Chainlink price likely to rally as CCIP testnet activity gathers steam

- Chainlink network’s CCIP testnet has been subjected to interesting activity like digital coin transactions of the Australian, New Zealand and Singapore Dollar.

- Multiple transactions on the CCIP testnet have bridged stablecoins between the Ethereum and Avalanche chains.

- The growth and adoption of CCIP will likely catalyze Chainlink price recovery in the long term.

Chainlink, a Web3 services platform token, is likely to witness a rally with the increase in activity on the CCIP testnet. Testing of different digital coin transactions is fueling activity on the testnet.

LINK price is in an uptrend since its June low; the altcoin is trading at $7.133 on Binance.

Also read: Pro-XRP attorney predicts XRP likely to hit its all-time high in a Bitcoin bull market

Chainlink’s CCIP testnet records buzz in activity

Chainlink’s Cross Chain Interoperability Protocol (CCIP) is used to securely send messages, transfer tokens, and initiate actions across blockchains. Chainlink launched a single, elegant interface for all cross-chain use cases for projects in its ecosystem.

On July 20, CCIP was made available to all developers across five testnets: Arbitrum Goerli, Avalanche Fuji, Ethereum Sepolia, Optimism Goerli, and Polygon.

Some interesting activity happening on CCIP testnet

— ChainLinkGod.eth (@ChainLinkGod) August 5, 2023

Australian Dollar Digital Coin A$DC

New Zealand Dollar Digital Coin NZ$DC

Singapore Dollar Digital Coin SG$DC

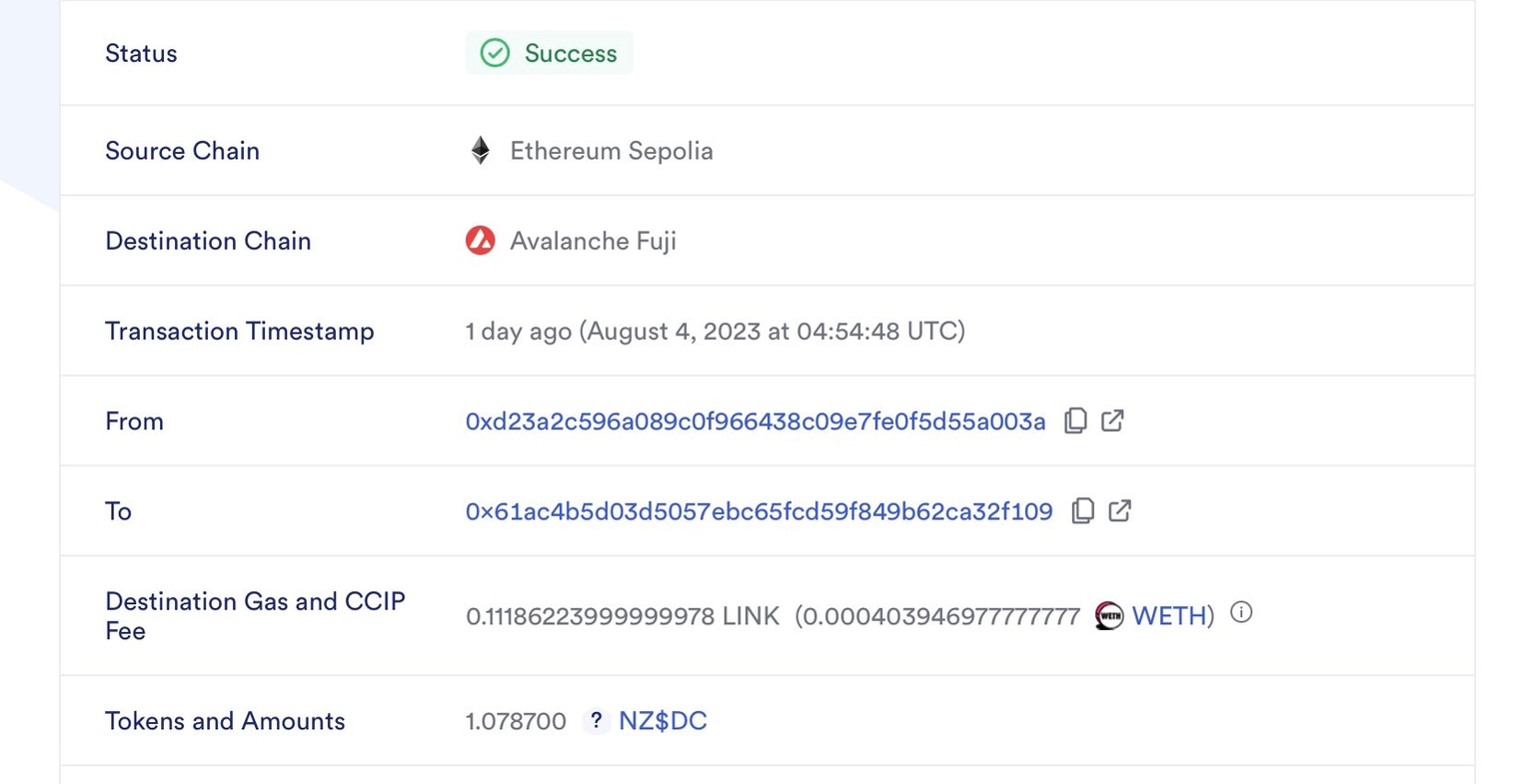

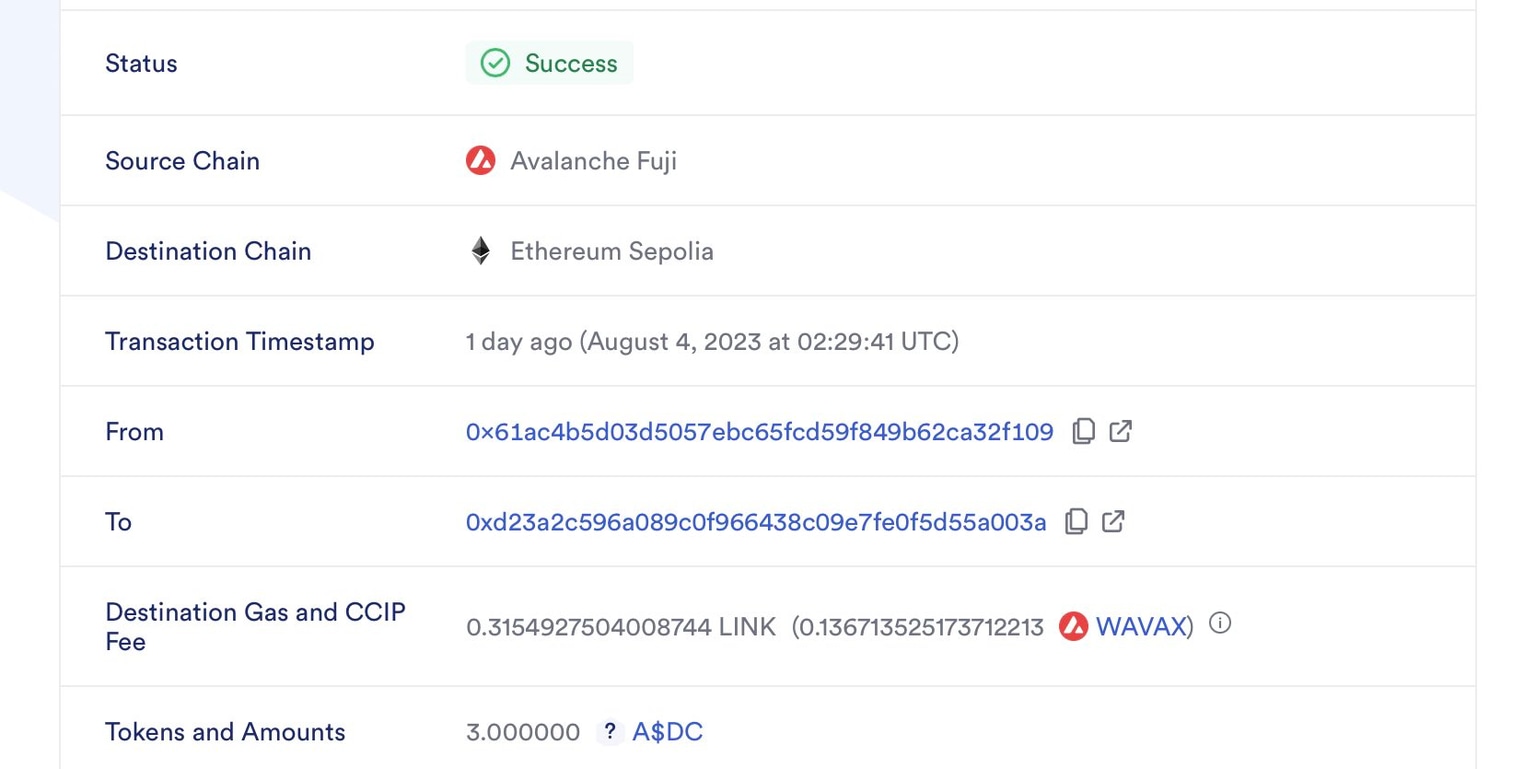

Multiple transactions bridging stablecoins between Ethereum Sepolia and Avalanche Fuji using CCIP’s burn-and-mint pic.twitter.com/8aGU1GoNd2

Since its launch, the CCIP testnet has noted interesting activity as the Australian Dollar Digital Coin A$DC, New Zealand Dollar Digital Coin NZ$DC, and Singapore Dollar Digital Coin SG$DC are transferred.

Multiple transactions bridging stablecoins between Ethereum Sepolia and Avalanche Fuji have been implemented using CCIP’s burn-and-mint feature.

CCIP transactions

Chainlink’s CCIP feature drives the altcoin’s adoption among projects and market participants. This could catalyze a recovery in LINK price in the short term.

At the time of writing, the LINK price is $7.139 on Binance, up from its June 19, 2023, low of $4.995.

Bitcoin, altcoins, stablecoins FAQs

What is Bitcoin?

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any person, group, or entity, eliminating the need for third-party participation during financial transactions.

What are altcoins?

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version.

What are stablecoins?

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

What is Bitcoin Dominance?

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and increased market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and profits to altcoins in a quest for higher returns, which generally triggers an explosion of altcoin rallies.

Like this article? Help us with some feedback by answering this survey:

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.