Dogecoin Price Forecast: DOGE screams buy as technical levels flip bullish

- Dogecoin bounces off crucial support as the upside opens up for gains toward $0.060.

- The TD Sequential indicator presented a buy signal, adding credence to DOGE’s bullish outlook.

- The IOMAP on-chain metric reveals that Dogecoin’s recovery will not be a walk in the park.

Dogecoin has been in a downtrend since the attempt to recover from February’s dip stalled at $0.062. The Meme Coin has tested support slightly under $0.050, but a rebound ensued, eyeing higher price levels toward $0.060.

Dogecoin nurtures uptrend

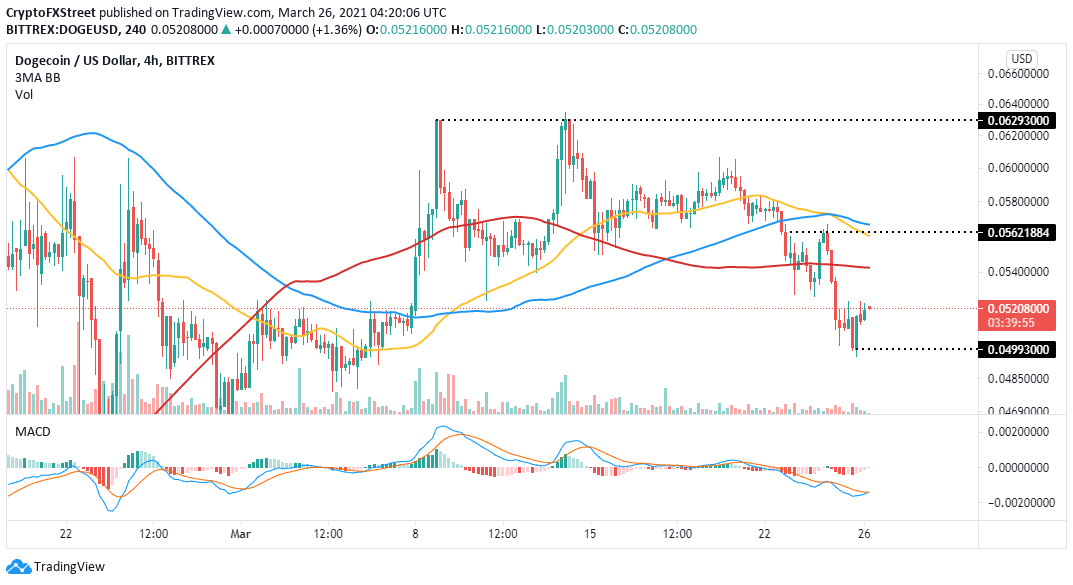

Dogecoin is exchanging hands at $0.052 at the time of writing. Bulls seem to be seeking support at this level, which will allow them to shift the focus back to $0.060. The Moving Average Convergence Divergence (MACD) indicator is about to flip bullish. If the MACD line (blue) crosses above the signal line, DOGE will witness an increase in the tailwind force.

DOGE/USD 4-hour chart

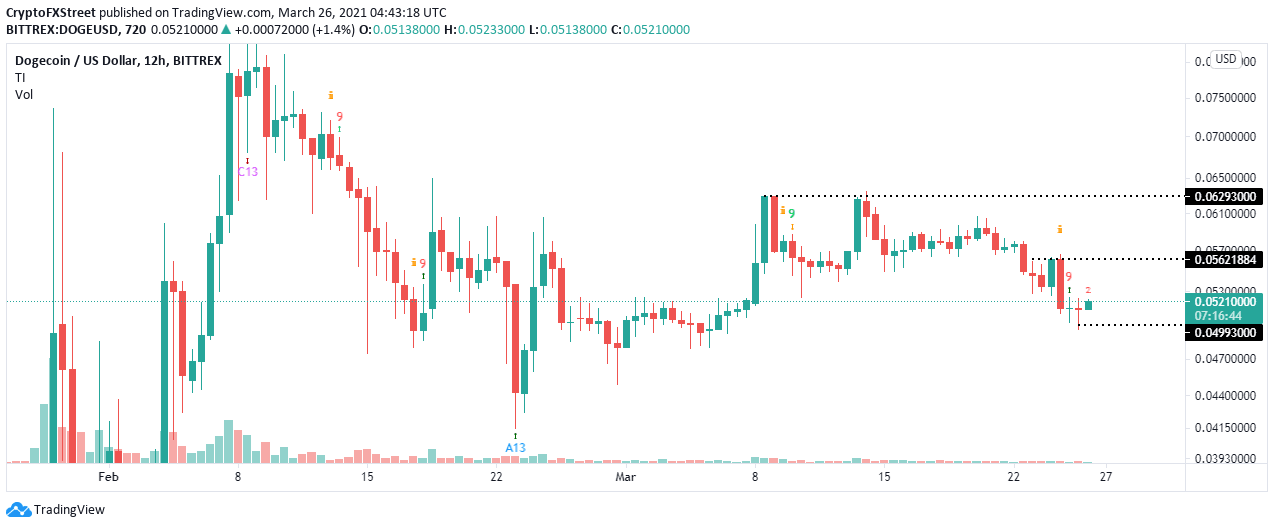

The TD Sequential indicator recently presented a signal to buy Dogecoin. This call to buy manifested in a red nine candlestick. If validated, Dogecoin is likely to lift higher in one to four 12-hour candlesticks.

DOGE/USD 12-hour chart

Looking at the other side of the fence

Dogecoin is facing immense resistance, according to the IOMAP chart. The most robust seller congestion runs from $0.055 to $0.057, where nearly 89,000 addresses had previously purchased approximately 8.76 billion DOGE. Besides this hurdle there are several others, adding weight to the pessimistic outlook.

Dogecoin IOMAP model

On the downside, little support exists to ensure that Dogecoin does not explore the levels downhill. The on-chain model directs attention to the subtle buyer congestion between $0.050 and $0.052. Here, roughly 89,000 addresses previously scooped up nearly 2.8 billion DOGE.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren

-637523332874747088.png&w=1536&q=95)