Dogecoin price back below resistance awaiting new catalyst

- Dogecoin price made a bullish breakout worth 18% of gains.

- DOGE’s breakout was short-lived with bulls closing out positions quickly and price collapsing back to the entry.

- Expect sideways action today with a pick-up in volatility after the FED meeting this evening.

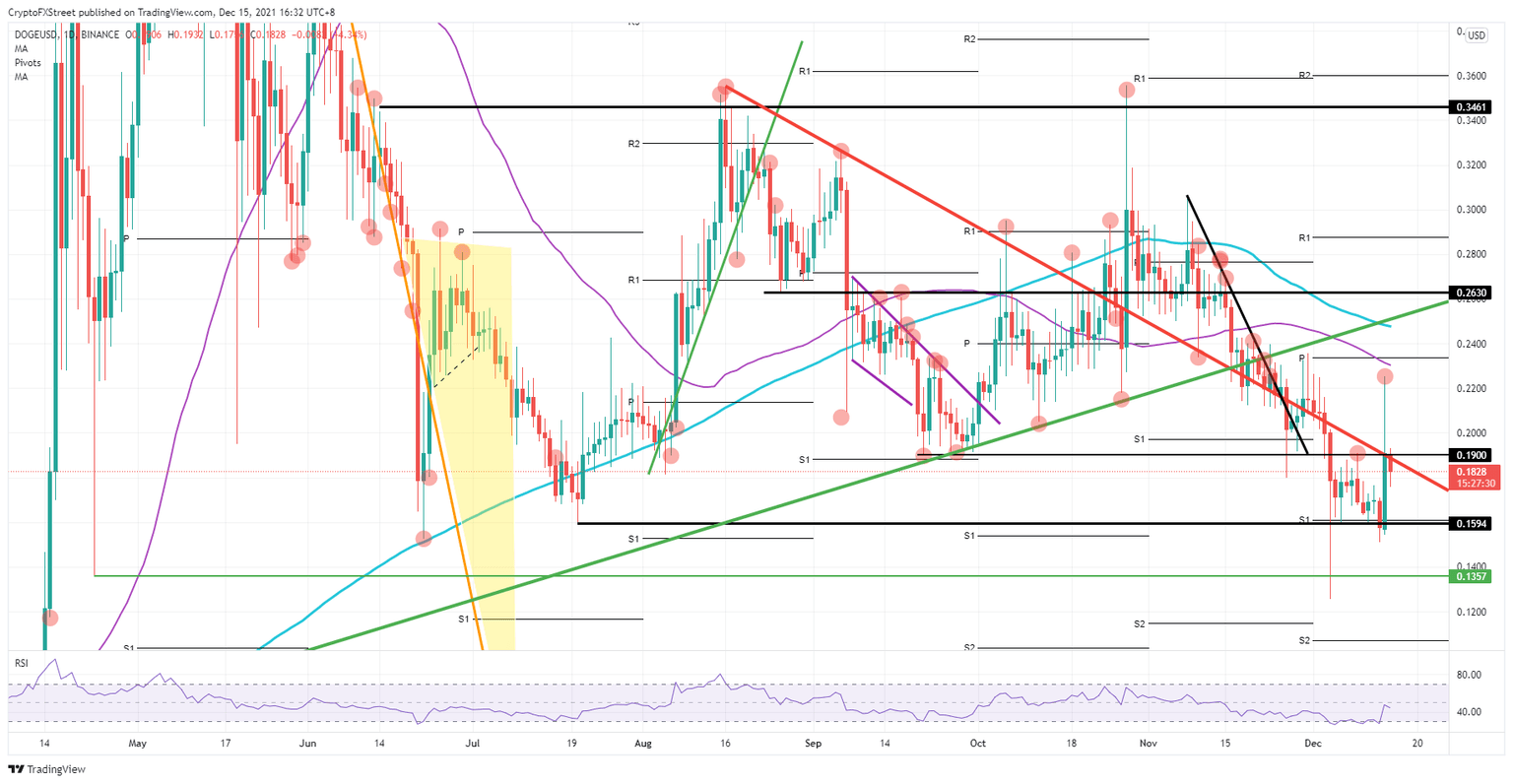

Dogecoin (DOGE) price saw bulls dictating price action with an explosion higher as it broke above a red descending trend line which has been hugging price’s line of descending highs throughout December. Bulls failed to maintain upside momentum, however, andprice soon collapsed as traders sought to scalp profits quickly rather than stay in the trade longer term. One of the last main catalyst events on the calendar is scheduled for this evening when the FED will announce its monetary policy decision and expect some sideways price action before, followed by the risk of greater volatility following the meeting.

Dogecoin price could swing back to $0.26

Dogecoin price made a breakout above the $0.19 technical level, going back to September 21, respecting key levels to the upside and the downside along the way, on Tuesday. It is no surprise that the body of yesterday’s bullish candle started at the monthly S1 support level, near $0.16, and then grew towards $0.19. Above that level it only made a thin candle wick up to$0.22. The spike above the red descending trend line at $0.19 was caused by bears pulling their stops and orders out of the market, which caused a short squeeze higher.

DOGE price should have closed above $0.19 to keep the bullish momentum going. But as price action has already been rejected and is trading to the downside this morning, it’s an indication that bullish investors may have fled the scene after booking gains along the way. Expect price to range-trade between $0.19 and $0.16, prior to the FED decision later on today. The FOMC could wellact as a catalyst to more price action, with the communication on future monetary policy setting the tone for either a risk-on or risk-off mode in the last few trading weeks of the year.

DOGE/USD daily chart

In the case of a hawkish FED policy statement investors will probably pull their money out of stocks and cryptocurrencies leading to a sell-off. Such an outcome would push DOGE price back below $0.16 to either the green line at $0.14 or the monthly S2 around $0.10. Alternatively, if the FED commits to an accommodative policy, expect DOGE price action to quickly return to $0.22, where it will be poised to break above both the 55-day and the 200-day Simple Moving Average, and achieve an upside profit target at $0.26.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.