Decoupling ahead? Bitcoin and Ethereum may finally snap their 36-month correlation

Bitcoin and Ethereum have been majorly trading in sync since 2018, increasing risk exposure of crypto-only investment portfolios.

Anish Saxena, a New Delhi-based automobile dealer, made “incredible” profits by investing in cryptocurrencies in 2020, just as his business took a hit from the coronavirus pandemic-induced lockdown.

“I had known about Bitcoin and Ethereum and dozens of other assets for years,” the 33-year old businessman said. “But I only got to invest in them after the lockdown pushed me and my family members out of work. And it helped us survive — big time.”

Saxena revealed that he had allocated about 80% of his investment portfolio to Bitcoin (BTC) and Ether (ETH), with the rest of his capital distributed across Polygon, Dogecoin (DOGE) and Chainlink’s LINK. His crypto-only investment netted him great profits, the numbers of which Saxena declined to reveal.

However, he did notice how he almost got half of his unrealized profits wiped by deciding not to liquidate ahead of the May 2021 crash.

“I was liquidating cryptocurrencies based on my household demand for cash,” Saxena said. “While I am still in profits, seeing my profits decline by more than 50% has prompted me to get a huge portion of my investments back into cash.”

Correlation risks

Retail traders like Saxena have come under pressure due to over-reliance on the two most predominant cryptocurrencies: Bitcoin and Ether.

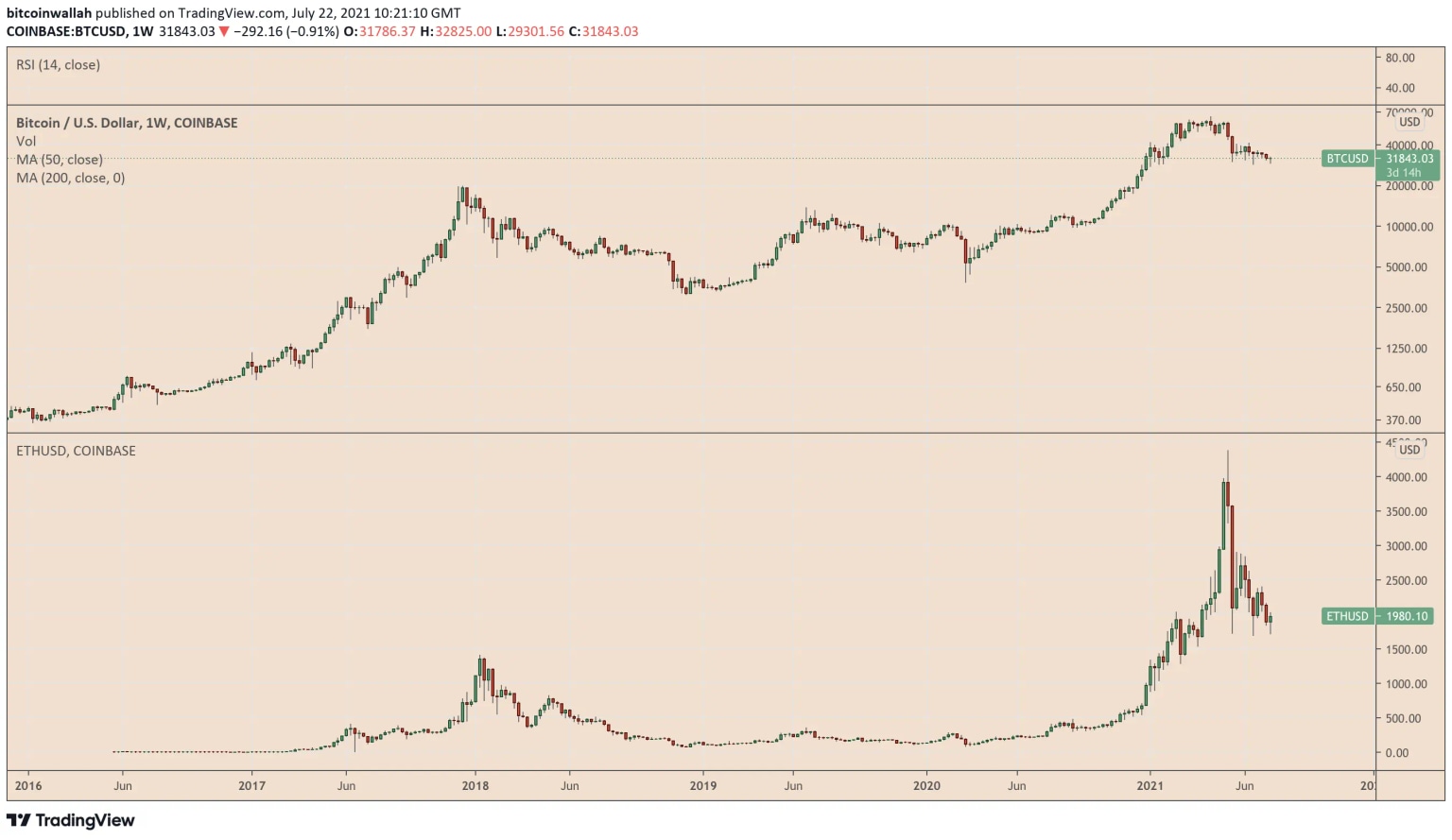

While different in terms of economics and use cases, both digital assets tend to move in the same direction. In recent history, their losses and profits appeared well-synced, illustrating that their holders might see their investments grow rapidly during bull trends but, at the same time, risk losing a lot when the uptrend exhausts and reverses to the bearish side.

“If it is a pure crypto portfolio, then, of course, having two cryptos which are highly correlated with one another adds risk to the portfolio,” said Simon Peters, a crypto analyst at multi-asset brokerage company eToro.

“While the portfolio could see exceptional performance one month with the two cryptos making gains in tandem, you could also see huge drawdowns in a bad month as the cryptos move lower together.”

The realized correlation between Bitcoin and Ether has seldom dropped below 50% in the previous three years. Source: Skew

On the other hand, Liam Bussell, head of corporate communications at fiat-to-crypto gateway provider Banxa, called Bitcoin and Ether liquidity backstops for crypto traders.

In his comments to Cointelegraph, the executive said that traders utilize their initial gains in the top two cryptocurrency markets to invest in mid and lower-cap digital assets, citing rallies in Dogecoin and across nonfungible token projects. He noted:

“Once the market begins to slow, traders try to move back to liquid assets like BTC and ETH. This can offset declines for a short time but can’t maintain the market indefinitely. There are gains to be made in bear markets, but it is volatile coins, and the risk is high.”

Additionally, Peters advised traders and investors to counterbalance their crypto investment risks by allocating a good portion of their capital in traditional financial instruments, including stocks, commodities, and fixed-income securities/funds.

“Historically, crypto has shown itself to be pretty uncorrelated to other asset classes and offers better risk-adjusted returns,” the analyst explained.

Decoupling ahead?

Peters, meanwhile, reminded that the Ethereum network’s transition from proof-of-work to proof-of-stake — known as Ethereum 2.0 — might limit its correlation with Bitcoin.

In detail, one of the principal features included in the upcoming Ethereum blockchain upgrade, called Ethereum Improvement Proposal 1559, is deflation and intends to burn a portion of transaction fees collected from users.

That could wipe out at least 1 million ETH tokens every year from the circulating supply, thus making the asset scarcer, according to crypto education publication Coinmonks.

Bitcoin exhibits a similar scarcity by reducing its newly issued supply rate by half every four years, a process called a halving. The cryptocurrency has a limited supply cap of 21 million tokens.

“It’s possible that a decoupling could occur between bitcoin and ether following the completion of the transition to 2.0, as the ‘tokenomics’ — how ETH works on the 2.0 blockchain — will be different to at present," said Peters, adding:

“Demand for ETH could vary depending on staking reward yields at that time, which in turn could drive the price of ETH higher or lower independently from other cryptos.”

As for Saxena, the novice trader said he would “hodl” on to a portion of his BTC and ETH.

“If business picks up again after a full economy reopening, I’m planning to invest consistently across Bitcoin, Ethereum, gold and mutual funds,” he noted.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.