Dogecoin price undergoes setback as Moscow ignores Ukraine’s peace offer

- Dogecoin price had its best rally in over a year on news Ukraine was giving up on NATO membership bid.

- DOGE price saw profit-taking during ASIA PAC , with first-in traders stealing the winnings ahead of their US.

- Expect to see further losses with a break below $0.1137 and a dip towards the low of February to $0.1067

Dogecoin (DOGE) price has profited from the global relief rally yesterday which began in the ASIA PAC session, and then both EU and US traders were more than happy to take over into the US close. The rally got sparked in the early hours by comments from Ukraine that they were willing to meet Russia halfway on its demands. Sentiment started to fade, however, in early trading hours as Moscow remained silent and did not welcome or comment on the extended olive branch from Ukraine.

Dogecoin price in the dark on what Russia will do next

Dogecoin price saw its best trading day yesterday, matched by a complete paring back of incurred profits. Price action drops again today as traders scramble to unwind their long positions from yesterday in what looked to be a relief rally from solving the deal-breaking issue between Russia and Ukraine. But after more than 24 hours, Russia has refrained from commenting or even welcoming the efforts of Ukraine, which is putting markets back on edge and makes it clear that this situation will not be resolved anytime this week.

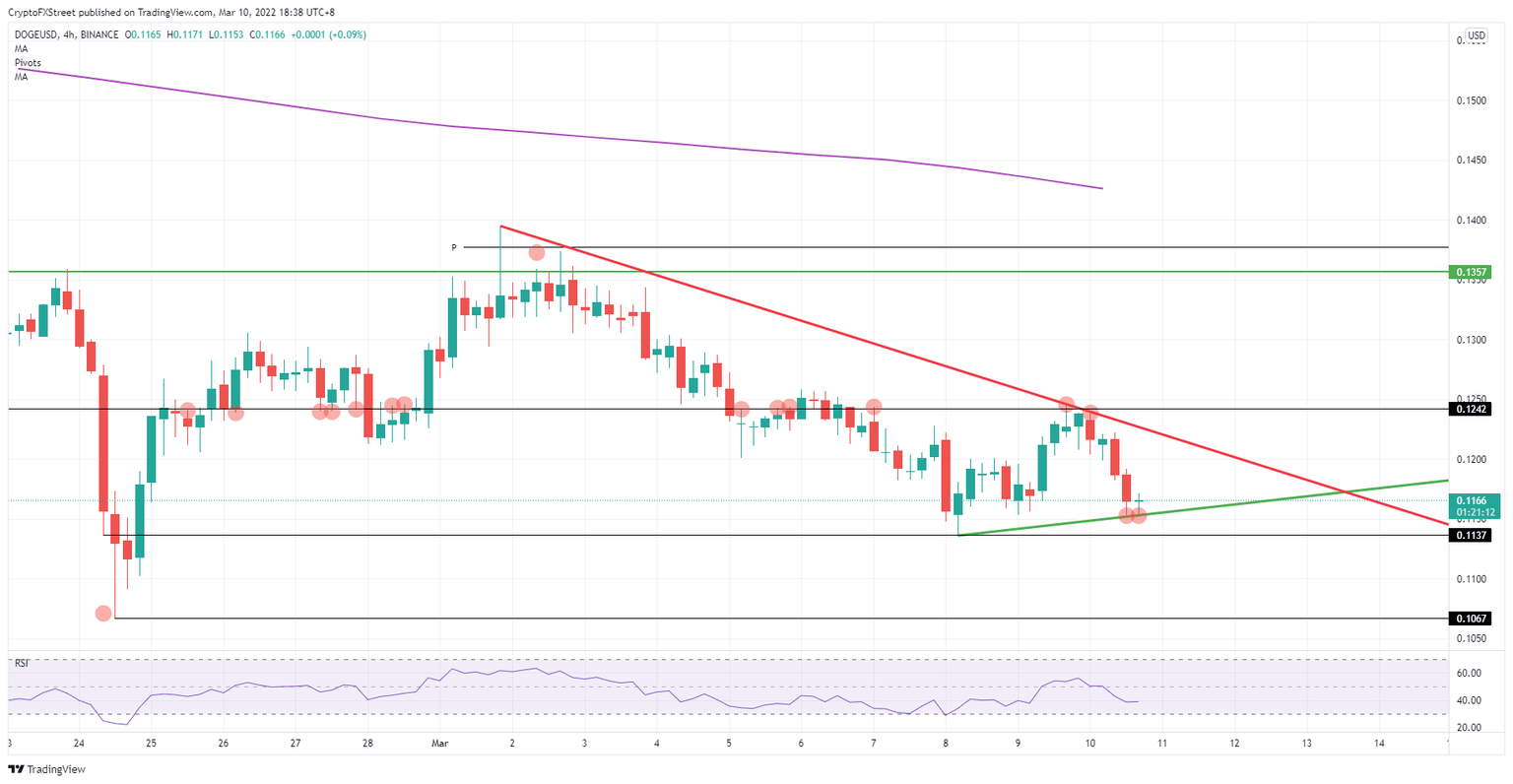

DOGE price action is now testing the low of an intermediary trendline that already saw two tests in the past few hours and does not look to give enough power to the leg up for a total bounce back to $0.12 or higher. From the top, the red descending trend line makes it a triangle that could break either way but will probably see further declines as US traders have yet to come in, and when they do will see their positions holding significant losses. Expect this to see a break below the green ascending trend line and an accelerated down move as bears punch through $0.1137 and trigger a correction towards $0.1067.

DOGE/USD 4H-chart

As talks and backchanneling are still ongoing, a second tranche in the relief rally could still happen today, which would materialise in the form of a break above the red descending trend line, hitting $0.1242. Once through that area, expect to see a strong rally that could last for multiple days towards $0.1357, taking out $0.1300 along the way. This would undoubtedly be the case if a pullback from Russia is discussed and fighting stops from both sides in a peace agreement.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.