Crypto.com price likely to trap bulls as downside objective remains unfinished

- Crypto.com price shows a recovery as it attempts to produce a higher high above the August 25 swing high at $0.133.

- This development could result in trapped bulls, especially if CRO heads down to collect liquidity below $0.0985.

- A daily candlestick close above $0.133 with a higher low relative to $0.112 will invalidate the bearish thesis.

Crypto.com price is on a downtrend with no signs of stopping just yet. However, the recent spike in bullish momentum must have given buyers a wrong impression of a recovery rally as the downside objectives are still uncollected.

If bulls are not careful, they are likely to get squeezed in the coming days.

Crypto.com price plans to undo recent gains

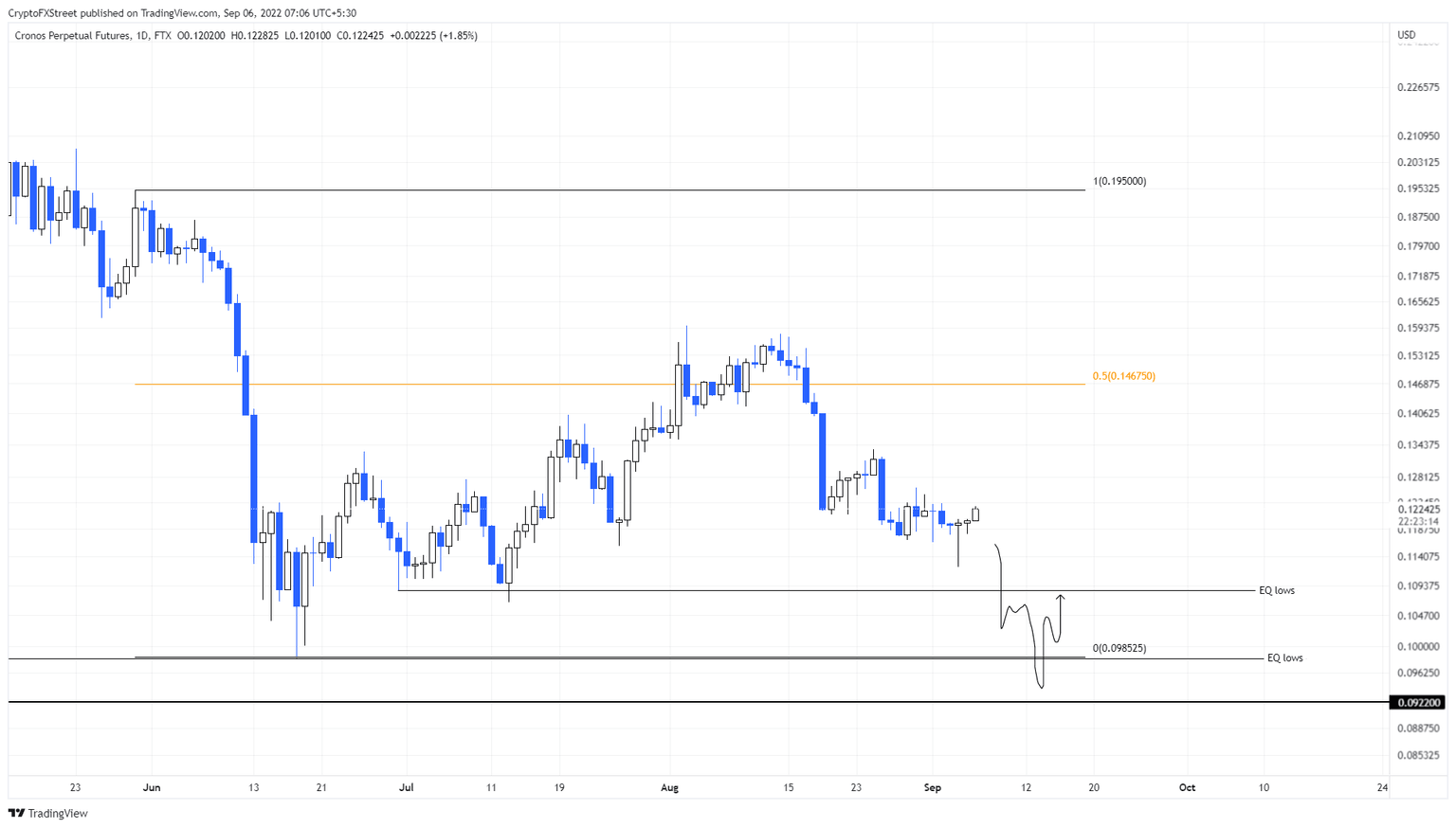

Crypto.com price dropped 28% between August 14 and September 4, creating a swing low at $0.112. This downswing was followed by a quick recovery on September 4 with a 2.80% upswing over the next two days.

However, this move is temporary and likely to be reversed as market makers take CRO lower to collect the liquidity resting below equal lows formed at $0.1080 and $0.0985. Opening long positions after this development will have a higher chance of succeeding.

But for now, Crypto.com price is getting ready for a 10% to 19% downswing as bears seize control.

CRO/USDT 1-day chart

While things are looking bullish for Crypto.com price due to the sudden burst in buying pressure, this rally should be avoided. The liquidity resting below $0.1080 and $0.0985 are likely to be collected before a massive run-up.

However, bulls could prematurely trigger a run-up if they can produce a daily candlestick close above $0.133. This move will invalidate the bearish thesis, but additional confirmation will arrive if Crypto.com price can set up a higher low relative to September 4 swing low at $0.112.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.