Cardano price: ADA on a rollercoaster ride with massive dump by whales

- Cardano whales and large wallet investors sold 600 million ADA tokens since May 2022, actively trading the Ethereum-killer altcoin.

- An on-chain indicator revealed signs of capitulation in Cardano, similar to the March 2020 Covid crash.

- Analysts believe Cardano price is set to witness a pullback to collects liquidity.

Cardano price bounced back after suffering a decline in the FTX-triggered crash in crypto this week. The token of the smart contract platform hit a low of $0.34 over the past 24 hours and analysts predict a close above the $0.38 level.

Also read: Investigating Samuel Bankman-Fried’s FTX and Alameda implosion and Terra connection

Cardano whales sold 600 million ADA tokens

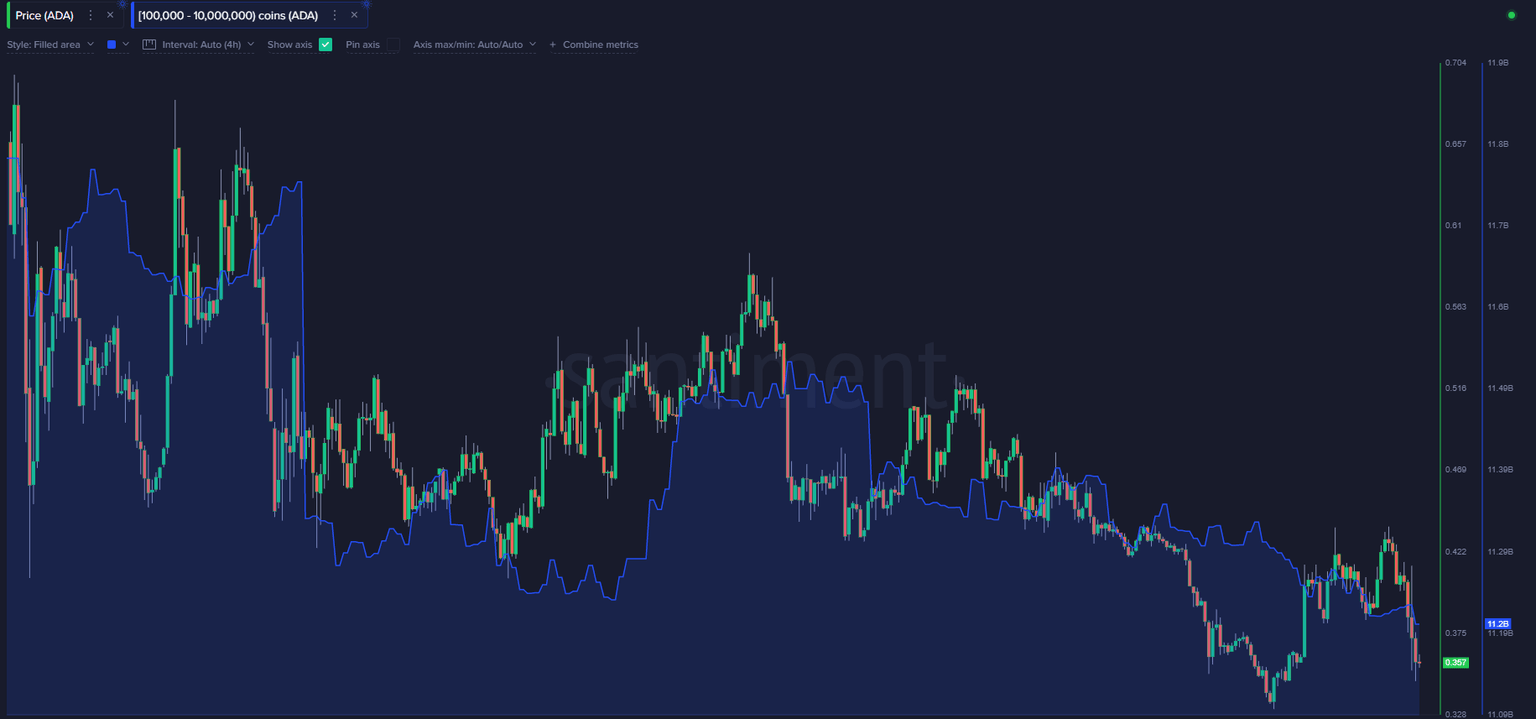

Cardano price has sustained above the $0.34 level despite selling pressure from large wallet investors. Whales sold 600 million ADA tokens worth $204 million since May 2022.

Balance of Addresses Holding between 100,000 to 10,000,000 ADA

The Ethereum-killer altcoin nosedived 11% over the past week, in response to FTX’s liquidity crisis and bloodbath in crypto.

Cardano fared better than most other altcoins in top 30 cryptocurrencies by market capitalization, in the FTX-triggered crypto bear market. Cardano price cracked support at $0.38 today before plunging to $0.30.

Cardano is currently changing hands at $0.34, amid a unanimous push by bulls to close the day above key support at $0.38. John Isige, technical analyst at Crypto News believes Cardano’s price rally may be short-lived given the risk-off market sentiment.

ADAUSD price chart

Cardano shows signs of capitulation similar to Covid crash

Evaluating the Network Realized Profit/ Loss divided by actual price indicator, it is evident that Cardano is showing signs of capitulation similar to March 2020. Net realized profit/ loss metric presents the overall magnitude of profit or loss realized by all holders spending the asset. It is assessed relative to the price when a coin last moved.

Big capitulation events usually occur in two waves, the second wave is shorter than the first. The first wave attracts traders looking to book quick profits before the second wave.

Network Realized Profit/Loss divided by actual price

RektCapital, pseudonymous crypto analyst and trader believes Cardano price would need to close the week above $0.36 for a relief rally to continue. Unless that happens, it is possible that the $0.33 level comes into play as support for Cardano price.

ADAUSD price chart

The analyst recommends watching whether the $0.33 level is weakening as support before making a move in Cardano.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.