Crypto.com Price Prediction: CRO poised for a 50% rally if these conditions are met

- Crypto.com consolidates after rallying 50% in January.

- A 50% spike toward $0.12 is possible if bulls maintain support.

- The health of the uptrend depends on the $0.054 remaining untagged.

Crypto.com price is worth keeping a close eye on. After an impressive 50% rally witnessed earlier in the month, the technical suggests more uptrend gains could occur in the coming weeks.

Crypto.com price has higher targets to reach

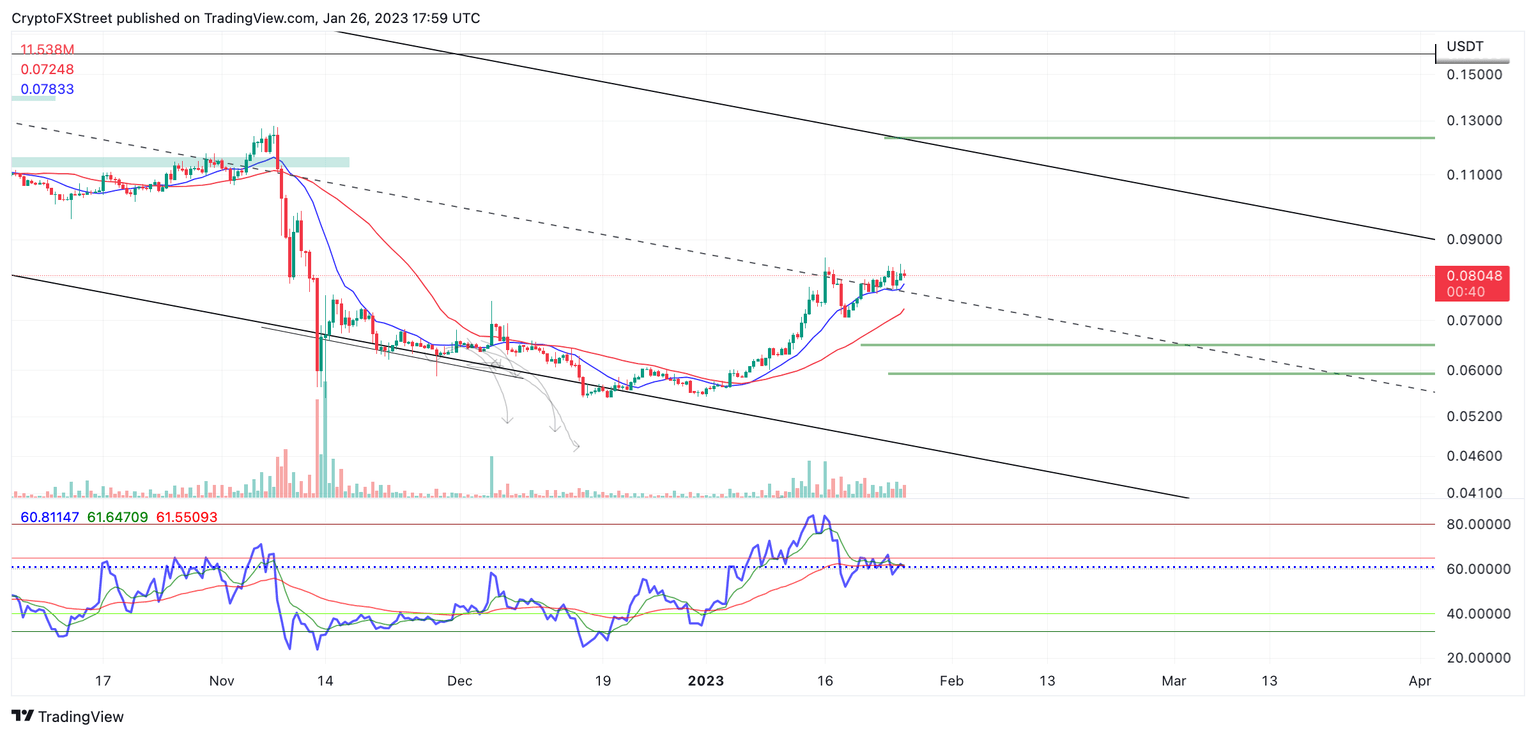

Crypto.com price should remain on traders' watch list as the technicals suggest more volatility and uptrend price action could occur. Since January 1, the Ethereum-based exchange token has rallied 50%. CRO is now in its 12th day of consolidation as the bears continue to forge resistance near $0.09. A break above the aforementioned level could induce a 50% upswing to take out liquidity established in the fall.

Crypto.com price currently auctions at $0.080. The Relative Strength Index (RSI), an indicator used to gauge trend and potential by comparing trading contrasting previous rallies, shows the current auction coming down into a previous resistance zone. While the CRO price progressively produces higher daily closing candlesticks, the descending RSI could be suggesting that selling pressure is being absorbed.

Additionally, the Crypto.com price is consolidating above a descending parallel channel median line. The descending trend channel acted as resistance and support throughout 2021. Based on classical technical analysis, the CRO price could rally towards the other side of the trend channel near $0.12. The bullish scenario creates a potential 50% rise from CRO’s current market value.

CRO/USDT 1-day chart

For traders looking to enter the market, the uptrend potential depends on the $0.054 swing low holding as support. If the low is breached, CRO could descend toward the $0.04 zone resulting in a 50% decline from Crypto.com’s current market value.

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.