Cryptocurrencies Price Prediction: Dogecoin, Polkadot & Ripple – American Wrap 1 March

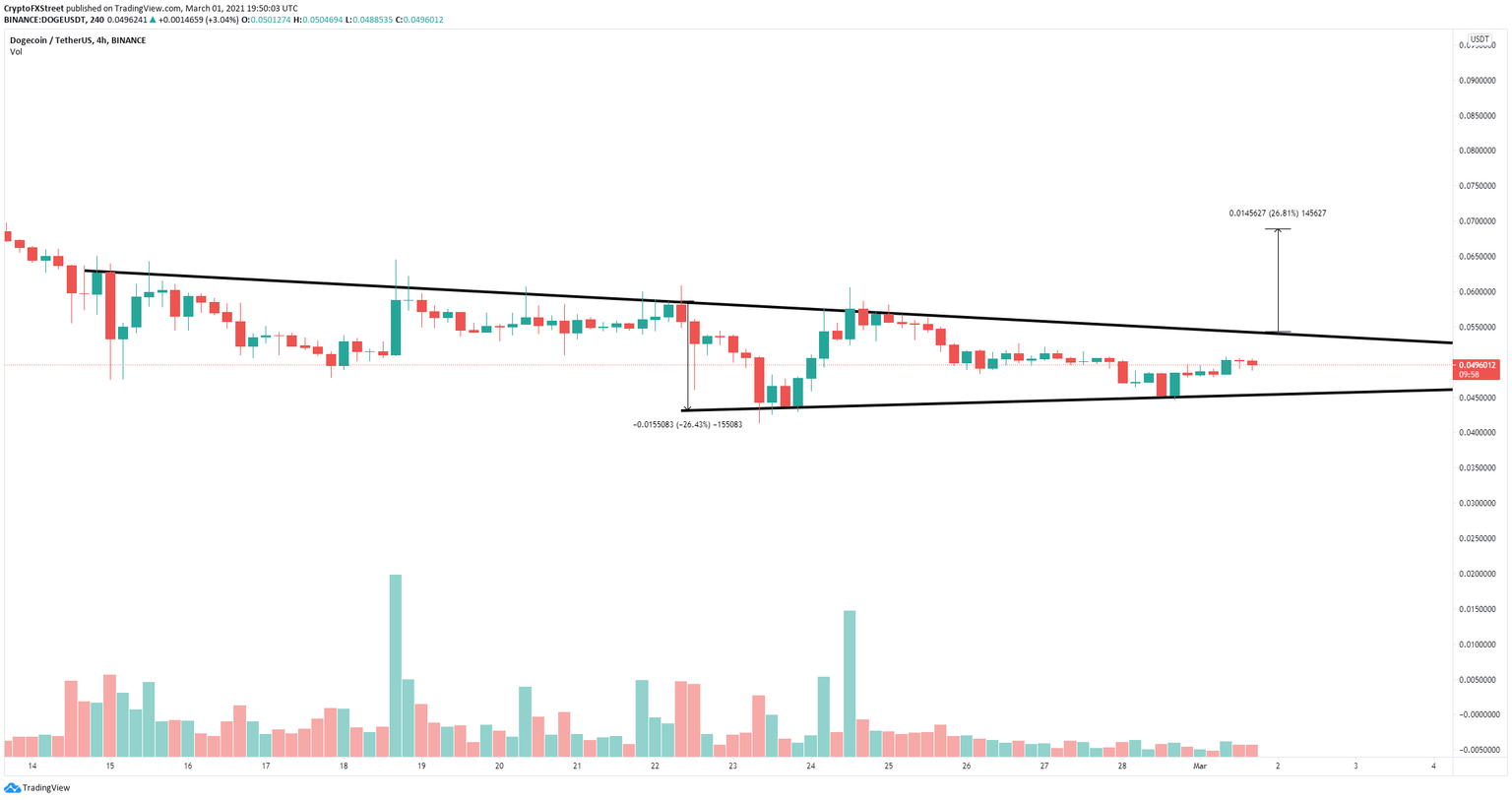

Dogecoin price aims for greatness after developers release new update in two year

Dogecoin is back on the spotlight after developers release a new update for the first time since 2019. The new upgrade makes Dogecoin faster and reduces CPU usage for users running Dogecoin nodes.

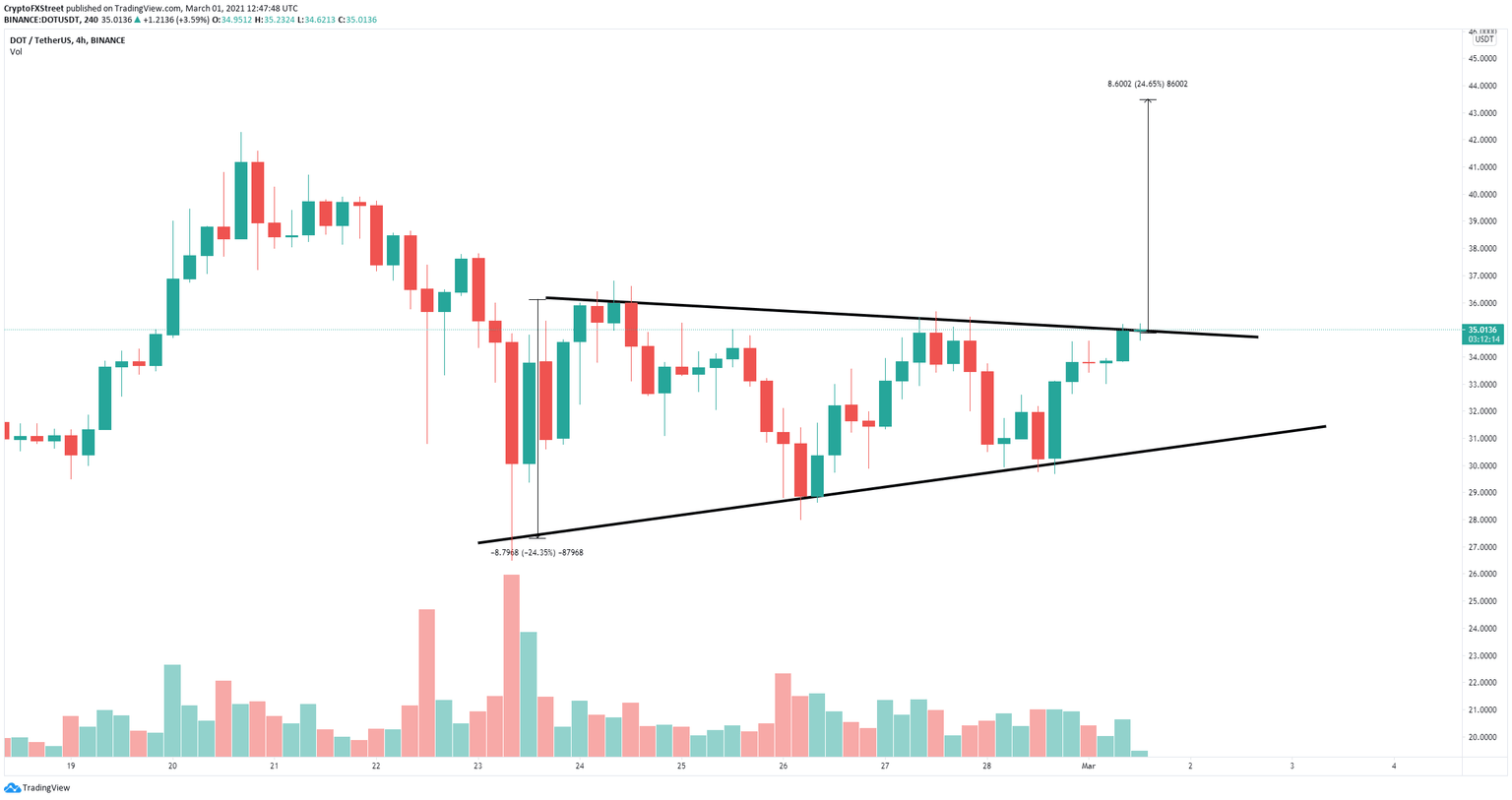

Polkadot price targets $44, but faces significant long-term selling pressure

Polkadot price has significantly rebounded from a low of $29.7 on February 28 but continues trading sideways inside a tightening pattern on the 4-hour chart. Bulls aim for a breakout above the critical resistance level at $35 while bears hope for another rejection.

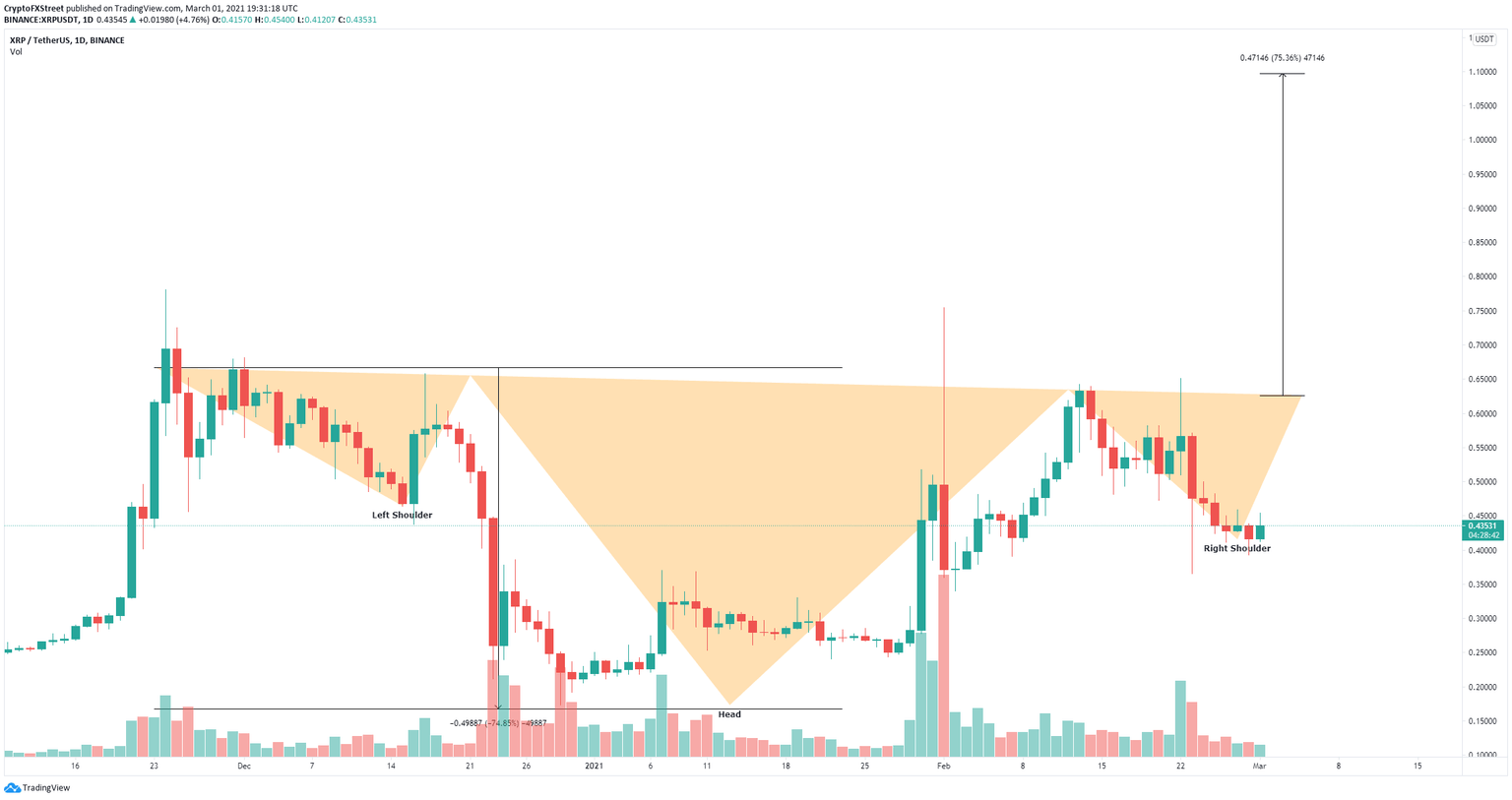

XRP price underperforms crypto market but technicals reveals 75% breakout in the works

XRP has formed a downtrend since February 22 and has been slowly declining towards a recent low of $0.39. Ripple bulls aim for a 75% breakout if they can conquer a key resistance level.

Author

FXStreet Team

FXStreet