Crypto.com Coin price at crucial level as major rout could be next

- Crypto.com Coin price came into the crosshairs on Thursday.

- CRO underwent a massive sell-off with an+8% loss on the close for Thursday.

- Expect to see more at risk as this support is the only thing that stands between bulls and a 30% loss.

The price of Crypto.com Coin (CRO) took a strong uppercut of 8% losses as bulls were knocked out against the ropes Thursday. In a ninja-type of event, bears suddenly swarmed the market and sparked sell-offs across the board in bonds, equities and cryptocurrencies. Several warnings were already issued throughout the week that tail risks were flaring up again, and the message from Federal Reserve Chair Jerome Powell on Tuesday was initially perceived as dovish by markets before its hawkish intent was digested later in the week.

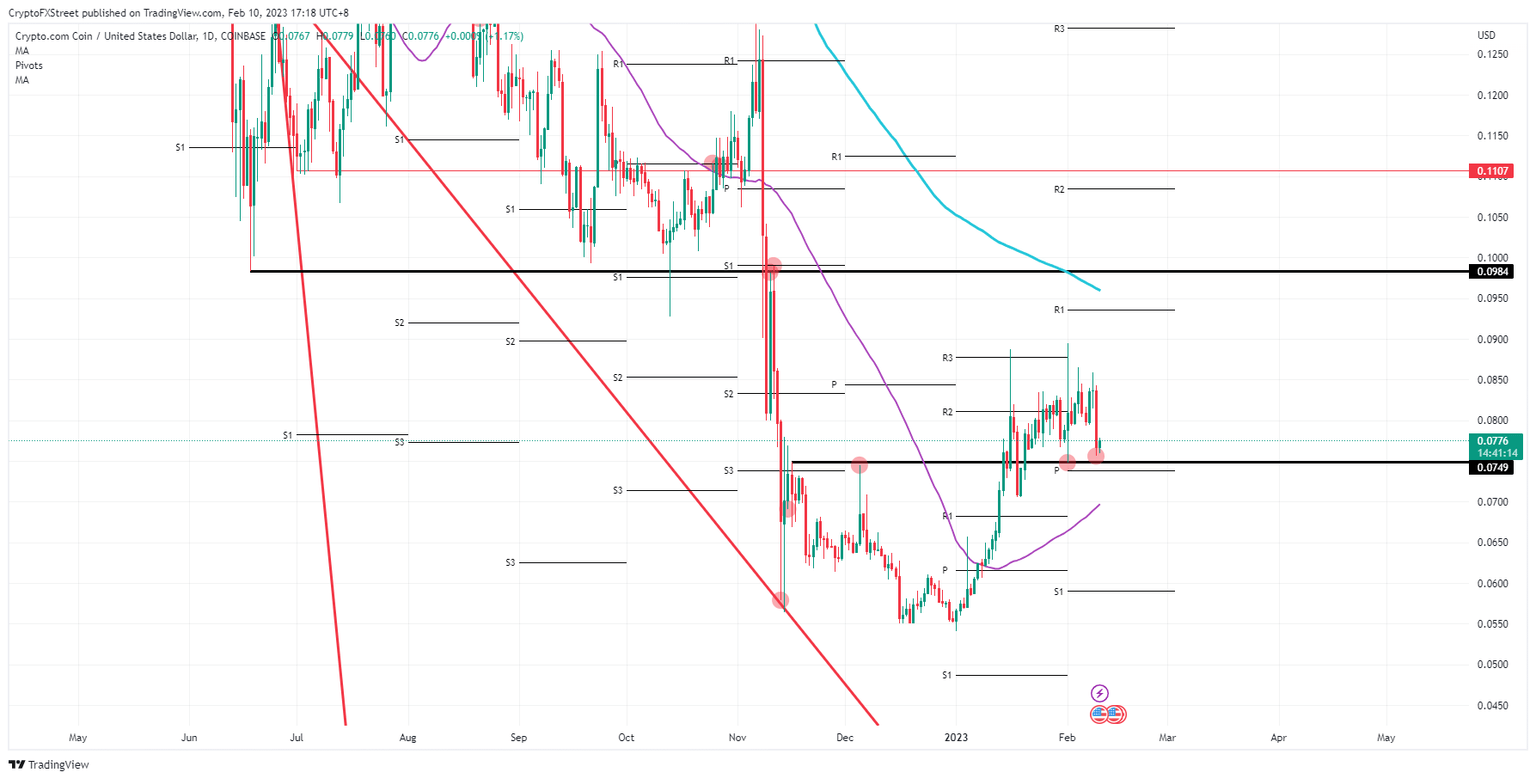

Crypto.com Coin price has only two lifelines protecting from 30% implosion

Crypto.com Coin price could tank another 30% if bears can breach two crucial support levels as the January rally is at risk of being erased from the books. Following the surprise visit from Zelenskyy in Brussels, Russia has started its first part of the next offensive with several missile attacks, mortars and an organized drone attack. All eyes are on Brussels Friday where EU leaders will discuss Zelenskyy’s plea for fighter jets in response to the new Russian offensive.

Thus, CRO is at the mercy of current geopolitical forces about to enter their one-year morbid celebration. Expect more tail risks to be added and further ammunition to be provided to bears if the EU gives the green light for the fighter jet delivery. A nosedive move through $0.0749 and the 55-day Simple Moving Average at $0.0700 opens the door for a full erasure of the January rally by falling to $0.0550.

CRO/USD daily chart

With these support levels in place, a rebound could be granted as well. After all, several intelligence agencies were predicting the next offensive to happen in the middle or the end of January. Do not expect to see a test at $0.10. Bulls need to be realistic and focus on $0.0850 as the profit-taking level for now.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.