Dogecoin Price Forecast: DOGE primed for a 30% rally to new highs

- Dogecoin price witnesses intense buying pressure as it continues trending up.

- A breach of the previous high at $0.088 forecasts an upswing to $0.10

- Spike in social volume and realized market capitalization suggests that investors need to be wary.

Dogecoin price slid into consolidation after a 1,100% rally between January 28 and 29. But a recent spike in buying pressure allowed DOGE to resume its uptrend.

Dogecoin price prepares for another rally

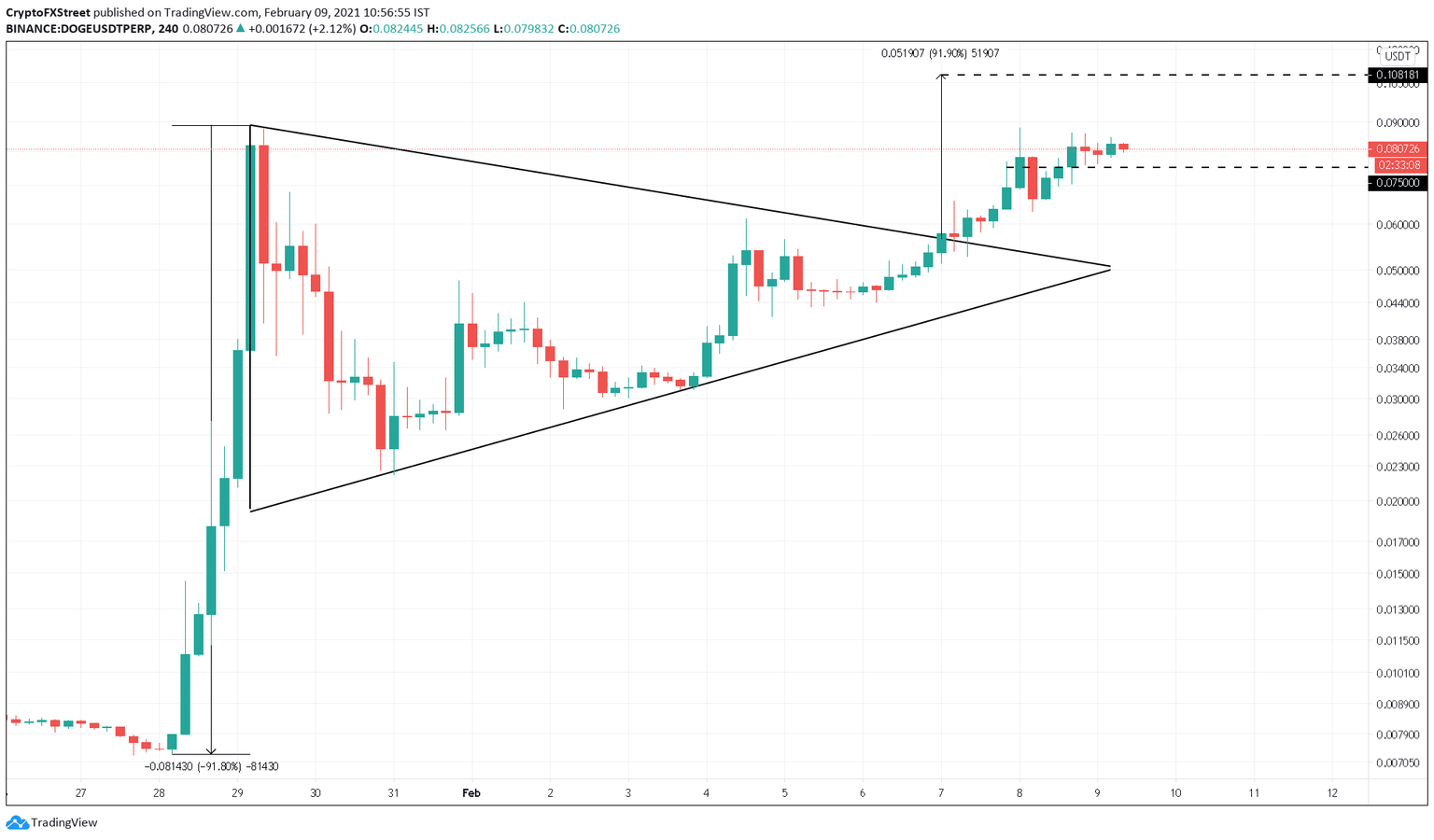

DOGE has surged approximately 40% since it broke out of a bull flag pattern.

The technical formation forecasts a 90% target, that could see Dogecoin price climb another 30% to reach a new all-time high of $0.10.

DOGE/USDT 4-hour chart

Several celebrities including Elon Musk and Snoop Dog have endorsed Dogecoin causing FOMO among retail investors. Despite the high levels of speculation around this cryptocurrency, the bearish signs cannot be overlooked.

On-chain metric hint at overbought market conditions

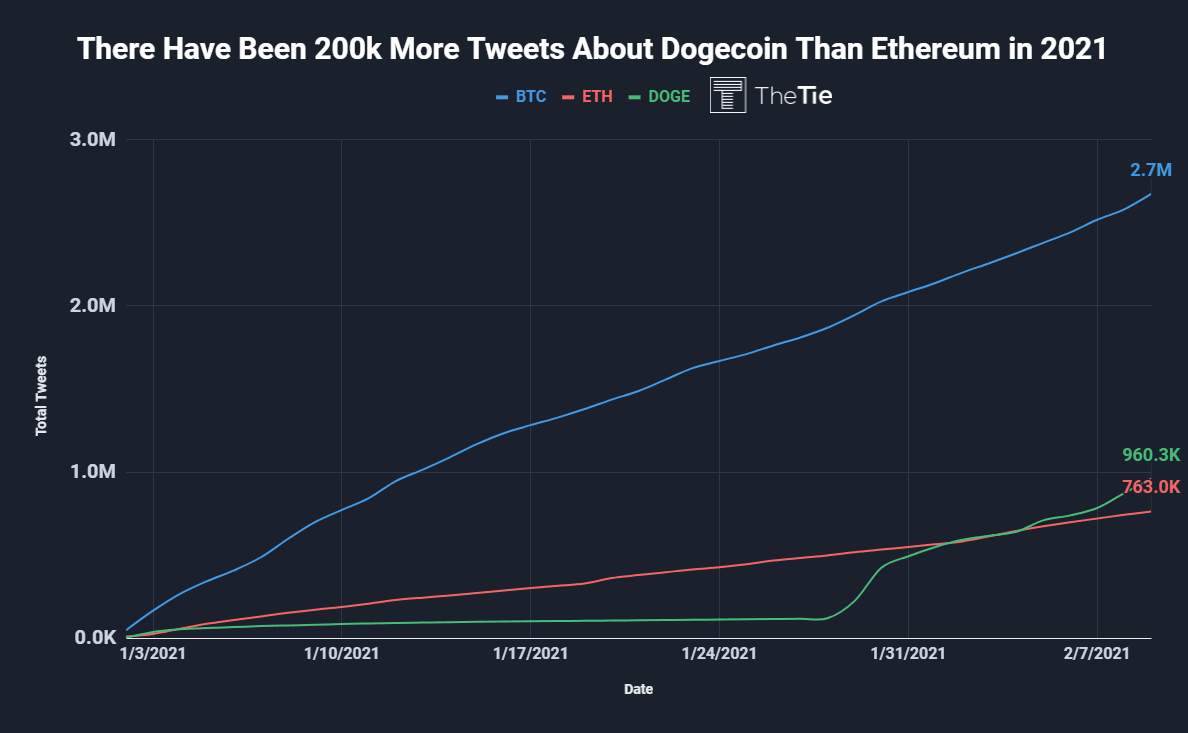

In a recent report, The TIE's stated that the social engagement around Dogecoin has skyrocketed. Nearly 1 million tweets were sent out about DOGE surpassing Ethereum-related tweets by 200,000. The meteoric rise in social activity points to an increase in notoriety by the meme coin.

Usually, such a significant increase in social volume signals that the market has reached peak hype. This is when investors become irrationally confident about the coin's potential. Hence, a continuation of the uptrend is unsustainable and opens an opportunity for downward price action.

Dogecoin Social Metric Comparison chart

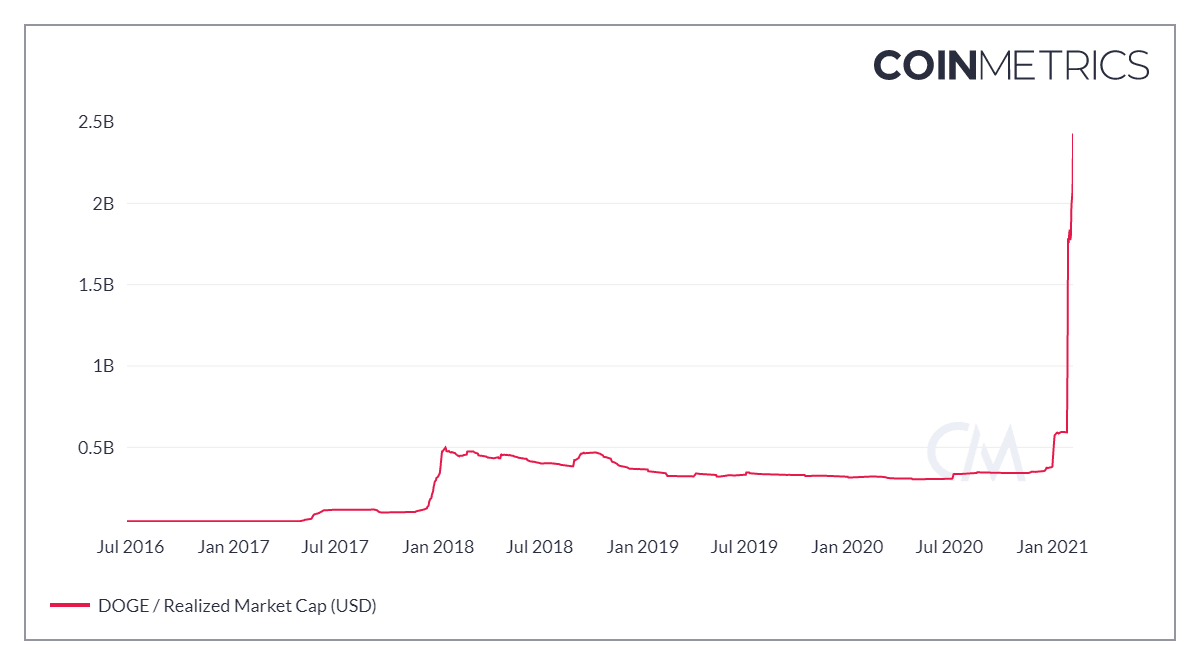

Coinmetrics' on-chain data shows dormant DOGE tokens from 1 to 5 years on the move. The resurgence of inactive coins suggests that long-term holders are getting ready to take advantage of the recent price action to book profits.

Dogecoin's realized market capitalization also spells trouble after experiencing a 550% increase in the last few weeks. Such market behavior indicates that most of the DOGE tokens were purchased recently by investors.

Realized market capitalization is a metric that considers the price at which the coin was last moved, which paints an accurate picture of the network's participants.

Doge Realized Market Capitalization chart

Therefore, a spike in selling pressure leading to a breakdown of the support at $0.075 could put a lot of these recent investments in the red. Based on IntoTheBlock's In/Out of the Money Around Price (IOMAP), roughly 50,000 addresses previously purchased 9.02 billion DOGE around this price level.

Hence, if this support buckles under selling pressure, it could trigger a sell-off invalidating Dogecoin's bullish thesis.

Dogecoin IOMAP chart

In such a case, Dogecoin price could drop to the next stable support at the $0.070 level where 37,000 addresses purchased 2.35 billion DOGE.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.