Dogecoin Price Prediction: How the original DOGE whales have snuck back into the market

- Dogecoin price shows the circulation of tokens back near all-time highs.

- DOGE price shows a persistent uptick in daily active wallets.

- Invalidation of the bearish thesis remains a breach above $0.118.

Dogecoin prices could become very volatile in the days to come. As sideways price action persists during the first trading week of September, On-chain metrics show high-cap players are returning to the market.

Dogecoin price planning a sell-off?

Dogecoin price currently auctions at $0.06 as the bulls and bears are wrestling within a newfound congestive zone just below the swing low established on July 26. Traders witnessing the mundane price action may be stifled as to where the notorious meme coin is headed next.

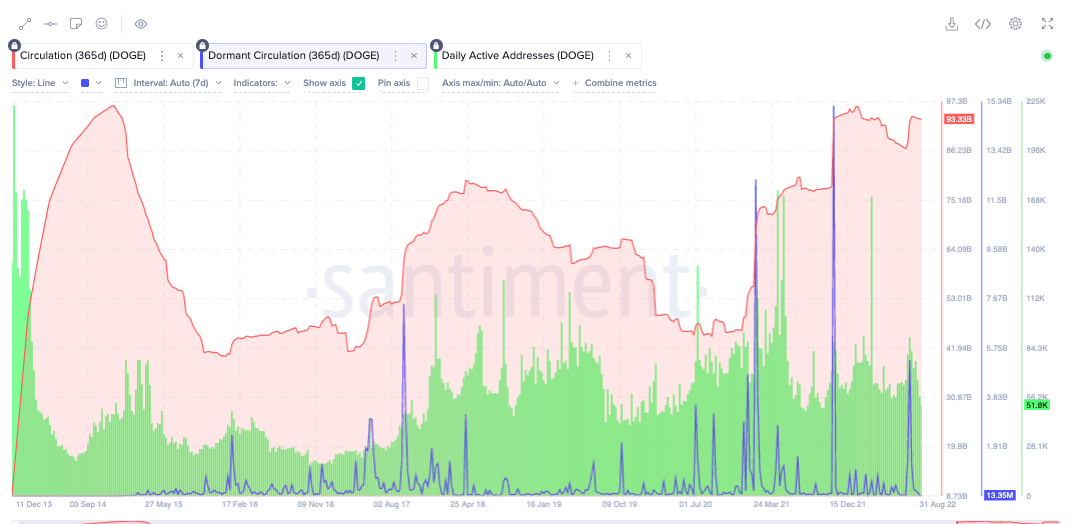

A few of Santiment’s On-chain analytical tools provide insight into what is going on underneath the Doge’s hood. For one, the 365 Day Circulating supply indicator is back near all-time highs, currently 93 billion tokens. Since Dogecoin’s inception, DOGE has witnessed significant short-term liquidations each time the indicator went above 90 billion.

Sentiments’ Price=365-Day Circulating Supply and Daily Active Addresses Indicators

Additionally, there is a persistent uptick in active addresses. The indicator also corroborates the idea that smart money may be planning a big move.

When combining these factors, the Dogecoin price could endure a painful September. Being an early buyer comes at high risk. Last month’s bearish trade setup targeting the June 18 swing low is still in play, and the invalidation level remains at $0.012.

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.