Dogecoin price to jump on the bull trend and as DOGE eyes a 25% rally

- Dogecoin price jumps over 3% in early Wednesday trading.

- DOGE must thank Asian stocks for their staggering performance and tailwind in crypto.

- Expect to see another test at $0.08 with a possible break above, opening up a 23% gain.

Dogecoin (DOGE) price is popping higher after another gloomy day on Tuesday as markets rolled over yet again. This Wednesday morning a bullish undertone is emerging as Asian stocks rally higher and pull risk assets along with them. The move higher comes after China’s central bank committed to coming up with more financial aid for companies, which triggered a massive bull wave in all risk assets.

Dogecoin price riding the bull wave higher with nearly a 23% gain

Dogecoin price is on a tear this Wednesday after the ASIA PAC session held an upbeat surprise, which was very supportive for equities and cryptocurrencies. The Chinese central bank, the People’s Bank of China, is opening up its wallet again in a bid to provide financial support for companies. This boosted Asian stocks higher and allowed peak performance of nearly all crypto assets.

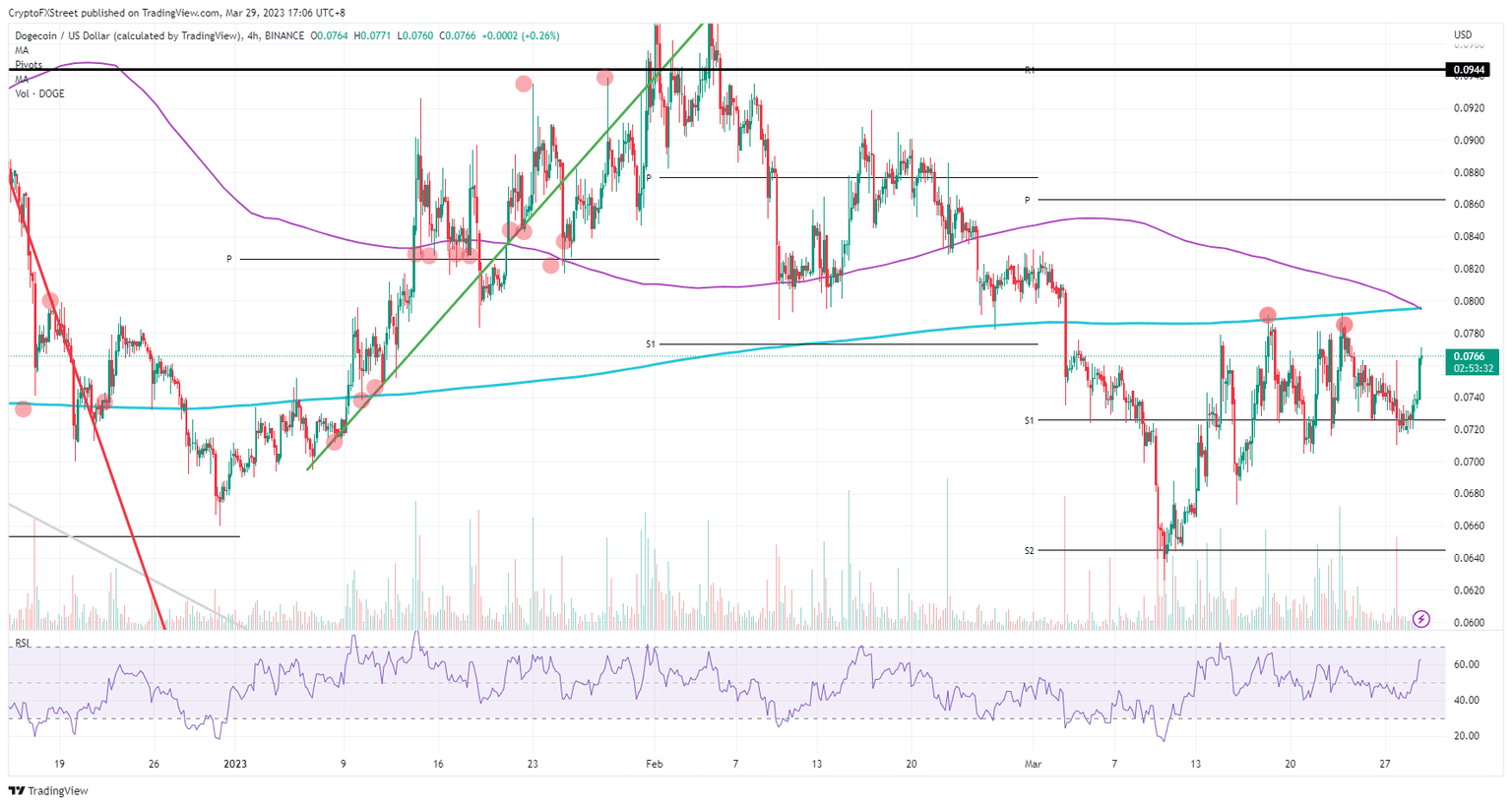

DOGE sees the recovery at a very crucial time as the 55-day Simple Moving Average (SMA) has just breached below the 200-day SMA, flirting with a Dead Cross. This spike higher could be vital to untangle that cross and rather turn it into a Golden Cross. That would mean that DOGE could rally all the way up to $0.10 for a 23% gain.

DOGE/USD 4H-chart

The risk to the downside is of course that the bearish sentiment in the US session takes over again. Expect to see a fade with price action sliding back below $0.076 by the US opening bell. Although the monthly S1 support at $0.0726 should be enough, there could be a small depression toward $0.0700.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.