Dogecoin Price Analysis: DOGE bulls light up the chamber for a 35% move

- Dogecoin recovery is gradual but consistent, as bulls stream back into the market.

- A symmetrical triangle pattern on the 4-hour chart hints at a 35% upswing to $0.07.

- A sell signal on the 4-hour chart could jeopardize the expected rally.

Dogecoin bulls are persistently pushing for recovery after the recent slump to $0.04. The liftoff from this support has not been drastic, but buyers are consistently returning to the market. Initially, resistance at $0.06 hindered recovery leading to a dive to $0.04. However, the uptrend has been renewed, and Dogecoin is getting closer to a massive upswing.

Dogecoin on the verge of another breakout

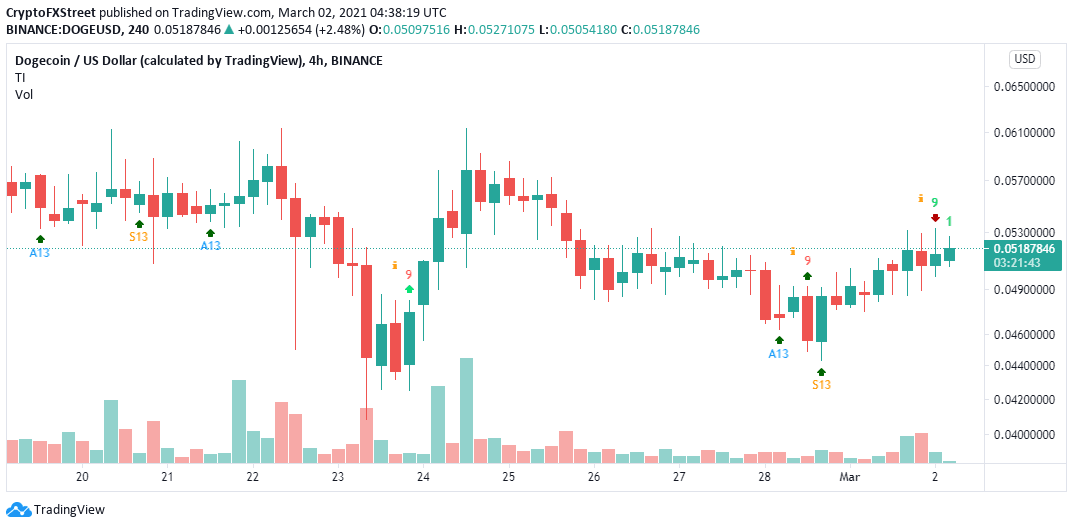

The cryptoasset is dancing within the confines of a symmetrical triangle, printed on the 4-hour chart. This technical pattern does not have a bullish or bearish bias. It is formed after a significant move in price followed by a period of consolidation.

Two trendlines are drawn: one connecting consecutive declining peaks, and the other links a series of ascending lows. Usually, a breakout or breakdown takes place before the trendlines meet. Symmetrical triangles are distinct for their exact targets after the breakout, measured from the pattern's highest to lowest points. In this case, DOGE is nearing a potential 35% liftoff to $0.07.

DOGE/USD 4-hour chart

The bullish outlook is currently supported by the Relative Strength Index (RSI) on the 4-hour chart. The trend strength indicator has a positive gradient toward the overbought region. As it gains ground, buyers get more confident, ready for the breakthrough to the all-time highs.

Looking at the other side of the fence

The TD Sequential indicator has recently flashed a sell signal on the 4-hour chart, hinting at overhead pressure intensifying in the near-term. This call to sell occurred in a green nine candlestick. If validated, we can anticipate Dogecoin's fall in one to four 4-hour candles and perhaps retest the support at $0.044 and $0.04, respectively.

DOGE 4-hour chart

It is worth mentioning that the symmetrical triangle can lead to a breakdown with the same 35% target to $0.03. Immediate support by the 50 Simple Moving Average must be protected to avoid the possible dip. Otherwise, closing the day below the moving average could pave the way for retesting the triangle support, risking a freefall to $0.03.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren