XRP price underperforms crypto market but technicals reveals 75% breakout in the works

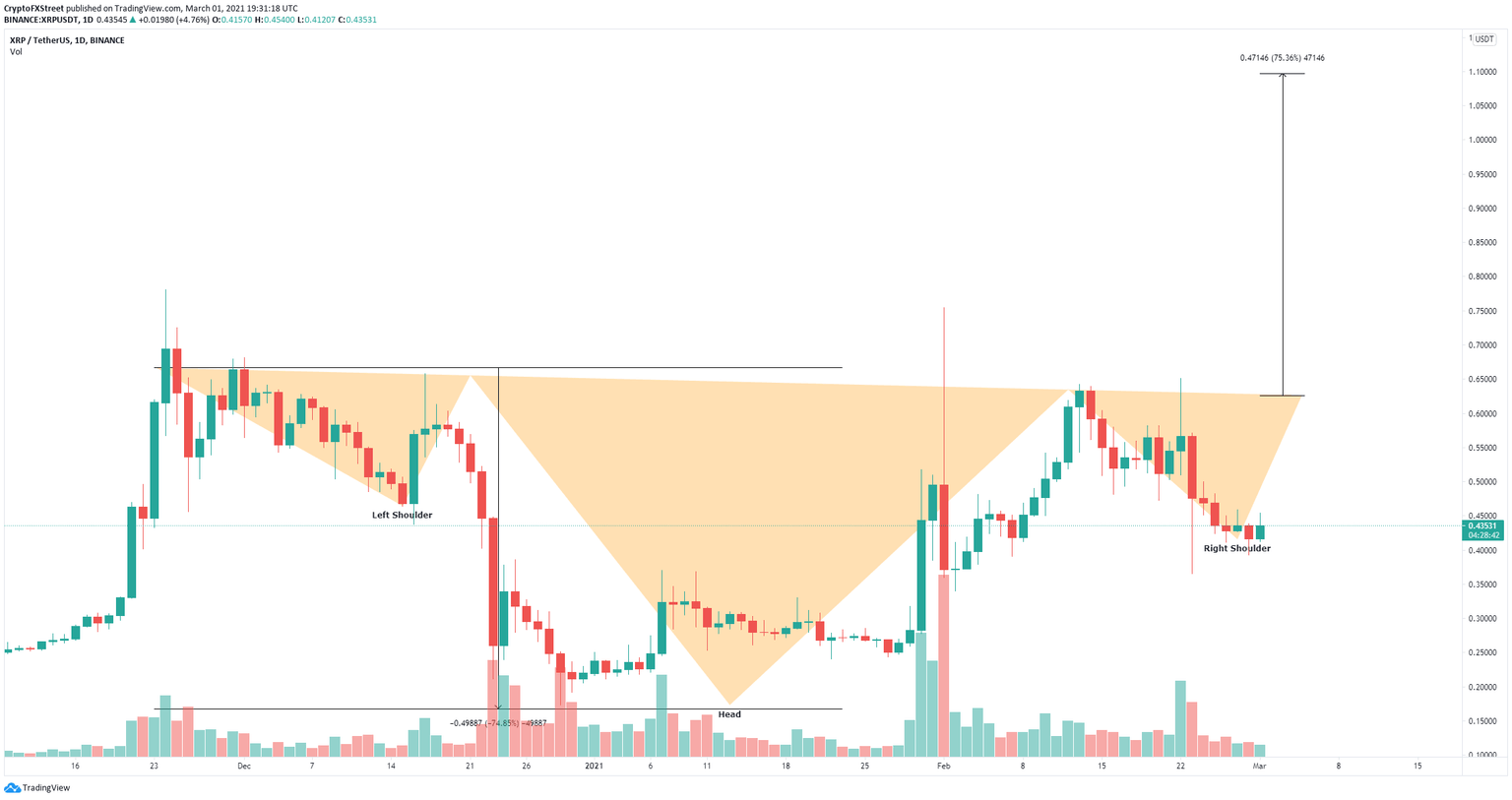

- XRP price is bounded inside an inverse head and shoulders pattern.

- The number of whales has seen a significant uptrend in the past two weeks.

- XRP could be on its way to a massive 75% breakout if key level breaks

XRP has formed a downtrend since February 22 and has been slowly declining towards a recent low of $0.39. Ripple bulls aim for a 75% breakout if they can conquer a key resistance level.

XRP price could potentially aim for a 75% move

On the daily chart, XRP has formed an inverse head and shoulders pattern which has established a resistance level at $0.62. In the short-term, it seems that XRP bulls have the upper hand as the number of whales holding at least 10,000,000 coins has increased by 10 since the beginning of February

XRP Holders Distribution chart

The resistance level formed at $0.62 is the key for a massive 75% breakout. The bullish price target in the long-term would be located at $1.10 as there is very little resistance above $0.75.

XRP/USD daily chart

However, it's important to remember that XRP's performance has been really bad in the past few months and a breakdown below $0.40 would invalidate the inverse head and shoulders pattern

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.

%2520%5B13.53.14%2C%252001%2520Mar%2C%25202021%5D-637502002326185327.png&w=1536&q=95)