Dogecoin price is inches away from the next bull run, here’s the level to watch

- Dogecoin price hovers above two compressing moving averages.

- DOGE price shows support on the Relative Strength Index after performing a break of structure rally.

- Invalidation of the uptrend is a breach below the swing low at $0.049.

Dogecoin price shows bullish promise. Defining the best risk-to-reward entry for upside gains remains the challenge.

Dogecoin price is bullish with contingencies

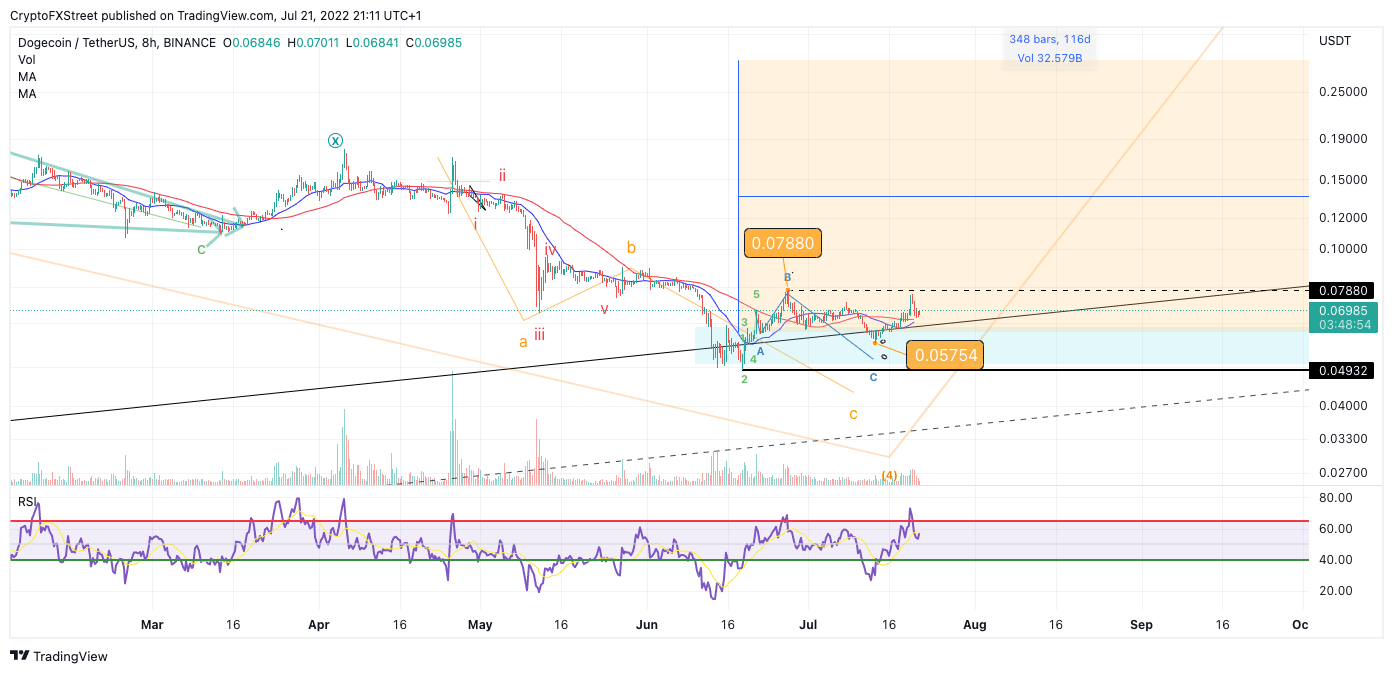

Dogecoin price rallied 30% since the July 13 swing low at $0.0574. The notorious dog coin has retraced 50% of the way and now trades just under the $0.07 barrier. Early bulls have likely entered the market with appreciation to the recent market structure break near the $0.0725 zone. Now the question is, are the early bulls right? Or will they have to endure one more smart money sell-off before the anticipated bull run takes place?

Dogecoin price currently trades at $0.069, hovering just above the compressing 8- & 21-day simple moving averages (SMAs). Scalpers may be eyeing this $0.069 level as a possible entry zone in hopes that the SMAs can produce a bullish cross. The Relative Strength Index breached extremely overbought territories and now finds support back within a healthy uptrend mid-zone.

DOGE/USDT 8-Hour Chart

When combined, it does seem like the Dogecoin price is setting up for a decisive move. Short-term targets are $0.08 and $0.125, while the technicals suggest extended FOMO targets could reach as high as $0.25 in the coming weeks.

Invalidation of the uptrend is a breach below the swing low at $0.049. However, placing an early entry is a bit risky as the DOGE price could show one more 25% decline into the $0.052 zone. Waiting for a breakout past $0.0788 is the safer bet to qualify for an uptrend scenario. Investors should keep in mind that a breach of the invalidation level could trigger a sellers' frenzy with targets in the $0.02 zone, resulting in over a 60% decline from the current DOGE price.

In the following video, our analysts deep dive into the price action of DOGE, analyzing key levels of inerest in the market. -FXStreet Team

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.