Breaking: FTX exchange and FTX US allegedly hacked, uninstall app to protect against malware

- FTX and FTX US wallets appear to be hacked, with over $600 million in assets leaving the exchange.

- FTX telegram group warned traders to uninstall FTX apps and avoid visiting the website as it may download malware and trojans to their devices.

- Galois Capital, a leading crypto hedge fund, admitted to having 50% of their holdings, $100 million, stuck on the FTX exchange.

FTX US General Counsel Ryne Miller said that following chapter 11 bankruptcy filings- FTX US and FTX.com initiated preventive measures to move cryptocurrencies to cold storage. The process was expedited to mitigate damage from unauthorized transactions.

Suspicious on-chain transactions worth $400 million drained funds from FTX mere hours ago, and experts on Twitter allege that updating the exchange’s app loads malware.

Also read: Investigating Samuel Bankman-Fried’s FTX and Alameda implosion and Terra connection

FTX and FTX US hacked, millions of dollars in crypto flowing out of the exchange

Samuel Bankman-Fried’s cryptocurrency exchanges FTX and FTX US are targets of an ongoing hack. The General Counsel of FTX US confirmed to the Telegram group that there had been unauthorized transactions overnight, and the exchange has now moved assets to cold storage.

An account administrator in the FTX Support Telegram chat wrote,

FTX has been hacked. FTX apps are malware. Delete them. Chat is open. Don't go on FTX site as it might download Trojans.

Counsel Miller pinned this message. FTX exchange has stated on its official Telegram channel that it has been hacked and instructed users not to install any new upgrades and delete all FTX apps.

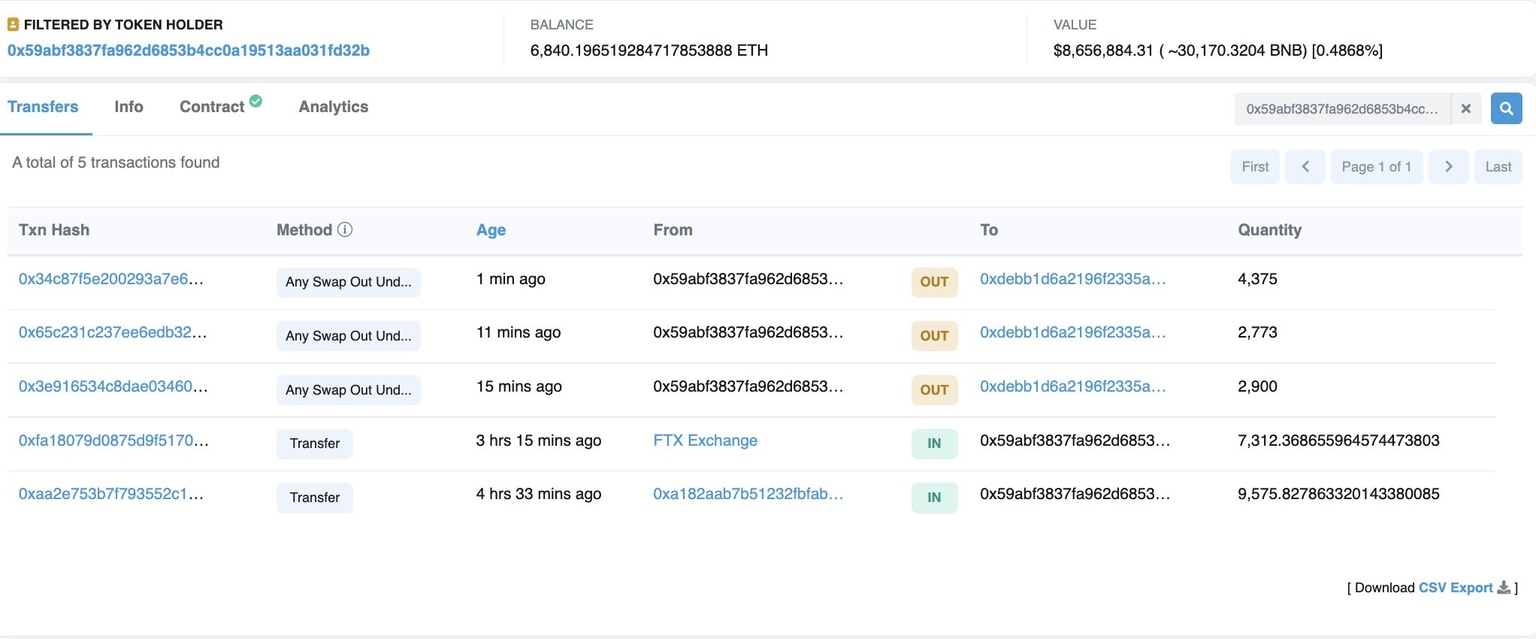

PeckShield Inc., a blockchain security company, labeled the address 0x59abf3837fa962d6853b4cc0a19513aa031fd32b as FTX accounts drainer. This wallet address bridged 10,000 ETH worth $12.6 million on Binance Smart Chain via Multichain.

FTX attacker drained 10,000 ETH, bridged it to BSC

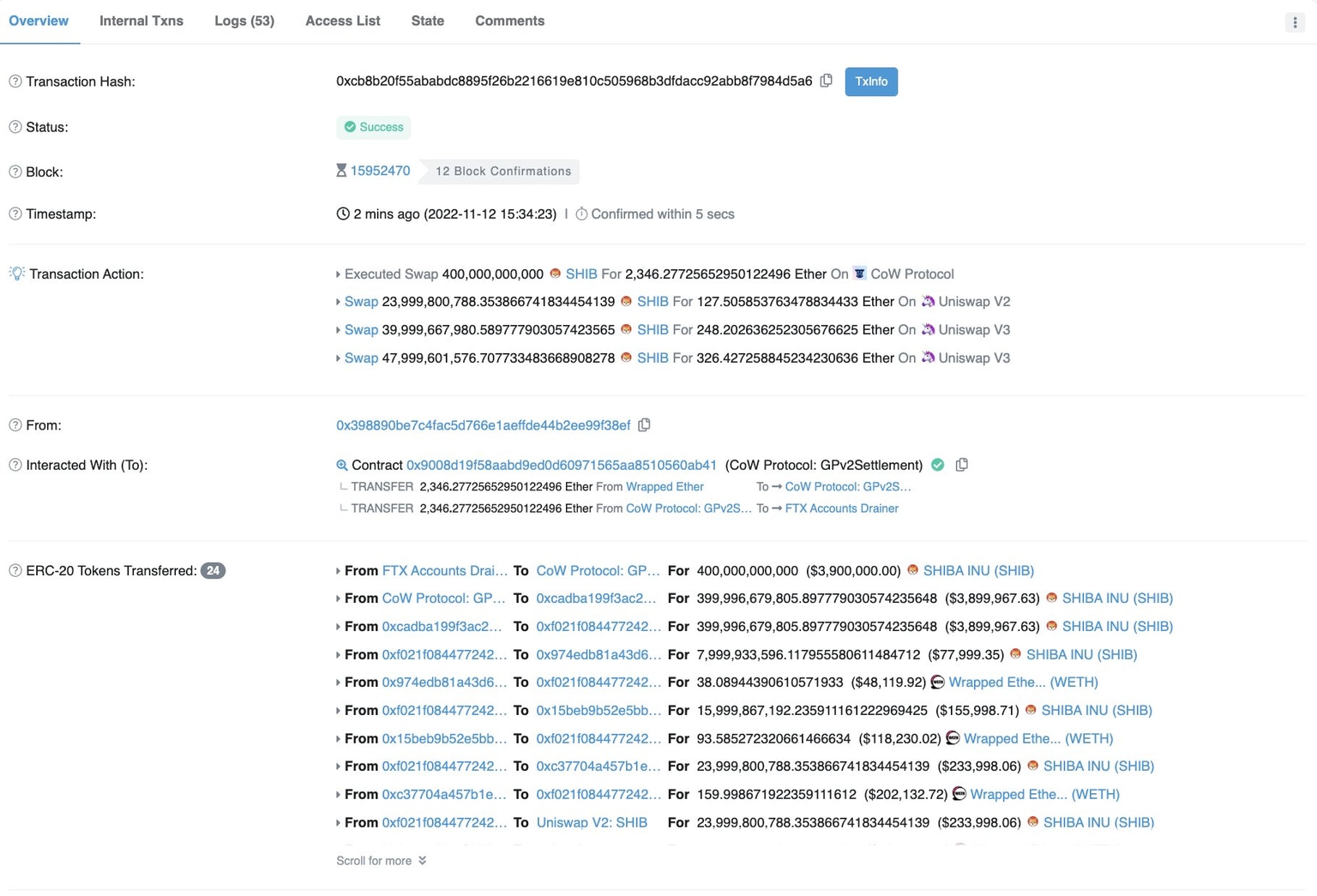

The attacker swapped 400 billion Shiba Inu tokens worth nearly $3 million to Ethereum. Less than an hour ago, the wallet swapped nearly $50 million worth of Paxos Gold (PAXG) to Ether.

400 billion Shiba Inu swapped to ETH

USD Tether has blacklisted the FTX attacker’s USDT on Avalanche and Solana worth nearly $30 million. The attacker's address has drained most FTX wallets of their funds and currently holds $164.6 million worth of Ether tokens (130,283 ETH).

The wallet address marked as the attacker has finished dumping Chainlink (LINK), Polygon (MATIC), AAVE, and Shiba Inu (SHIB) on-chain. Apart from Ethereum and DAI stablecoin, Paxos Gold (PAXG) and SNX will soon be sold off by the wallet. Funds have been moved to decentralized exchanges like 1inch.

Many FTX wallet holders have reported $0 balances in their FTX.com and FTX US wallets. FTX’s API appears to be down, and the login portal was unavailable, giving users a 503 error. This error happens when a server is unavailable, commonly because it's down for maintenance.

Hedge fund admits to losing 50% capital to FTX fallout

Galois Capital, the Hedge Fund famous for predicting the collapse of Terraform Labs LUNC (formerly LUNA) and UST, has admittedly lost 50% of its $100 million holdings to FTX collapse.

Co-founder Kevin Zhou told investors through a YouTube video,

I am deeply sorry that we find ourselves in this current situation. We will work tirelessly to maximize our chances of recovering stuck capital by any means.

Zhou informed investors that it could take years to recover a percentage of stuck capital.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.