Three reasons why Dogecoin price could crash to $0.087

- Dogecoin price is on thin ice from a technical perspective as it hovers around the $0.159 support level.

- A breakdown of this barrier could lead to a 50% crash to $0.082 or lower.

- On-chain metrics indicate declining interest in DOGE, supporting the bearish outlook.

Dogecoin price needs to tread lightly as it is on a vital level, a breakdown of which could lead to a steep correction. This crash could take DOGE back to levels last seen at the start of the 2021 bull run. Therefore, investors need to pay close attention to the meme coin over the coming days.

Dogecoin price exudes bearishness

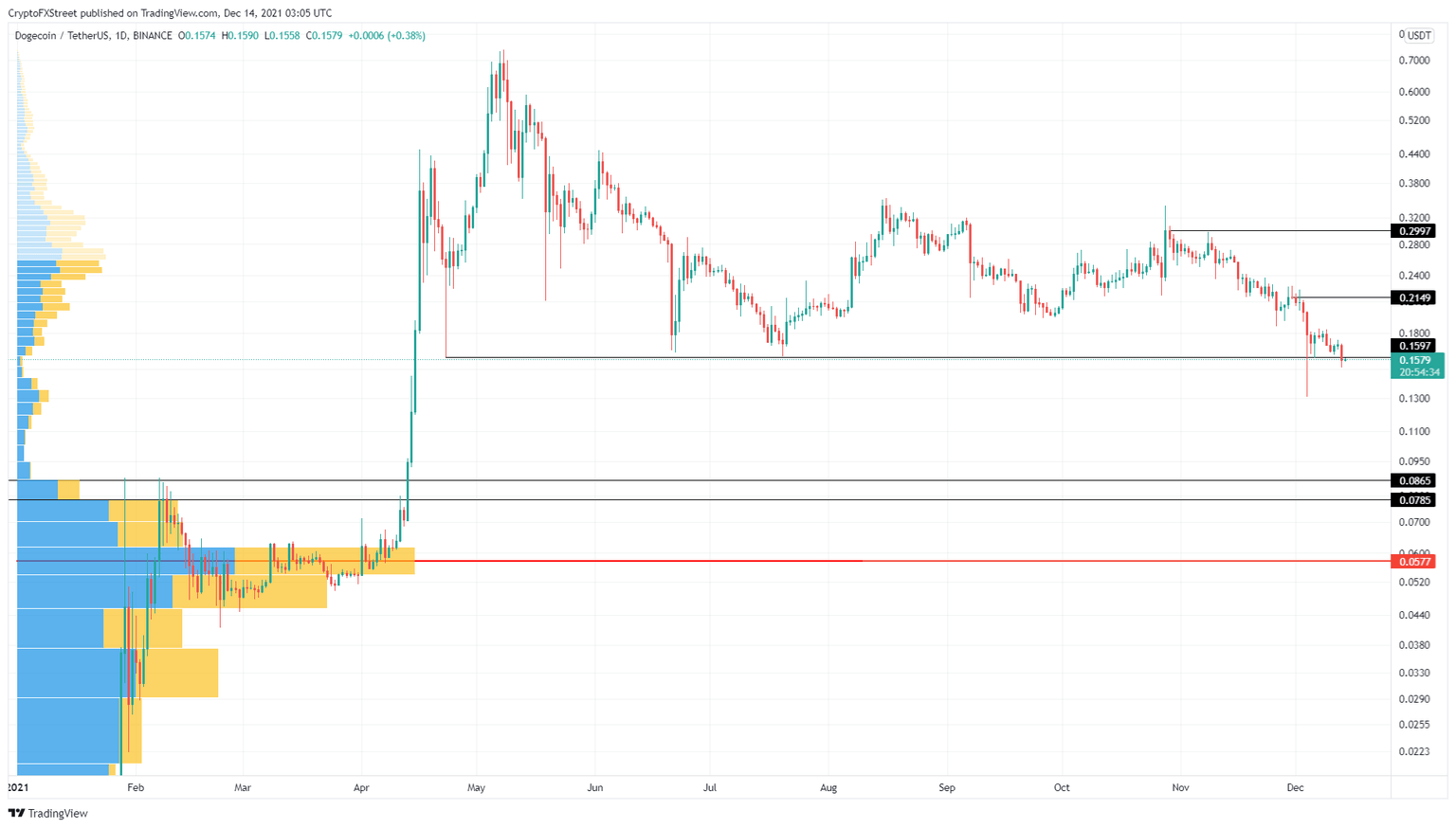

Dogecoin price crashed 7% on December 13 and produced a daily close below $0.16. This descent marks a breakdown of the $0.16 support level that has kept the DOGE price action bullish since April 23.

The recent price action has indicated a flip of this barrier into a resistance level and theoretically triggered the potential for a massive crash. The volume profile for 2021 shows that no support level could sustain a crash except the $0.086 and $0.078 barriers, indicating a 45% to 50% decline on the cards for the original meme coin.

The recent breakdown of the $0.16 foothold, therefore, is undoubtedly a bearish development. A failure to set up a higher high will further confirm the potential descent that awaits DOGE. In a highly bearish case, the point of control (POC) at $0.057 could serve as the best barrier to reverse the downtrend. A retest of this will occur after DOGE sheds 63% of its value from its current position.

DOGE/USDT 1-day chart

On-chain metrics reveal waning interest in DOGE

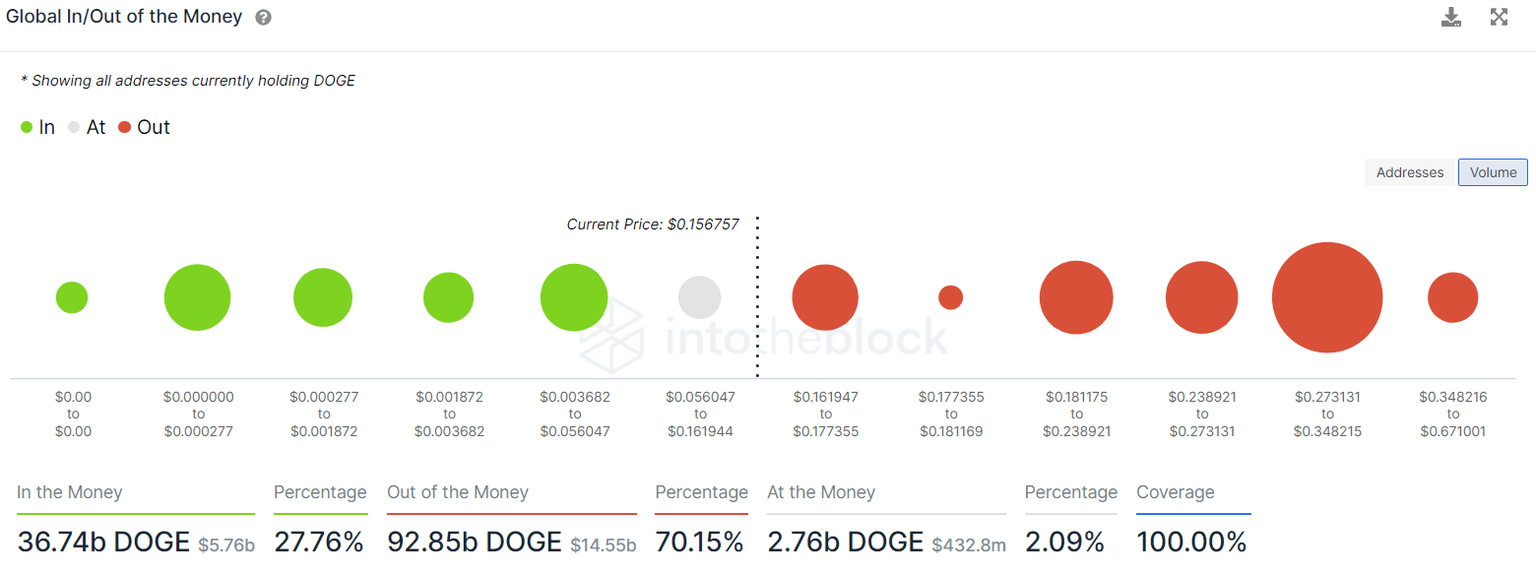

The second reason why Dogecoin price could witness a brutal sell-off is from an on-chain perspective. The immediate support level for Dogecoin price ranges from $0.16 to $0.056. Here, roughly 325,740 addresses purchased 2.76 billion DOGE at an average price of $0.073.

Interestingly, this level coincides with the ones obtained via the volume profile from a technical perspective. This further reinforces the importance of the $0.16 support floor as a make or break level, the penetration of which could see a significant loss in DOGE’s market value.

DOGE GIOM

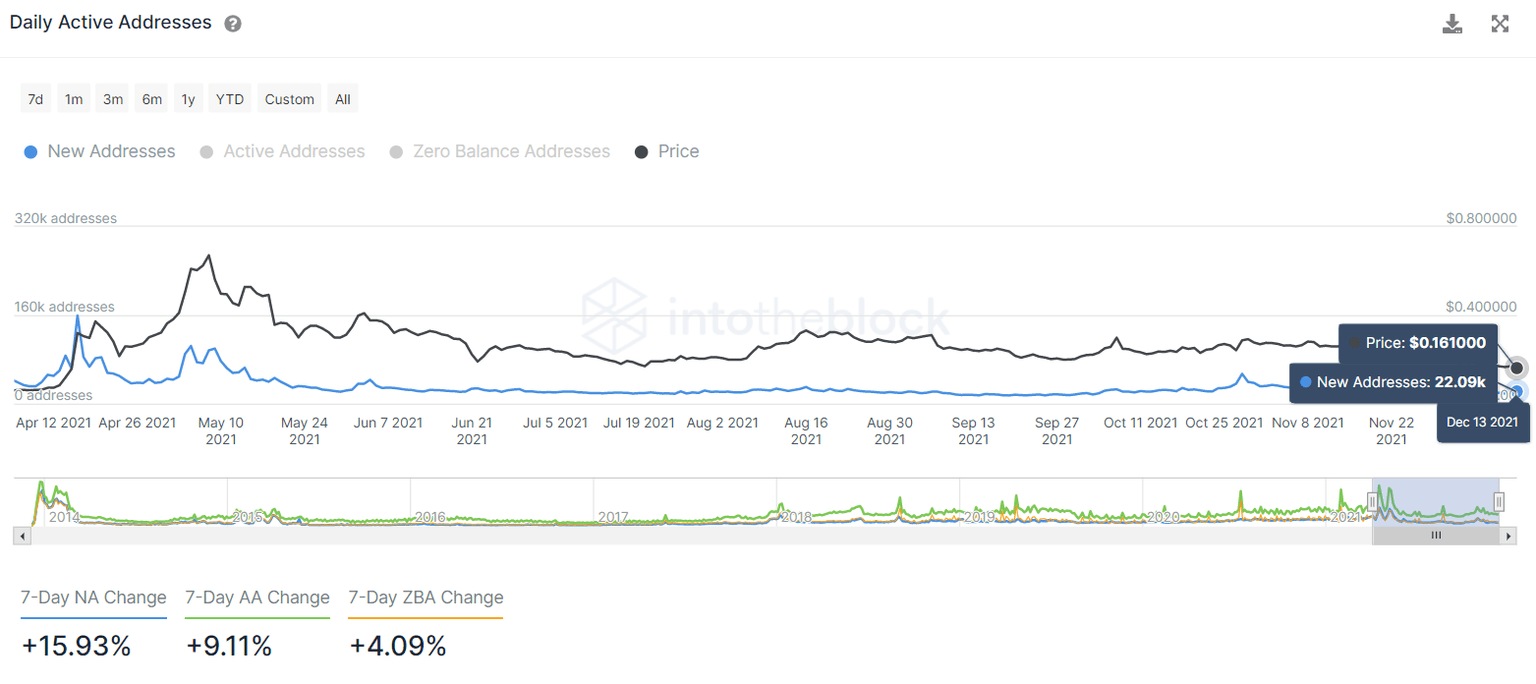

The number of new addresses joining the DOGE blockchain has reduced from 159,390 on April 16 to 22,090 on December 13.

This 86% decline in new addresses indicates that investors have been moving away from Dogecoin and are not interested in the asset at the current price levels.

DOGE new active addresses

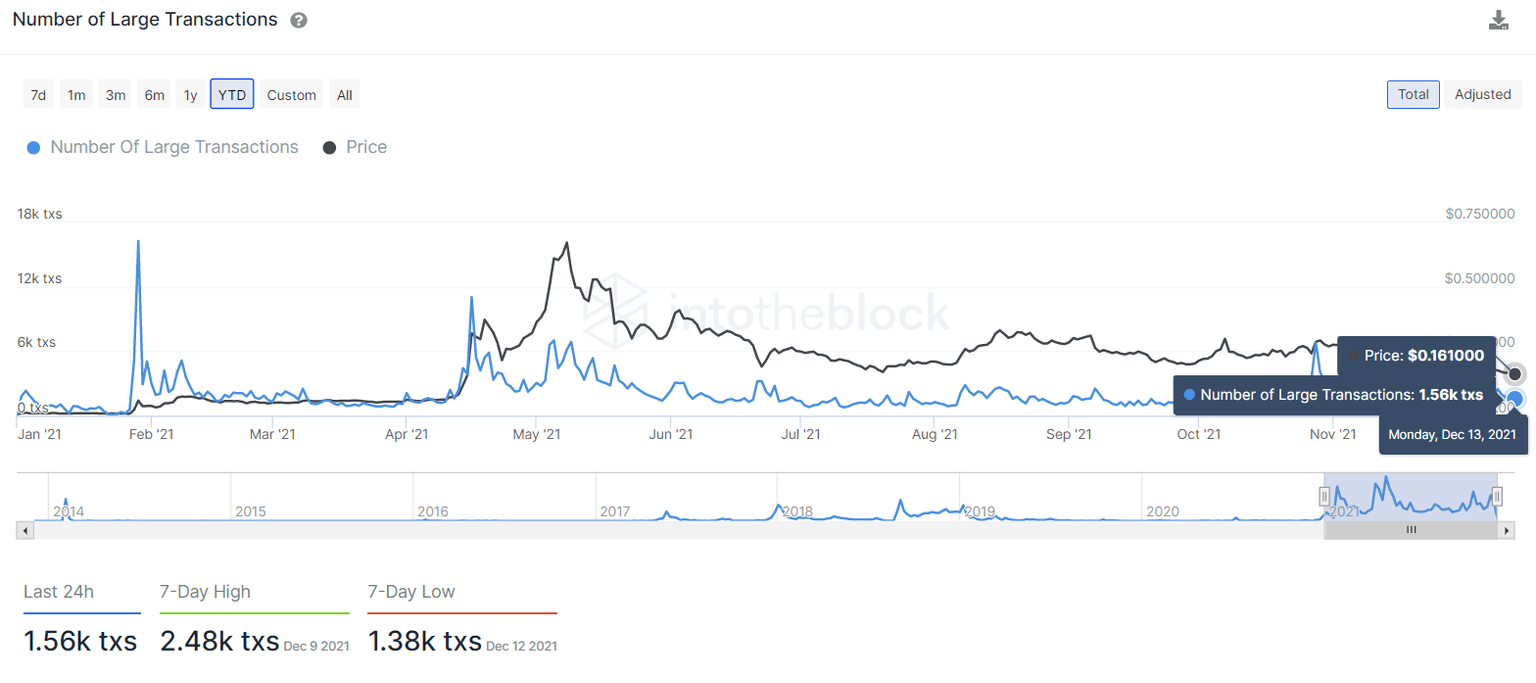

Further building on this line of reasoning is the 85% drop in large transactions with $100,000 or more. Unlike the new addresses joining the network, this on-chain metric gives an idea of the decline in the quality of investors.

The number of large transactions dropped from 11,050 on April 16 to 1,560 as of December 13 and is the third reason why DOGE could be due for a big sell off. This index serves as a proxy for investment interest from whales or high net worth investors. An 85% nosedive of these transfers indicates that these participants are bearish on Dogecoin price and its performance.

The reason for a large-scale drop in new addresses and large transactions could be due to the emergence of a new meme coin - Shiba Inu.

Unlike DOGE, SHIB has rallied 41,054% year-to-date, painting its quality as a superior investment asset. Due to its attractiveness and the returns it offers, one could speculate that investors could have jumped ship to buy Shiba Inu as much as for any other reason.

DOGE large transactions

On the other hand, if the Dogecoin price recovers above the $0.16 support level, investors can breathe a sigh of relief. Supposing increased buying pressure propels DOGE to produce a daily close above $0.215 it will create a higher high and invalidate the bearish thesis.

In this situation, investors can expect the FOMO to propel the Dogecoin price to continue its ascent and retest the $0.30 hurdle.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.