Dogecoin Price Prediction: DOGE bulls hold the key for 40% gains

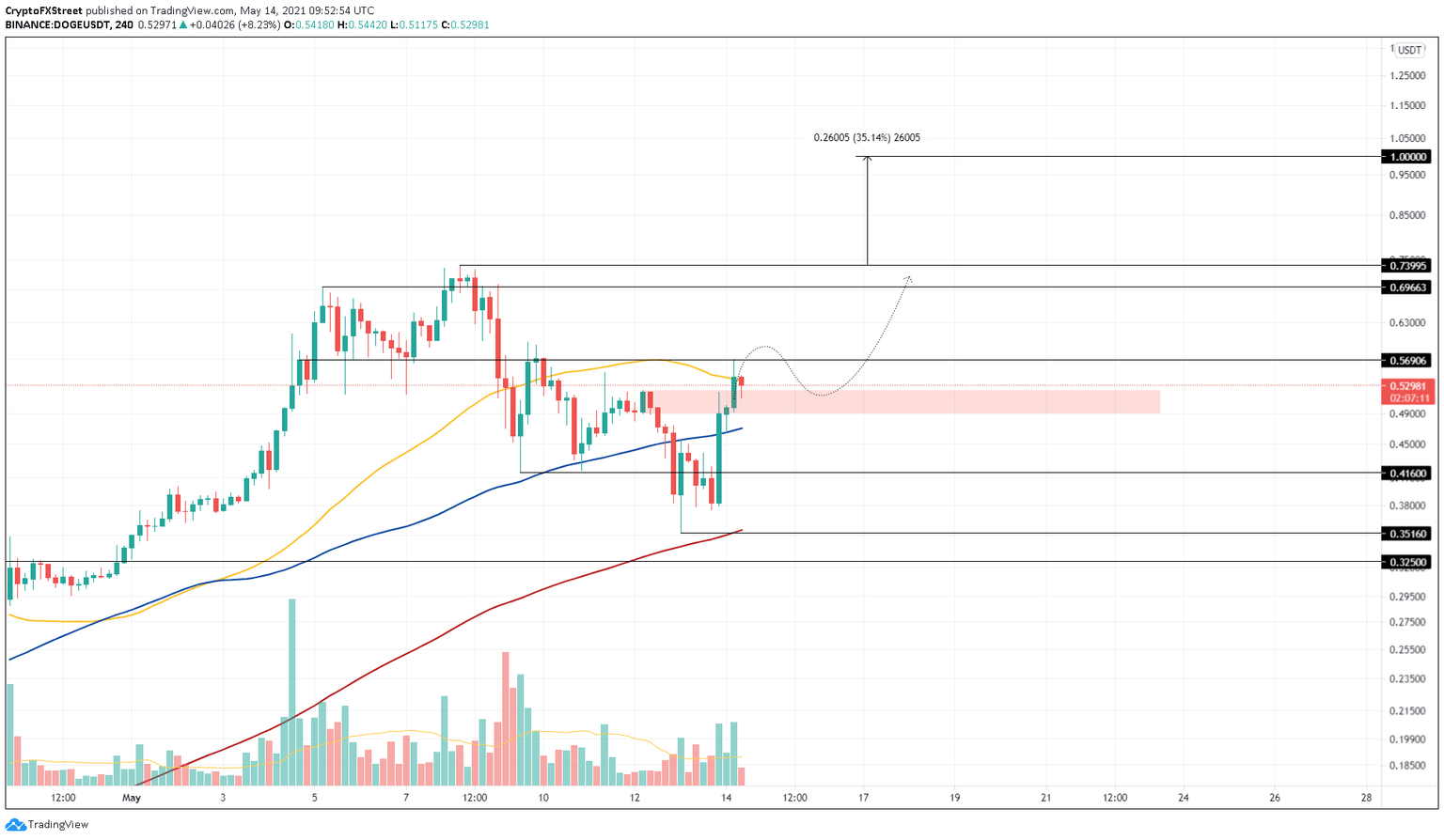

- Dogecoin price is at a pivotal point, resulting in a 40% upswing or 30% sell-off.

- A swift surge beyond $0.522 and a retest of this level confirms a bullish outlook.

- If DOGE slices through the $0.351, it will put an end to the optimistic narrative.

Dogecoin price has seen a massive surge after Elon Musk’s recent tweet revealed that he is working with the developers of the meme coin to improve its transaction efficiency. With DOGE approaching a critical point in its uptrend, more gains stand to be realized if buyers push through.

Dogecoin price at crossroads

Dogecoin price has benefited from Musk’s remarks, but it faces a decision as it hovers near the supply zone that extends from $0.489 to $0.522. This area of resistance is critical and separates a 40% bull rally from a 30% decline.

Considering the optimism around Musk’s initiative to work hand-in-hand with Dogecoin developers, it seems like DOGE price will slice through the $0.489-$0.522 resistance wall and invoke a 40% upswing to $0.739.

If FOMO kicks in after these price hurdles are breached, there is a high probability that Dogecoin price will hit $1, which is an additional 35% upswing from $0.739.

DOGE/USDT 4-hour chart

Nonetheless, a rejection from the $0.522 supply wall could result in a 20% decline. Dogecoin price may try to find support around $0.416 or head lower if the selling pressure builds up.

A breakdown of the demand level at $0.351 will likely invalidate the bullish thesis. In that case, the Dogecoin price will slide 7% to tag the next support floor at $0.325.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.