Crypto.com Price Prediction: CRO starts the year bullish, but will gains continue?

- Crypto.com price has risen by 7% since the start of the new year.

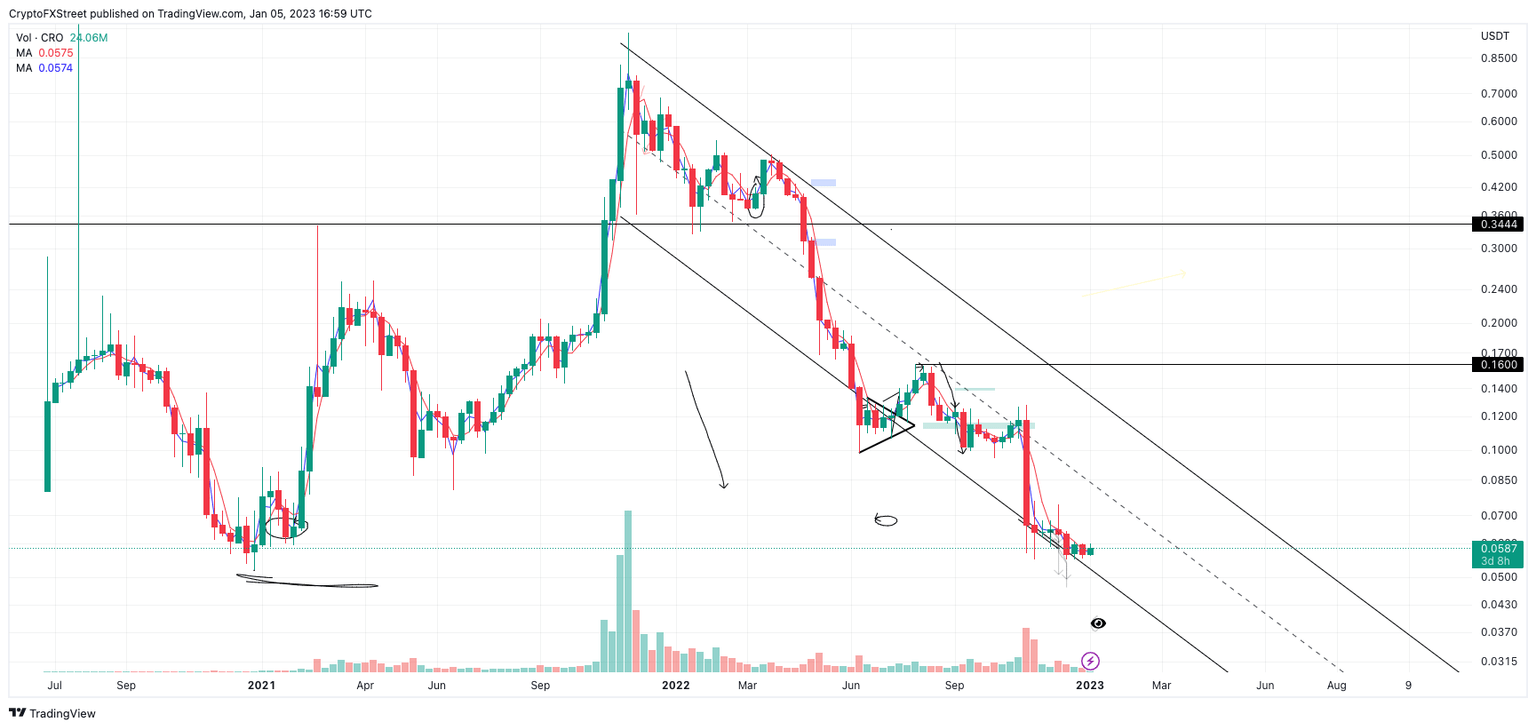

- The CRO price has an untagged liquidity level from 2020, which is 12% below the current market value.

- A breach below $0.0550 could be the start of a 12% downtrend.

Crypto.com price hovers near uncollected liquidity from 2020. Key levels have been defined to determine if bears have the potential to shake out long-term investors.

Crypto.com price is playing it close

Crypto.com price has been trading within a 6% range since the second week of December. On January 1, the Ethereum-based crypto exchange token bounced from the lower end of the contracting range producing at $0.0553, halting the bears' attempt to breach the 2022 low at $0.550. CRO would then go on to rally by 7% into the $0.06 barrier.

Crypto.com price currently auctions at $0.058. The recent move north had produced a 7% increase in market value from 2023's opening price. In the process, the bulls have breached both the 8-day exponential moving average and 21-day simple moving averages. As the price consolidates, the moving averages are coiling, suggesting a strong move will resolve the stalling market's behavior.

If the market is genuinely bullish, the first level of interest to aim for would be December's opening price of $0.065. CRO would rise by 10% under the bullish scenario.

CRO/USDT 1-week chart

On the contrary, a slide beneath the recently breached indicators could wreak havoc on Crypto.com's uptrend potential. The yearly low at $0.0550 will ultimately face a challenge if the bulls lose their footing. The next key target would be the swing low at $0.0520, which has remained unbreached since 2020. The CRO price would be 12% off its market value if the cards played out in the bears' favor.

This video details how Bitcoin price moves could affect Crypto.com price

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.