Cryptocurrencies Price Prediction: Dogecoin, Chainlink & Bitcoin — Asian Wrap 12 Apr

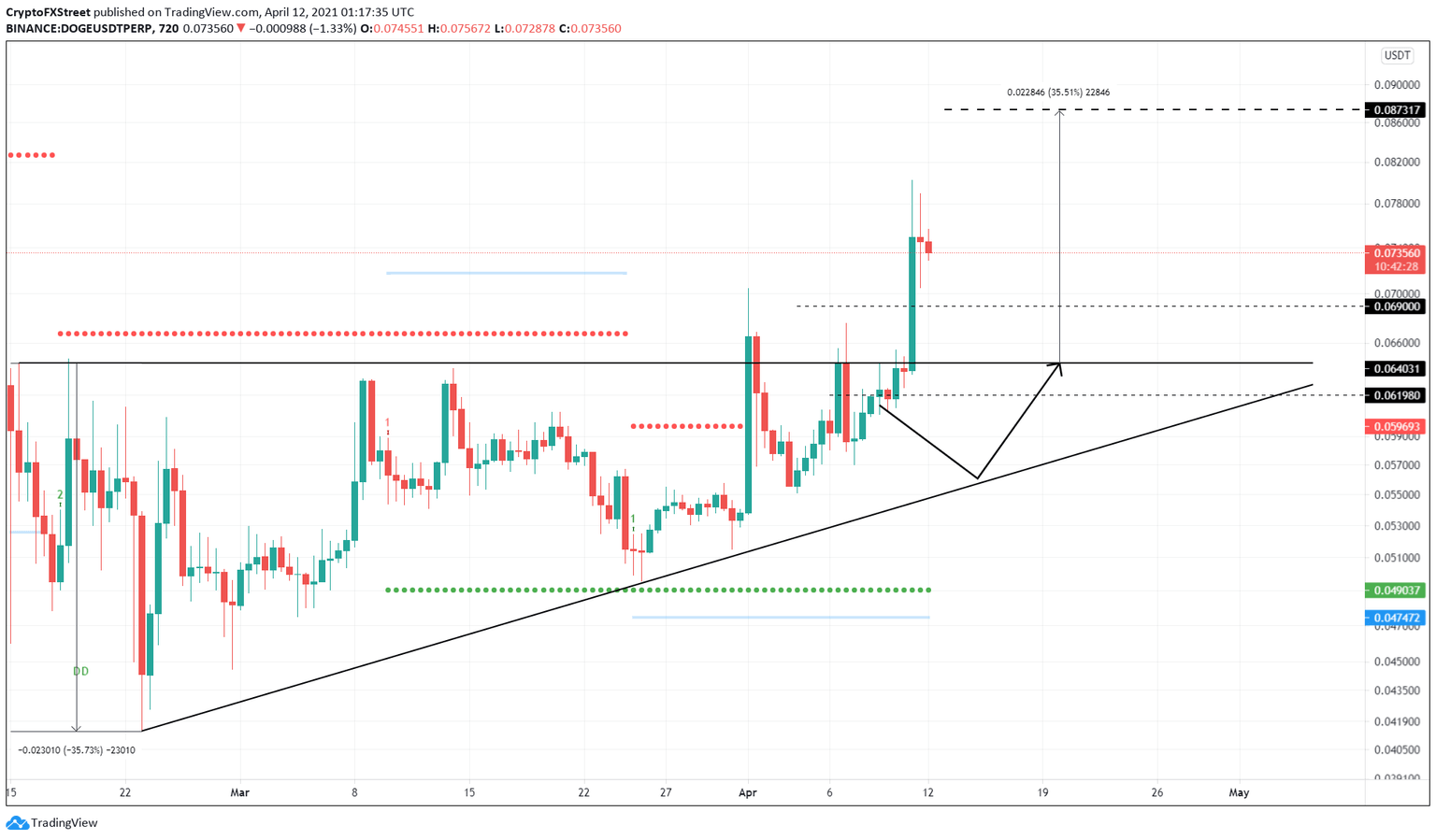

Dogecoin Price Prediction: DOGE pauses before continuing 35% ascent

The Dogecoin price produced an ascending triangle pattern obtained when the series of highs and swing lows are connected using trend lines. Such a price action shows aggressive buying pressure, and so, the breakout tends to be a bullish one.

A decisive close above the triangle’s base at $0.064 will signal the start of a 35% upward trend to $0.087. This target is determined by adding the distance between the first swing high and low to the horizontal supply barrier at $0.064.

Chainlink Price Prediction: LINK approaches make-or-break point

The Chainlink price has seen three major upswings fail to cross above the $35 level for the last two months creating a series of highs. Now, the oracle token faces a similar fate as the recent jab to overthrow this barrier has failed and reveals that a minor pullback is imminent.

When the swing highs and lows formed from January 22 are connected using trend lines, LINK shows the formation of an ascending triangle. This pattern has a bullish bias and forecasts a 50% upswing to $52.88, determined by adding distance between the first swing high and low to the triangle’s base at $35.

Bitcoin bull market top to be beyond $60K as miners and whales drive BTC price higher

Bitcoin has outperformed many traditional assets in the first quarter of 2021, as institutional investors have flocked to the cryptocurrency as a hedge against inflation.

The world’s largest cryptocurrency has witnessed a parabolic price run in the past few months, as many governments worldwide have been easing the effects of the pandemic with new fiscal stimulus packages.

The leading digital currency has recorded a 101% return in Q1 of 2021, outperforming traditional investments like oil, the Dow Jones, S&P 500, and the Nasdaq.

Author

FXStreet Team

FXStreet