Chainlink price warns no space for mistakes, as LINK hovers above critical support

- Chainlink price stumbles at topside trend line, plunges into support.

- Weekly bearish momentum divergence at the recent high was a clue that weakness was coming.

- JustBet will use Chainlink oracles to optimize gaming platforms on the Polygon Network.

-637336005550289133_XtraLarge.jpg)

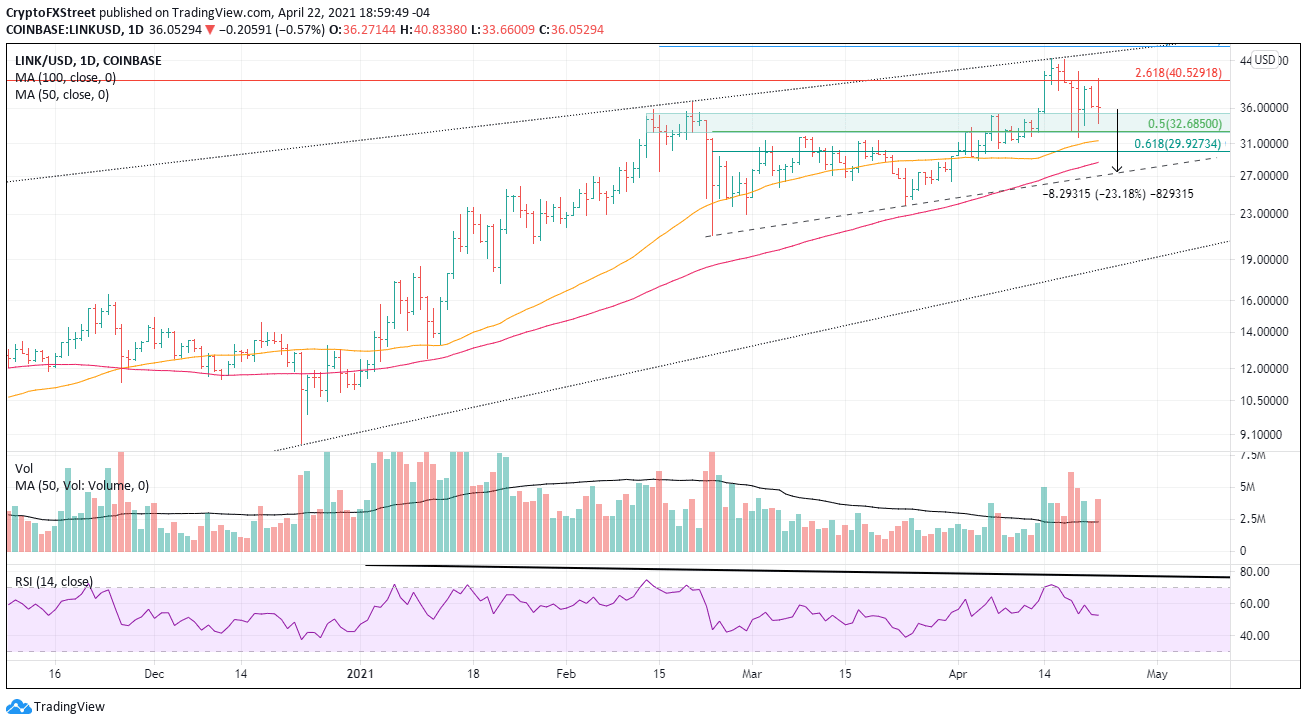

Chainlink price has been holding a critical region of support framed by the 50% retracement of the February-April rally. Heavy distribution marks the volume profile of LINK since it touched the topside trend line. All indicators point to a downward resolution of the current standoff and a decline of roughly 20% from the current price.

Chainlink VRF and Price Feeds combine to launch a leading-edge JustBet gaming experience

JustBet selected LINK oracles to integrate into its decentralized gaming platform to offer a completely new experience, one in which external data is leveraged to enhance the security and functionality of many critical on-chain gaming functions.

The gaming platform, running live on Polygon mainnet, is built using smart contracts to ensure no human interaction and airdrops cannot be tampered with. The problem with smart contracts’ is that they cannot access actual data outside of the blockchain, thereby impeding the ability to reference external data before on-chain actions occur.

The integration of LINK oracles will solve the problem with external connectivity, enabling the platform to use off-chain data to enhance the functionality of the blockchain. More specifically, the oracle “fetches off-chain data on behalf of the smart contract and delivers it to the blockchain so it can be used to trigger on-chain actions.”

The two LINK solutions will power the JustBet platform to be more interactive and a fair gaming experience on the Polygon Network with verifiable randomness. JustBet plans to work closely with Chainlink in the future and explore how to deploy more Chainlink-powered services.

Chainlink price may need a catalyst to resolve the tug-of-war

LINK stalled at the topside trendline at the February high, extending from the 2019 high through the 2020 high. Again, this month, the digital token reversed from the topside trendline and has been fighting a more significant sell-off thanks to a key range of support.

A broader sell-off in the cryptocurrency complex may be needed for LINK to punch through the closely staggered levels of support. The first level of support is the 50% retracement at $32.68, followed closely by the 50-day SMA at $31.39 and then the 61.8% Fibonacci retracement at $29.93.

If losses are not contained, LINK will not find support until the 100-day SMA at $28.64 and finally ending with the bearish thesis target, the rising trend line at $27.44.

LINK/USD daily chart

A daily close above the 261.8% extension of the mid-2020 decline at $40.53 would offer a glimpse of hope for speculators, but the topside trendline is just above at $45.18. It will take substantial buying pressure to spring LINK beyond that level.

Author

Sheldon McIntyre, CMT

Independent Analyst

Sheldon has 24 years of investment experience holding various positions in companies based in the United States and Chile. His core competencies include BRIC and G-10 equity markets, swing and position trading and technical analysis.