DOGE sees high liquidations as meme coin sector bleeds heavily

- DOGE sees nearly $60 million in long liquidations following 18% dive.

- DOGE could see support at the $0.109 level based on on-chain data.

- Meme coin sector is down more than 16% as WIF, BRETT, MAGA take heavy losses.

Dogecoin's (DOGE) sharp decline earlier on Tuesday wiped off nearly $60 million from the crypto market as tokens in the meme coin sector struggled with huge losses.

DOGE liquidations nears that of Bitcoin

Dogecoin long traders took a heavy hit on Tuesday as DOGE's 18% dive within 3 hours triggered long liquidations worth about $60 million. This marks DOGE's largest daily liquidation since May 2021. As a result, DOGE open interest (OI) declined by 11% in the past 24 hours.

The increased DOGE liquidations are quite notable, considering they approached levels usually seen in Bitcoin and Ethereum, which have larger market caps and trading volumes.

Also read: Pepe poised for 18% crash following breakdown from ascending trendline

DOGE descent may have been fueled by whales gradually reducing their holdings. According to data from IntoTheBlock, the percentage of DOGE held by addresses owning more than 0.1% of its supply has reduced from 45% to 41%. In contrast, the holdings of retailers and mid-sized investors have grown.

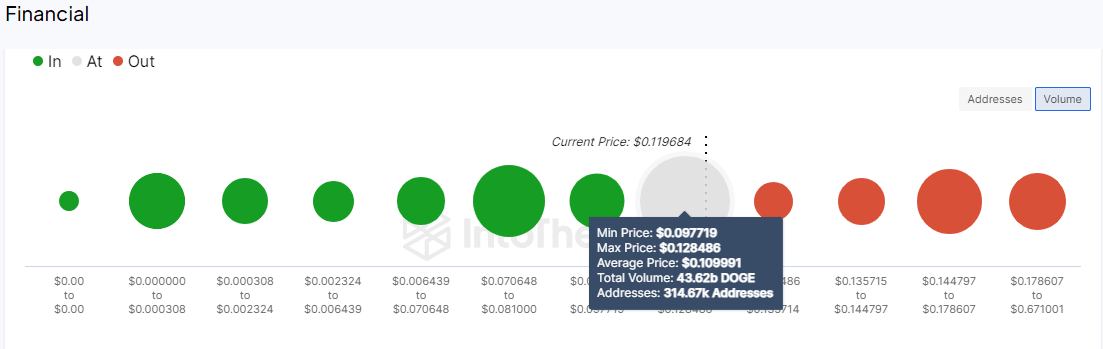

The $0.109 price level may prove a critical support for the top meme coin as it marks its highest accumulation zone — investors purchased over 43 billion DOGE at an average price of $0.109.

DOGE Global In/Out of the Money

Read more: TRUMP holders take profits, leaving supply on exchanges near six-month high

Other tokens in the meme sector share in the losses

The crypto market downturn has highly impacted the entire meme sector, down more than 16% on Tuesday. Some of the significant losses in the sector include Solana-based dogwifhat (WIF), which has decreased by over 20% in the past 24 hours. Base meme coin BRETT also took a 16% dive, extending its weekly losses to 20%.

Notably, MAGA, also known as the TRUMP meme coin, saw losses of about 20% after a report from Pirate Wires alleged that Republican Presidential candidate Donald Trump is launching an official token with the ticker "DJT." However, the former President has yet to confirm the rumors.

Meanwhile, BEER meme coin, launched less than a month ago, continued plunging as it suffered a 48% decline in the past 24 hours, extending its weekly losses to over 80%. The accelerated decline is likely spurred by several reports of insiders or team members steadily dumping the coin.

Author

Michael Ebiekutan

FXStreet

With a deep passion for web3 technology, he's collaborated with industry-leading brands like Mara, ITAK, and FXStreet in delivering groundbreaking reports on web3's transformative potential across diverse sectors. In addi