFs on April 20.

- This move comes after the recently launched Bitcoin ETF surpassed $1 billion in AUM.

- Ethereum price looks to surge 15% to retest recently set up highs around $2,548.

Ethereum price is looking to climb higher as three new ETFs gain approval in Canada, pushing ETH adoption to another level.

Canada takes lead

Canada’s Ontario Securities Commission approved Ethereum Exchange Traded Fund (ETF) for CI Global Asset Management (ETHX), Purpose Investment (ETHH), and Evolve ETFs (ETHR) on Monday.

This move comes after Purpose Investment’s Bitcoin ETF, launched in February, crossed the threshold of $1 billion in assets under management (AUM). Hence, the addition of three new ETFs has put Canada at the forefront of the cryptocurrency race.

Canada's decision comes when Ethereum is gaining mainstream adoption as PayPal-owned Venmo recently announced that it would allow its users to purchase BTC, ETH and other cryptocurrencies.

Although the DeFi Summer and the ongoing bull run helped put ETH in the minds of institutional investors, the ETFs will attract institutions and high net worth individuals toward the programmable money, Ether.

While Canada leapfrogs ahead of the US, Chinese tech giant Meitu seems to be taking the high road as it invested millions in purchasing ETH and BTC. While MicroStrategy, Tesla and others hopped on the Bitcoin bandwagon, Meitu is the first Chinese listed company in the world to purchase large quantities of ETH.

Ethereum price shows signs of quick rally

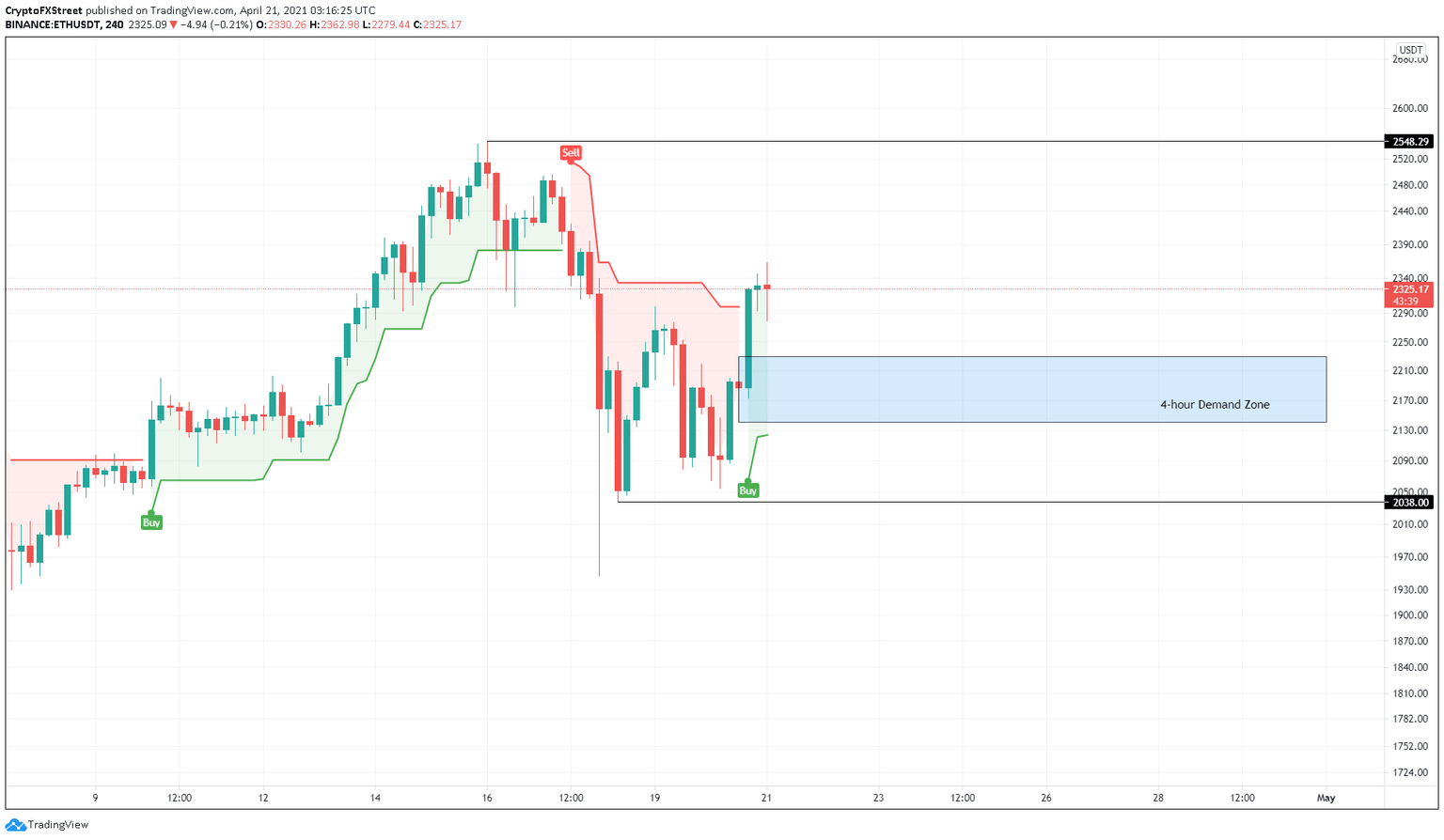

Ethereum price stabilized around the swing low at $2,038 and bounced 13% to $2,324, where it is currently trading. This surge has created a higher high and suggests a shift in trend. Now, ETH could be on its way to retest its all-time high at $2,548.

The demand zone that extends from $2,140 to $2,230 will play a pivotal role in helping Ethereum price scale up. A bounce from this level confirms ETH’s bullish outlook and sets the stage for a 15% upswing.

The recently spawned buy signal from the SuperTrend indicator adds credence to this bull rally.

ETH/USDT 4-hour chart

If the retest of the said demand barrier fails to hold, and Etheruem price produces a decisive close below $2,140, it would invalidate the bullish thesis and kick-start a bearish one. In such a scenario, investors can expect ETH to retest the swing low at $2,038 and even $1,946 under extreme conditions.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.