Crypto.com Price Prediction: Why 2023 could be the year for CRO believers

- Crypto.com price rallied by 54% since the start of the new year to January highs.

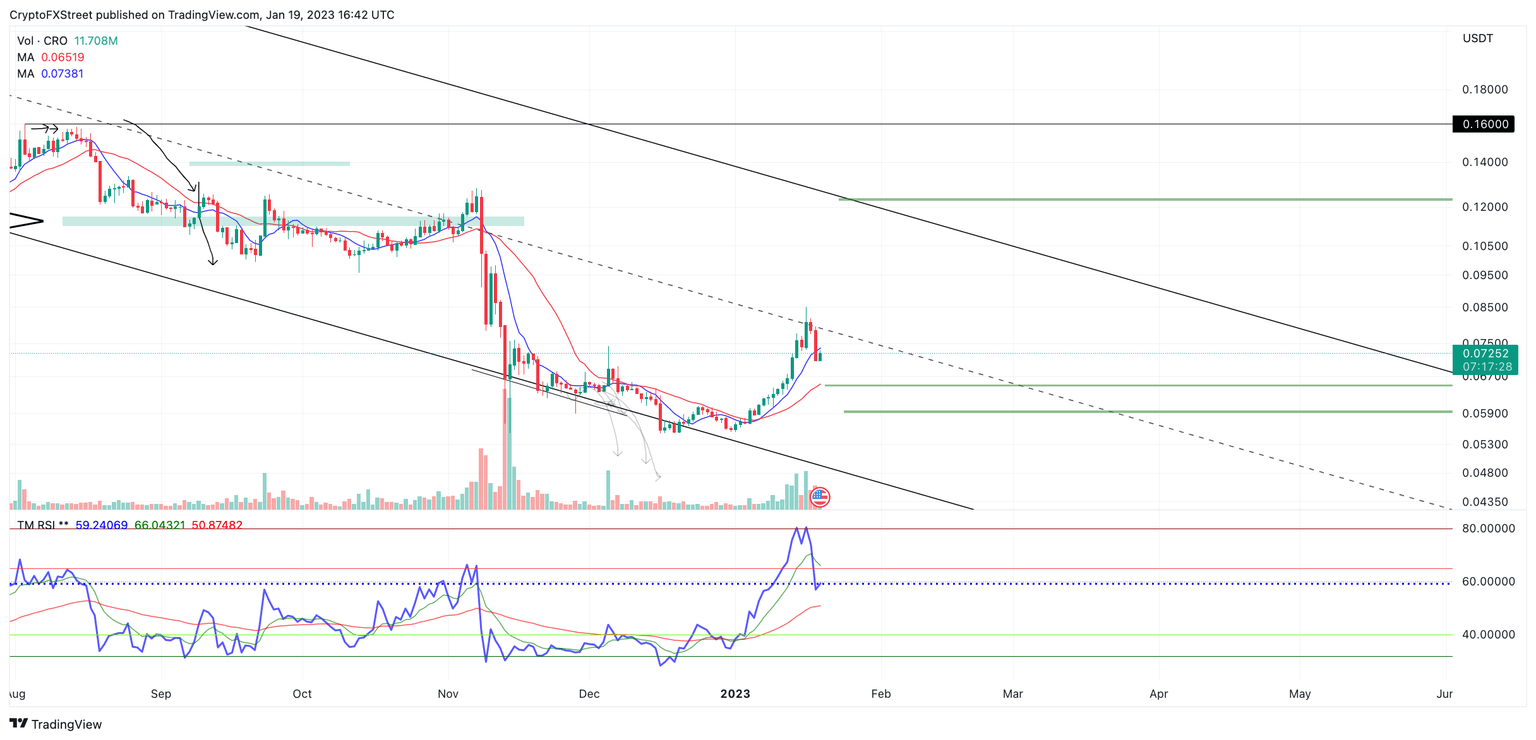

- CRO could rally towards $0.12 if the uptrend holds.

- Invalidation of the bullish outlook would constitute a breach below $0.054.

Crypto.com price could present a profitable opportunity for investors to partake in the coming weeks. Technical indicators have been evaluated to assess possible outcomes for the Ethereum-based exchange token.

Crypto.com price aims for untagged liquidity

Crypto.com price is showing optimistic signals going into the third trading week of the month. To recap, CRO rose by 54% since January 1 to a monthly high of $0.0857 on January 16, before correcting lower. The newfound rally shows strength in volume and momentum, which means the move north may be in the initial stages of a much larger swing trade.

Crypto.com price currently auctions at $0.072.The volume indicator has shown a classic ramping signal during the recent surge, which could be interpreted as bullish confidence. The Relative Strength Index (RSI), an indicator used to gauge momentum by comparing and contrasting previous swing points, shows the current uptrend as a genuine impulse wave since it has breached extremely overbought conditions tagging 80 on the RSI.

CROUSDT 1-day chart

The last time the RSI tagged 80 was in September of 2021. CRO breached the $0.20 level, followed by a 27% pullback into the $0.14 zone. CRO would then go on to rally over 300% into an all-time high at $0.97 within two months.

If the Crypto.com price is as bullish as the technicals suggest, the CRO price could rally toward November’s monthly high at $0.128. A barrier breach would result in a 70% increase from CRO’s current market value.

For traders looking to partake in the move, invalidation of the bullish thesis would be a breach below the January 1 swing low at $0.054. If the breach occurs, the Crypto.com price will go into price discovery to the downside with unforeseeable bearish targets. A tag of the invalidation alone would be a 22% loss.

This video details how Bitcoin price moves could affect Crypto.com price

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.