Dogecoin Price Prediction: One more 10% decline for the notorious meme coin

- Dogecoin price has lost support at the $0.06 level.

- DOGE price has been persistently falling under low volume after landing in oversold territory on the Relative Strength Index.

- Invalidation of the bearish thesis is a daily closing candle above $0.062.

Dogecoin price shows potential for more decline. Key levels have been identified.

Dogecoin price can fall further

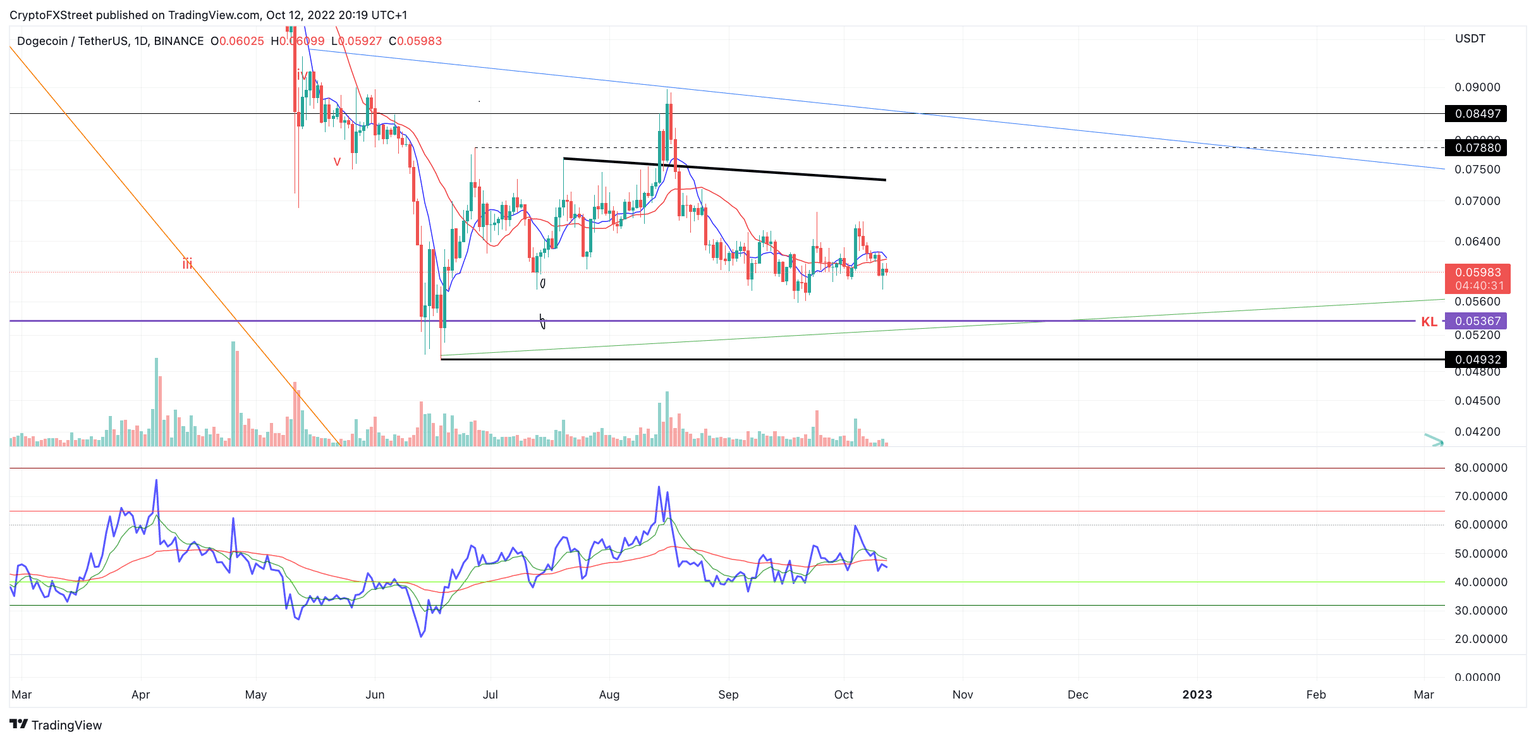

Dogecoin price is facing suppression as the bulls have recently lost support from the $0.06 level. The breach may be the beginning of a larger move headed south as the 8-day exponential and 21-day simple moving averages are set to produce a bearish death cross just above the current trading range.

Dogecoin price currently auctions at $0.059, which brings the loss of market value down to 10% for the month of October. It is worth noting that the current decline is occurring on low volume, which means the downtrend is weakening or the bulls are completely uninterested in the current price. The Relative Strength Index witnessed a key rejection after declining into oversold territory during the last sell-off.

DOGE/USDT 1-Day Chart

Combining these factors, a 10% decline seems like a reasonable target. If the mid $0.05 level does not hold as support, a sweep-the-lows event targeting June 18 swing low at $0.049 could be imminent. Such a move would result in a 17% plummet.

Invalidation of the bearish thesis is a daily closing candle above the colliding moving averages at $0.062. If the bulls reconquer the barrier, a challenge of the September highs at $0.063 stands a fair chance to occur. Said price action would result in a 15% increase from the current DOGE price.

In the following video, our analysts deep dive into Dogecoin's price action, analysing key market interest levels. - FXStreet Team

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.