Dogecoin Price Prediction: DOGE fever spreads to China as it prepares for a 22% downswing

- Dogecoin’s search engine volume spikes on Baidu as the world discovers the ‘Meme Coin.’

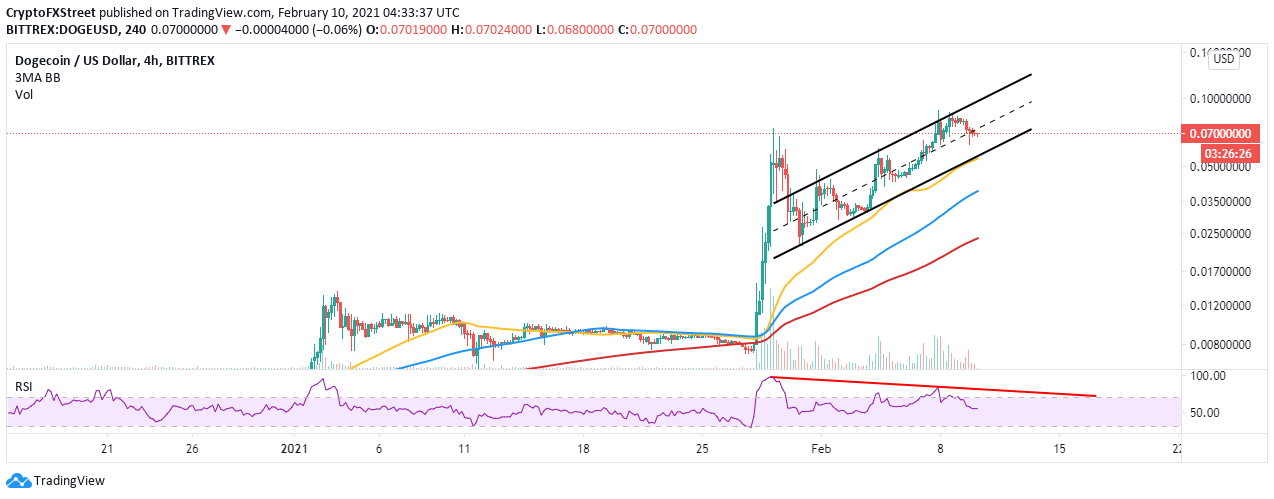

- DOGE is correcting toward the 50 SMA on the 4-hour chart after rejection at $0.089.

- The uptrend will be sustained if the ascending parallel channel’s middle support is reclaimed.

Dogecoin has been the most significant contributor to the crypto-related chatter on various social media channels. The ‘Meme Coin’ rallied again, surpassing the previous record high, and achieved a new all-time high of $0.089. Meanwhile, a retreat seems underway, with Dogecoin likely to retest levels toward $0.045.

Elon Musk tweets send Dogecoin to the moon

Elon Musk is among the most influential people in the world. He is the founder of Tesla, the world’s leading producer of electric vehicles, and the space exploration company, SpaceX. Recently Dogecoin found itself in the billionaire favor, whose tweets have sparked discussions amid DOGE’s rally to new highs.

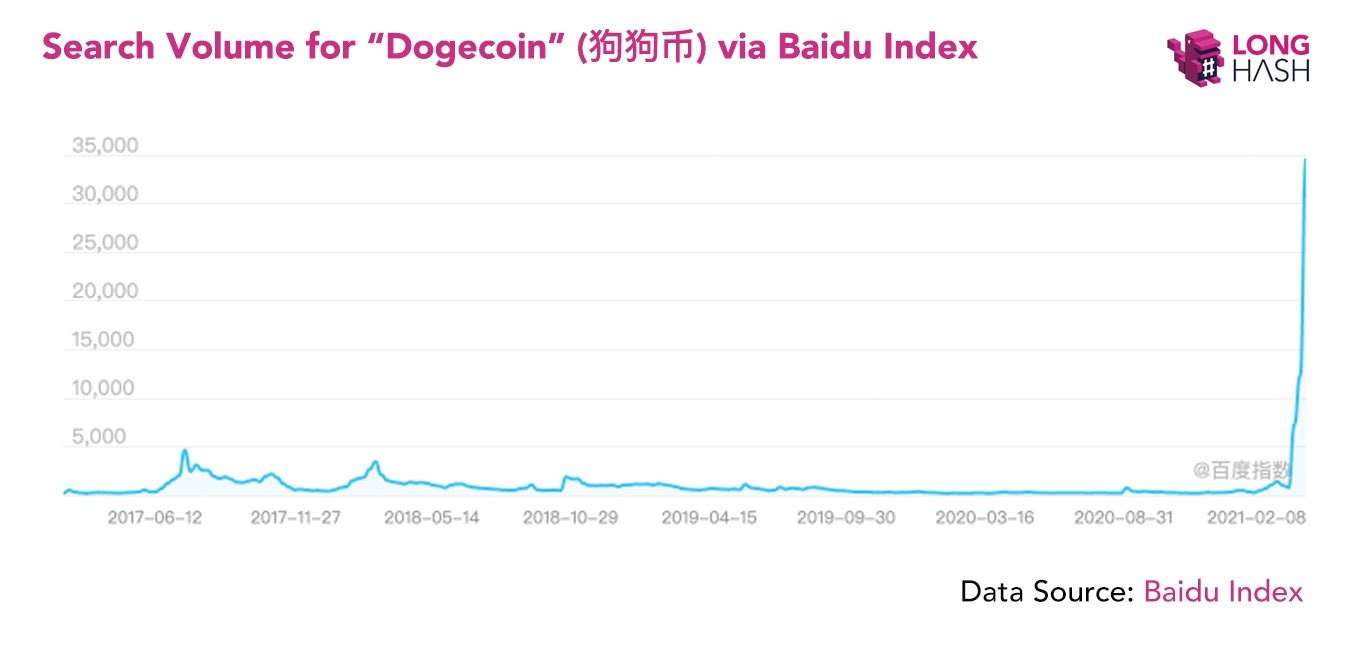

The Dogecoin fever appears to have spread its wings to China. Dogecoin search volume hit an all-time high on Baidu. According to LongHash, a gateway to China’s blockchain, the current volume was ten times that of the bull run in 2017.

Dogecoin search volume on Baidu

Dogecoin engages reverse gear

It is usual for a cryptoasset’s price to correct following a surge in its social media volume. For example, Dogecoin is in the middle of a retreat after being rejected at $0.089. An ascending parallel channel’s middle boundary support has given way to the declines, which are likely to linger to the lower edge. The 50 Simple Moving Average (SMA) is coincidently at this same level and is expected to halt the losses.

The pessimistic outlook has been validated the Relative Strength Index negative (RSI) divergence on the 4-hour chart. This divergence forms when the price makes a series of higher lows while the RSI creates lower highs. The deviation indicates that trading volume is reducing, and a reversal is likely to take place.

DOGE/USD 4-hour chart

Looking at the other side of the fence

It is worth mentioning that Dogecoin will continue with the uptrend eyeing $1 if the price recovers above the ascending channel’s middle boundary. Closing the day above this zone may recall more buyers into the market. Besides, the gap made by the 50 SMA from the 100 SMA and 200 SMA suggests that bulls influence the price.

On the other hand, the Dogecoin search volume has rallied in China, which may impact the buying pressure behind Dogecoin—thus placing DOGE on the trajectory to new record highs.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren