Dogecoin Price Forecast: DOGE coils up for an upswing as alt season clocks in

- Dogecoin price is up almost 10% in the last 48 hours as the altcoin season settles in.

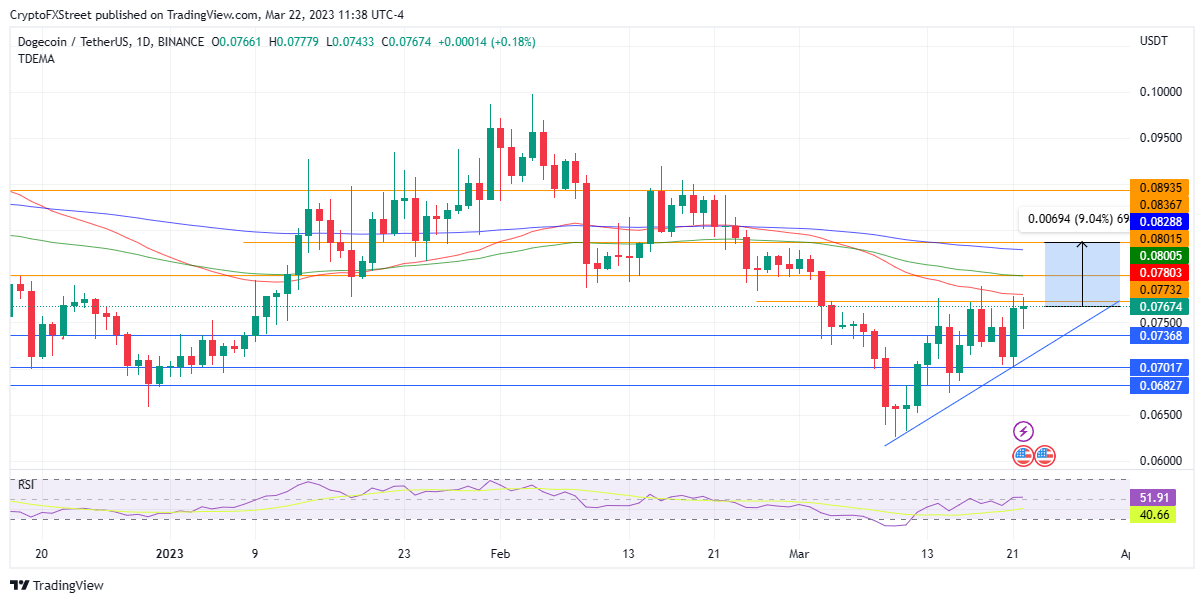

- DOGE could shatter the 50-day EMA at $0.07083 before marking a 9% climb to the $0.08367 resistance level.

- A daily candlestick close below the $0.07017 support level could invalidate the bullish thesis.

Dogecoin price has heeded the invite to the alt season to trade with a bullish inclination and record more gains for investors. Despite overhead pressure due to multiple supplier congestion zones, DOGE bulls have put the right foot forward and now the meme coin is preparing for another northbound move.

Dogecoin price heeds the alt season call with notable gains

Dogecoin price is up 4% over the last day as bulls build atop the gains made on Tuesday. Accordingly, the meme coin indicates a 50% increase in trading volume over the last 24 hours, indicating a lot of investor activity in the DOGE market.

As bulls look to record more gains, Dogecoin price is facing an immediate hurdle due to the 50-day Exponential Moving Average (EMA) at $0.07806. A decisive flip of this obstacle into a support level could pave the way for DOGE to record more gains. For this to happen, bulls must increase their buying momentum above current levels.

Past the aforementioned level, Dogecoin price could shatter the resistance confluence given by the horizontal line and the 100-day EMA at $0.08015. Further north, the largest meme coin could surge further to confront the 200-day EMA at $0.08289 or, in highly bullish cases, tag the $0.08367. Such a move would denote a 9% upswing from current levels.

If sidelined investors join the parade, Dogecoin price could cross the psychological $0.08500 level and confront the next obstacle at $0.08935, which was last tested on February 19. Such a move would constitute a 17% climb from the current price.

DOGE/USDT 1-day chart

On the downside, if investors give in to their selling appetite, Dogecoin price could squat towards the immediate support level at $0.07368. In dire cases of market sell-off, DOGE could plummet below the support provided by the uptrend line at $0.07017. A daily candlestick close below this level could invalidate the bullish thesis.

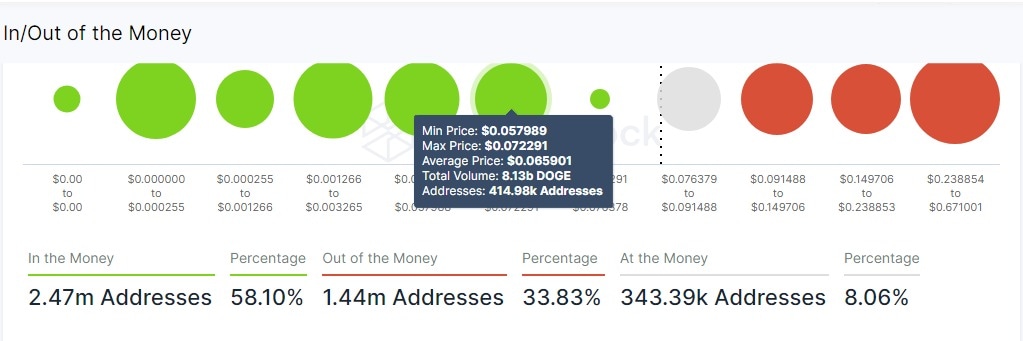

Nevertheless, data from IntoTheBlock supports the bullish case for Dogecoin price. The In/Out of the Money fundamental index identifies investors’ average purchase price of a cryptocurrency versus its current price. The statistical model analyzes crypto addresses that bought at an average price above or below the current market price.

DOGE IOMAP Model

The metric also underscores the relevance of the $0.07017 support level for Dogecoin price as it falls between the $0.05798 and $0.07229 range, where 414,980 addresses bought 8.13 billion DOGE at an average price of $0.06590.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.