Dogecoin plummets penny-from-Eiffel style as whales consider abandoning ship

- Dogecoin price lost 50% of its market value in November.

- On-chain metrics suggest whales are losing faith in hodling the notorious meme coin.

- Invalidation of the bearish thesis is a breach above $0.103.

Dogecoin price witnessed a devastating decline during the second trading week of November. A sweep-the-lows event could be underway if the bulls show up later. Key levels have been defined to determine DOGE's next potential move.

Dogecoin price falls violently

Dogecoin price has seen better days as the notorious meme coin is down 50% on the month. On November 8, during the US midterm elections, DOGE fell by 30% in free-fall fashion. The penny-from-Eiffel-style decline shows some optimistic signals suggesting DOGE could recover; however, on-chain metrics argue a different scenario in play.

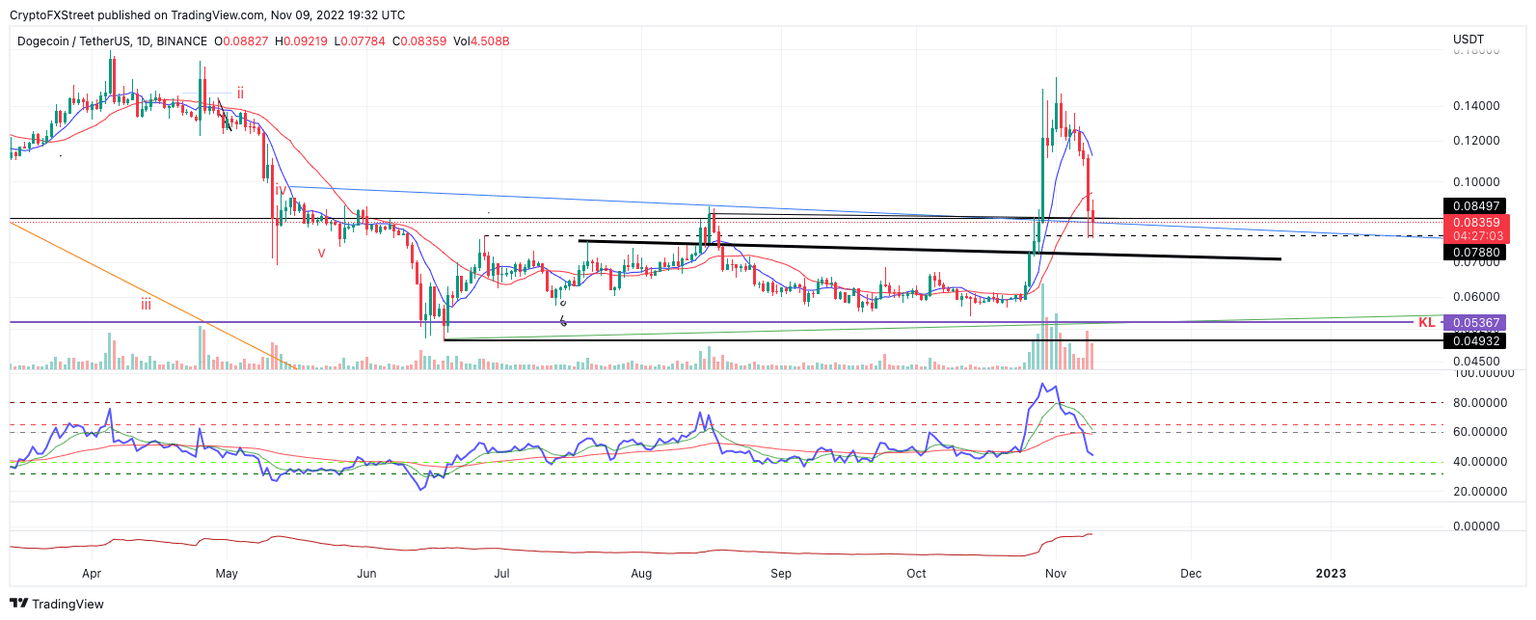

Dogecoin price currently auctions at $0.081. The decline shows relatively less volume than the previous uptrend rally. The Relative Strength Index (RSI) returns to the final levels of support after breaching extremely overbought conditions during the 160% rally at the end of October.

DOGE/USDT 1-Day Chart

Still, the most concerning signals are also one of the subtlest. The strongest candle's low within the recent uptrend has been breached. Based on classical technical analysis, DOGE's uptrend is now in jeopardy due to the breach.

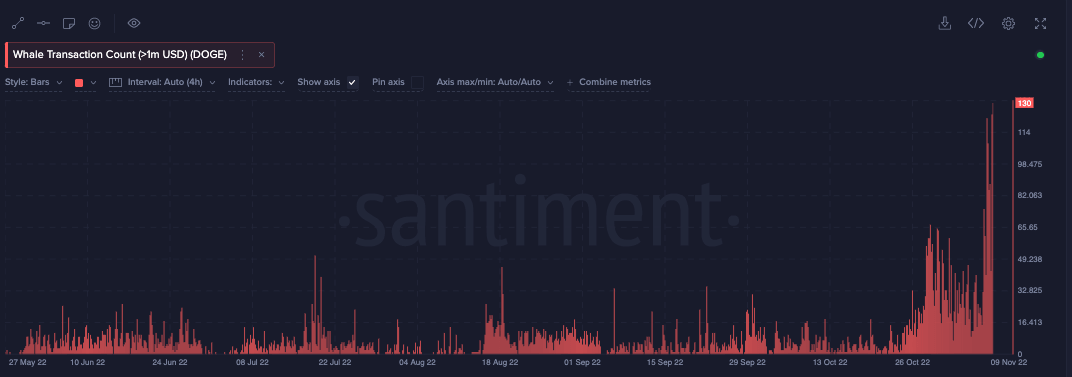

On-chain metrics compound the idea that DOGE's demise is far from over. Santiment's Whale Transactions Count >1M shows a significant uptick in movement. The indicator may suggest that high-cap DOGE investors are no longer interested in hodling, the notorious meme coin. Furthermore, they may be preparing to take profits during a countertrend rally in the weeks to come.

Santiment's Whale Transactions Count >1M Indicator

Considering these factors, DOGE may be due for more pain in the coming days. Traders may consider practicing healthier risk management techniques as the market could be subject to increased volatility. The next bearish targets lie at $0.06 and potentially the summer lows at $0.049.

Invalidation of the bearish thesis is a breach above the $0.103 liquidity levels. If the level is breached, DOGE could re-route north in the short term and rally as high as $0.12. Such a move would result in a 55% increase from the current Dogecoin price.

In the following video, our analysts deep dive into the price action of DOGE, analyzing key levels of interest in the market. -FXStreet Team

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.