Dogecoin price aims for greatness after developers release new update in two years

- Dogecoin price is on the verge of a significant 25% breakout.

- The digital asset receives its first update since 2019 due to increase in demand.

- DOGE was listed on Phemex with up to 20x leverage.

Dogecoin is back on the spotlight after developers release a new update for the first time since 2019. The new upgrade makes Dogecoin faster and reduces CPU usage for users running Dogecoin nodes. Additionally, the digital asset was just listed on Phemex against AAVE and USD and with a leverage of up to 20x.

Dogecoin price close to a bullish breakout

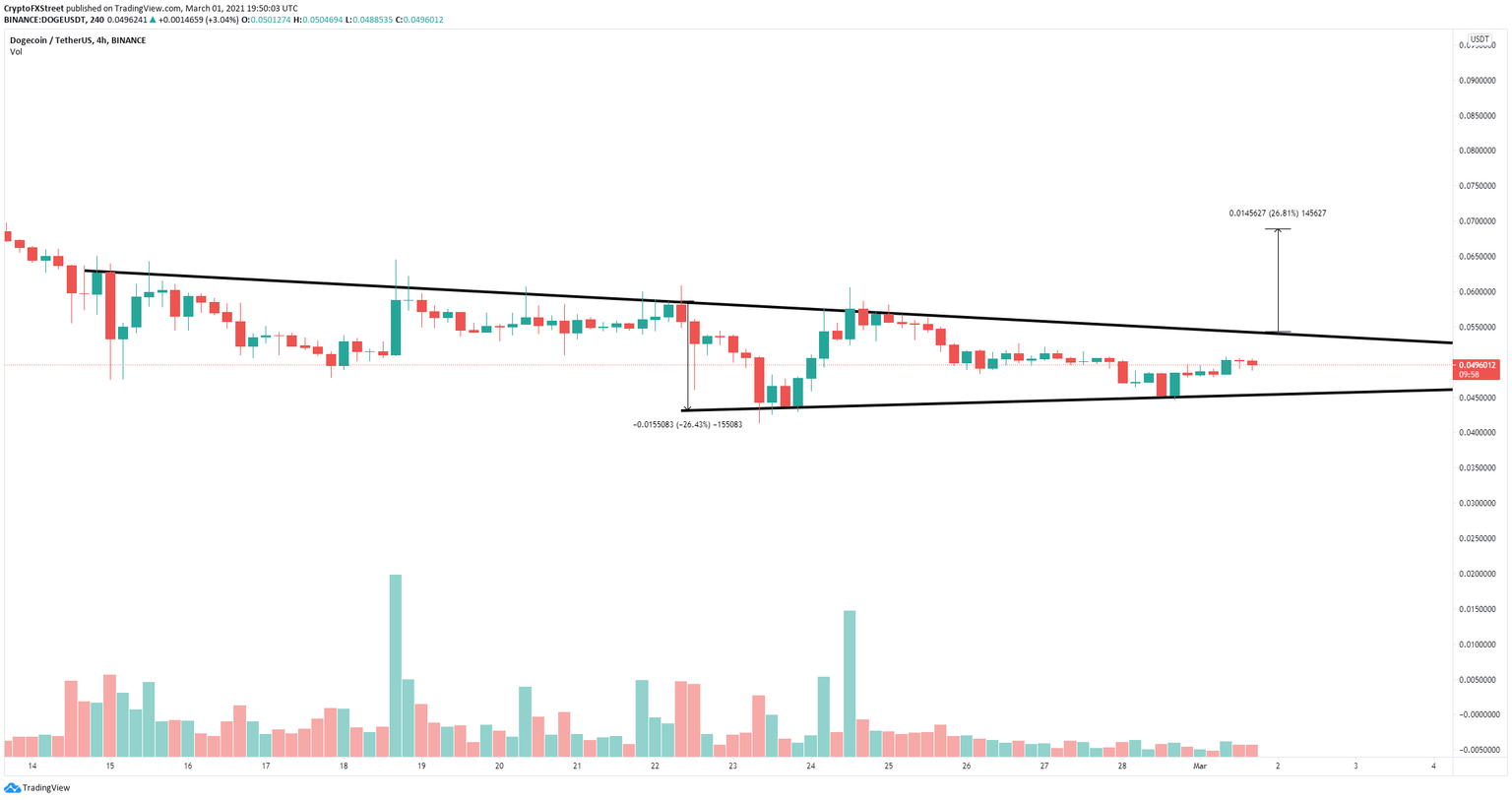

On the 4-hour chart, Dogecoin price is bounded inside a symmetrical triangle pattern which seems to be on the verge of a breakout. The key resistance level is located at $0.054, climbing above this point should quickly push Dogecoin price up to $0.07.

DOGE/USD 4-hour chart

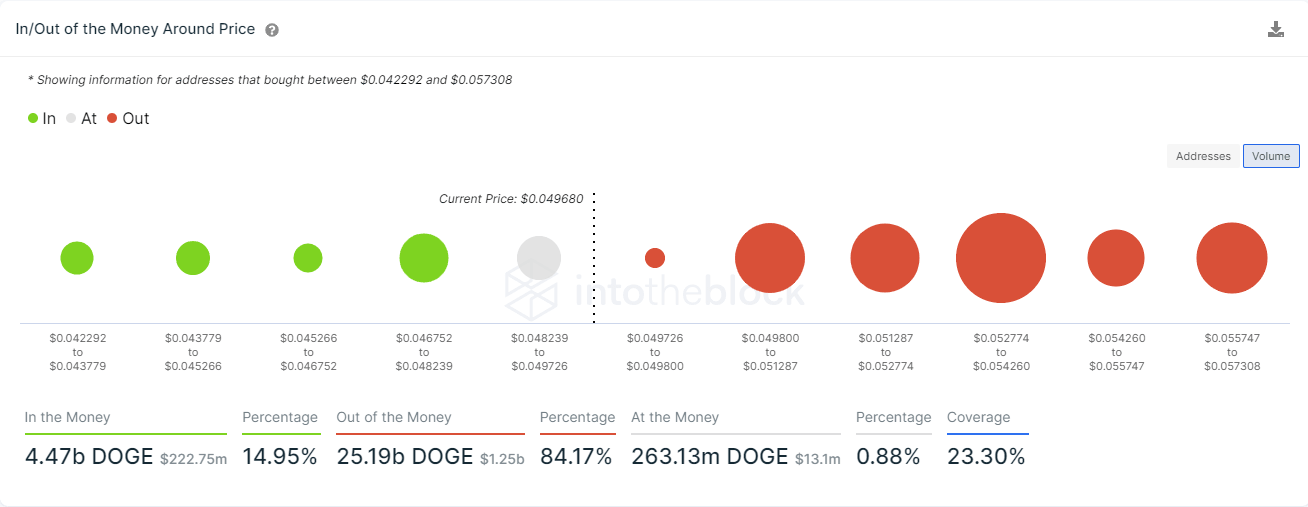

The In/Out of the Money Around Price (IOMAP) chart also shows the same thing as it indicates that the strongest resistance area is located between $0.052 and $0.054, adding credence to the bullish outlook above.

DOGE IOMAP chart

However, the IOMAP model also shows that DOGE has far weaker support on the way down below $0.05. A breakdown below the key support level of $0.0455 will quickly drive Dogecoin price by about 27%.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.