Crypto.com price takes off to $0.1562, but this is how traders can avoid sudden bull traps

- A bullish wave traverses the cryptocurrency market on Friday, causing numerous price rebounds.

- Crypto.com price needs to stay above 100-day SMA to solidify its uptrend to $0.1562.

- As the IOMAP model highlights, immense resistance may thwart CRO’s attempt to close the gap to $0.1562.

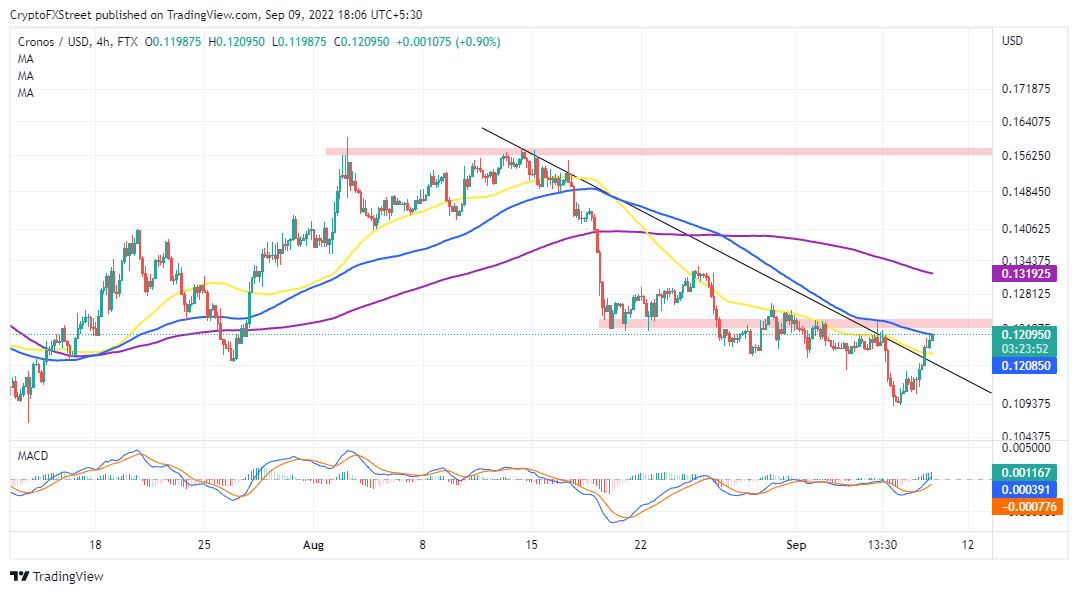

Crypto.com price is attempting to make a major move to $0.1562 after embracing a significant support area at around $0.1092. CRO’s impending upside move largely depends on its ability to suppress the supply zone at $0.1237. The crypto market is generally bullish, with Bitcoin price reclaiming the $20,000 level and Ethereum price holding slightly above $1,700.

Crypto.com price leaves a trail of key buy signals

Crypto.com price rebound has seen it recoup most of the losses incurred this week. However, the token is far from out of the woods, especially if the seller congestion zone at $0.1237 is considered. A four-hour to a daily close above this hurdle would elevate CRO – bringing it closer to its short-term target at $0.1406.

With the Moving Average Convergence Divergence (MACD) signal flipping bullish, buyers are unlikely to rest until Crypto.com price jumps to $0.1562. Movement into the positive territory (above the mean line) strengthens the bullish grip.

Read more: Crypto.com Price Prediction: CRO in grave danger this week as bears eye $0.1062

CRO/USD four-hour chart

Weak hands may consider taking profit at $0.1237, assuming they caught the trend in its initial stages around $0.1092. The expected move to $0.1562 will not come without its fair share of challenges – starting with the 200-day Simple Moving Average (SMA), currently at $0.1319. Other potential exit positions lie at $0.1406 and the ultimate target at $0.1562.

Crypto.com IOMAP chart

According to the IOMAP on-chain metric by IntoTheBlock, Crypto.com price has a relatively smooth path until the area running from $0.2016 to $0.3612. Around 21,200 addresses purchased 84.98 billion tokens in the range. As a result, a trend reversal is anticipated unless buyers keep up their aggressive momentum, aiming for higher levels toward $1.0000.

The same IOMAP model reveals the absence of significant demand areas, which leaves Crypto.com price in grave danger of pulling back.

It is worth mentioning that the 100-day SMA has the potential to transform into CRO’s immediate support. Crypto.com price needs sturdy demand areas in its trail to keep its uptrend in line.

The 50-SMA will collaborate with the descending trendline to cushion CRO from spiraling further. If push comes to shove, investors need to acclimate to a fresh round of declines – testing its primary support at $0.1092.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren

-637983276214513987.png&w=1536&q=95)