Crypto experts allege Gate.io and Crypto.com could collapse like FTX: Accident or proof-of-reserves?

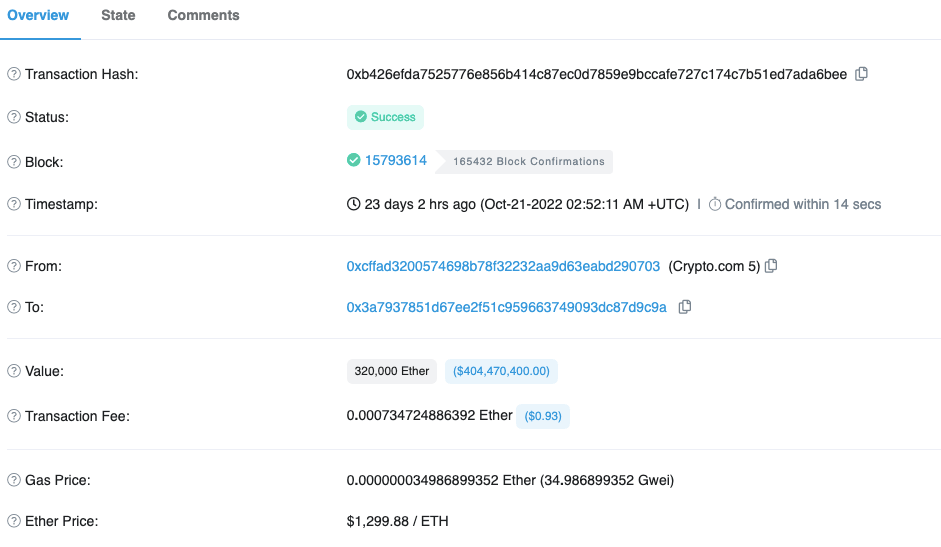

- Crypto.com’s cold storage revealed a suspicious transfer of 320,000 Ether worth $404 million to Gate.io.

- Kris Marszalek, CEO of Crypto.com, assured traders that the transfer was accidental; funds were to be moved to a new cold storage address.

- Experts allege that the transfer helped Gate.io show its proof of reserves of user funds shortly after the transfer.

Samuel Bankman-Fried’s FTX exchange collapse highlighted the importance of proof-of-reserves for centralized exchanges. When confirming the availability of funds on Crypto.com, cold storage information revealed a suspicious transfer of 320,000 Ether to Gate.io.

Gate.io completed its proof-of-reserves audit shortly after, arousing the suspicion of experts and analysts on crypto Twitter.

Also read: Breaking: FTX exchange and FTX US allegedly hacked, uninstall app to protect against malware

Gate.io finishes proof-of-reserves after receiving 320000 ETH transfer

The FTX collapse has raised concerns among crypto traders regarding safety of user funds in exchanges’ cold storage. Exchanges started publishing proof-of-reserves to steer clear of the issues that surrounded the FTX exchange before its collapse.

Gate.io completed its proof-of-reserves audit on October 28, 2022, merely days after receiving $404 million worth of Ethereum from Crypto.com. When investigating transactions by Crypto.com, on-chain analysts identified a suspicious 320,000 Ether transfer to Gate.io. Kris Marszalek, CEO of Crypto.com, explained this transfer was accidental. Crypto.com intended to move user funds to a new cold storage address, but an accident resulted in the transfer to Gate.io.

Ethereum transfer from Crypto.com to Gate.io

Interestingly, within days of the accidental transfer, Gate.io published its proof-of-reserves report. Solidity developer and on-chain analyst Shegen published evidence of the same on Twitter:

Audit assessment of Gate.io exchange

The move by Crypto.com has raised several unanswered questions for crypto traders. FTX exchange’s co-mingling of finances with Alameda research and loss of user funds, reflecting zero balances, have raised red flags.

Traders on crypto Twitter are worried about Crypto.com and Gate.io’s user funds and the authenticity of proof-of-reserves. Since Crypto.com claims that 100% of user-owned cryptocurrencies are held offline in cold storage, it has raised concerns among traders as to the authenticity of the claim.

Gate.io clarifies FUD regarding the proof-of-reserves

Gate.io spokesperson told FXStreet that the exchange's snapshot for proof-of-reserves was taken two days before the accidental transfer of Ethereum from Crypto.com. Gate.io was the first mainstream exchange to conduct such an audit in 2020, earning a patent in the process.

Crypto.com spokesperson assures traders of strong processes and systems

A Crypto.com spokesperson told FXStreet that the Ethereum transfer was made over three weeks ago on October 21. Crypto.com's whitelisted corporate account at Gate.io received the transfer and the exchange proceeded to withdraw the funds back to its cold wallets over the following days. The entire Ether tokens were successfully withdrawn by the exchange and returned to their cold storage and the team at Gate.io assisted by increasing their daily withdrawal limits with them.

The spokesperson said,

"Fund movements from Crypto.com custody systems are only possible between approved and whitelisted addresses attached to our cold wallets, our hot wallets and our corporate accounts at 3rd party exchanges. In this case, the whitelisted address belonged to one of our corporate accounts in a 3rd party exchange instead of our cold wallet. We have since strengthened our process and systems to better manage these internal transfers."

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.