Crypto.com Coin has bulls folding as bears are on target to push price sub $0.10

- Crypto.com Coin price action slips in late US trading on Tuesday.

- CRO price nears the last line of defence before bears test $0.10

- Expect to see another 12% decline if this sentiment continues throughout the week.

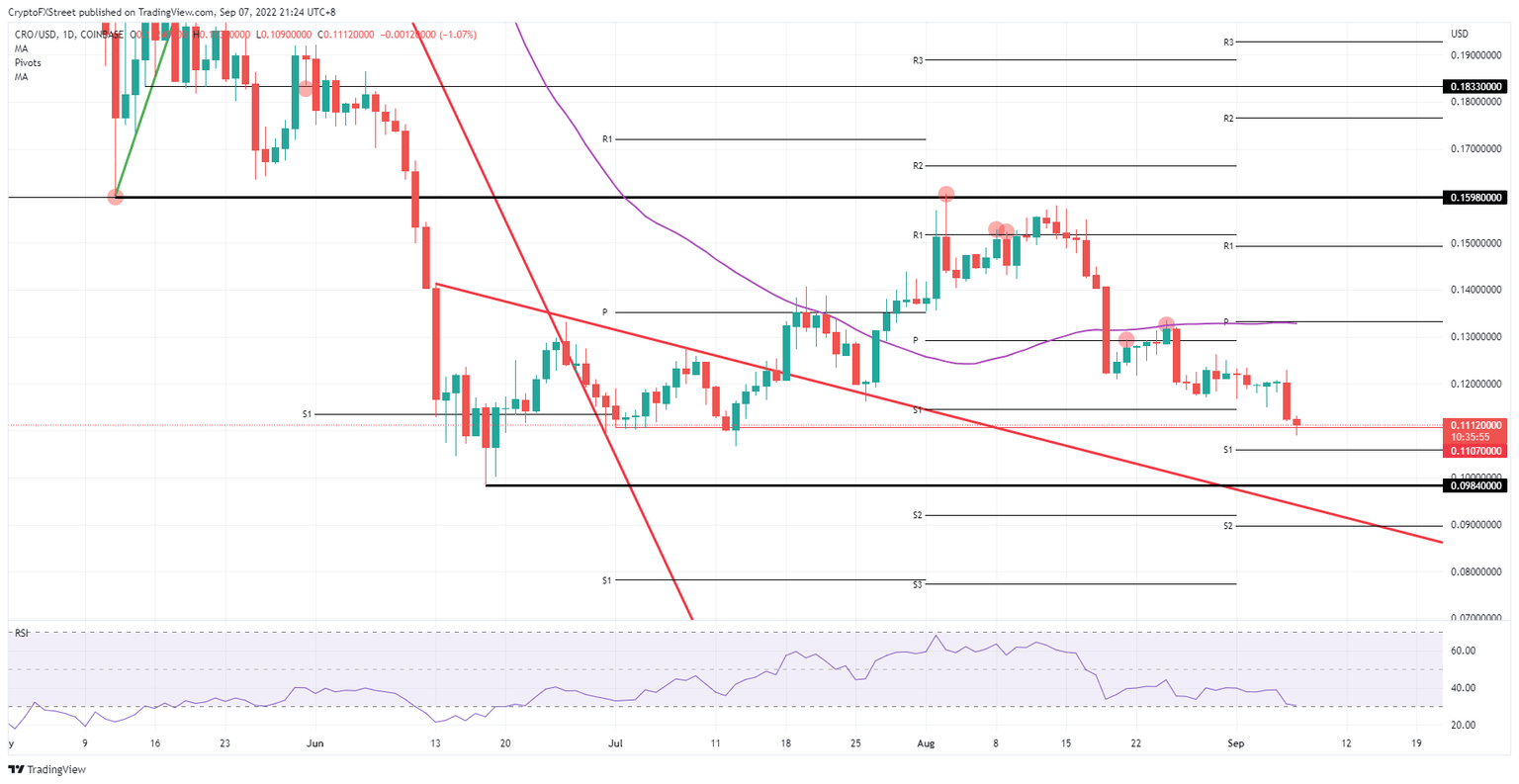

Crypto.com Coin (CRO) price slipped as bulls’ false hopes of a possible rally to $0.1300, near the 55-day Simple Moving Average, evaporated. Instead, CRO price plunged over 6% to the downside to find support near $0.1100. As bears rip through support, the low of 2022 is coming up for grabs and could see CRO price printing sub-$0.0984.

CRO price set to drop another 11%

Crypto.com Coin price is not enjoying much of an Indian summer as price action erases all previous gains in just the last hours of the trading session near the US close. With bears now pressing down on bulls and squeezing them to the downside, bulls are failing to hold onto the $0.1107 barrier that held up pretty well for most of the summer. With only the monthly S1 support level in the way, not much more is in the way to prevent bears from touching base at $0.0984 anytime soon.

CRO price thus has another 11% of devaluation forecast, with the psychological $0.1000 level at risk of breaking. Not only would that mean a break of a high level, but also the risk of new lows for 2022. With the monthly S2 support near $0.0900 and a red descending trend line possibly still in play, expect that level to be the next target to the downside.

CRO/USD Daily chart

Equity markets have repeatedly shown their resilience these past weeks and months, rallying in challenging circumstances. The same goes for cryptocurrencies with the staggering performance of Ethereum price this week as the most recent example. CRO price could, therefore, see a turnaround just on the back of one positive headline comment and Crypto.com coin price print back up at $0.1200 with the prospect of reaching up to $0.1300 depending on the catalyst at hand.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.