WTI Crude Oil: a break above 60.00 takes us towards a selling opportunity

WTI Crude below 5875/65 targets 5810/00 but try longs at 5785/75 with stops below 5750. A break lower is a sell signal targeting 5700/5690, perhaps as far as 5655/45.

Holding minor support at 5875/65 re-targets 5915/25 before a retest of 5975/85. A break above 6000 takes us towards a selling opportunity at 6080/6100, with stops above 6140. Read more...

WTI jumps above $59 boosted by upbeat ZEW data

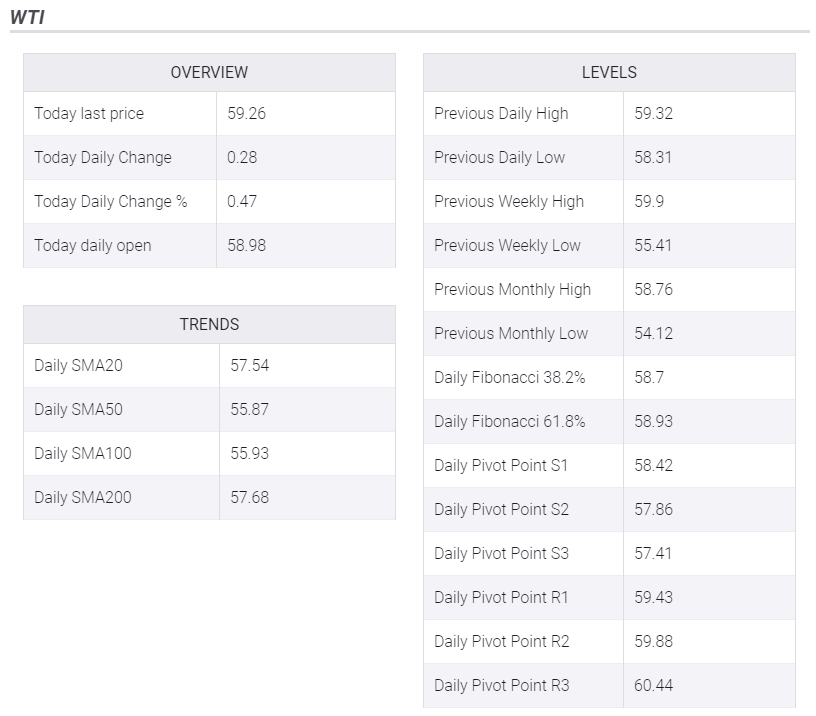

Crude oil prices came under modest selling pressure during the early trading hours of the European session and the barrel of West Texas Intermediate dropped toward mid-$58s before gaining traction in the last hour. As of writing, the WTI was up 0.4% on the day at $59.25.

Signs of life in the European economy

The upbeat ZEW survey, which showed the Economic Sentiment both in Germany and the eurozone improved sharply in December, seems to have provided a boost to crude oil prices by easing concerns over the potential negative impact of a deep economic slowdown in the euro area on the energy demand.

Meanwhile, Goldman Sachs announced that it raised the 2020 Brent oil average price forecast to $63 from $60 following the OPEC+ decision to deepen the oil output cuts by 500,000 barrels per day. Similarly, Russia's Gazprom Neft CEO Alexander Dyukov noted that the additional supply curbs would help support oil prices at $55-65 per barrel in the first quarter, as per Interfax news agency. Read more...

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Coinbase lists WIF perpetual futures contract as it unveils plans for Aevo, Ethena, and Etherfi

Dogwifhat perpetual futures began trading on Coinbase International Exchange and Coinbase Advanced on Thursday. However, the futures contract failed to trigger a rally for the popular meme coin.

Stripe looks to bring back crypto payments as stablecoin market cap hits all-time high

Stripe announced on Thursday that it would add support for USDC stablecoin, as the stablecoin market exploded in March, according to reports by Cryptocompare.

Ethereum cancels rally expectations as Consensys sues SEC over ETH security status

Ethereum (ETH) appears to have returned to its consolidating move on Thursday, canceling rally expectations. This comes after Consensys filed a lawsuit against the Securities & Exchange Commission (SEC) and insider sources informing Reuters of the unlikelihood of a spot ETH ETF approval in May.

FBI cautions against non-KYC Bitcoin and crypto money transmitting services as SEC goes after MetaMask

US Federal Bureau of Investigations (FBI) has issued a caution to Bitcoiners and cryptocurrency market enthusiasts, coming on the same day as when the US Securities and Exchange Commission (SEC) is on the receiving end of a lawsuit, with a new player adding to the list of parties calling for the regulator to restrain its hand.

Bitcoin: BTC post-halving rally could be partially priced in Premium

Bitcoin (BTC) price briefly slipped below the $60,000 level for the last three days, attracting buyers in this area as the fourth BTC halving is due in a few hours. Is the halving priced in for Bitcoin? Or will the pioneer crypto note more gains in the coming days?