Chainlink Price Forecast: LINK has a clear path to $16

- Chainlink rebounded massively over the weekend from the support formed last week at $11.

- LINK has eyes on $16, especially if on-chain metrics continue to improve.

-637336005550289133_XtraLarge.jpg)

Chainlink has rallied 122% from September’s lows at $7.2. The spike above $16 last week saw bears swing into action, leading to a correction towards $11. LINK’s bulls appear to have regained most control over the price and are ready for another liftoff above $16.

Chainlink eyes $16 as pressure behind the token builds

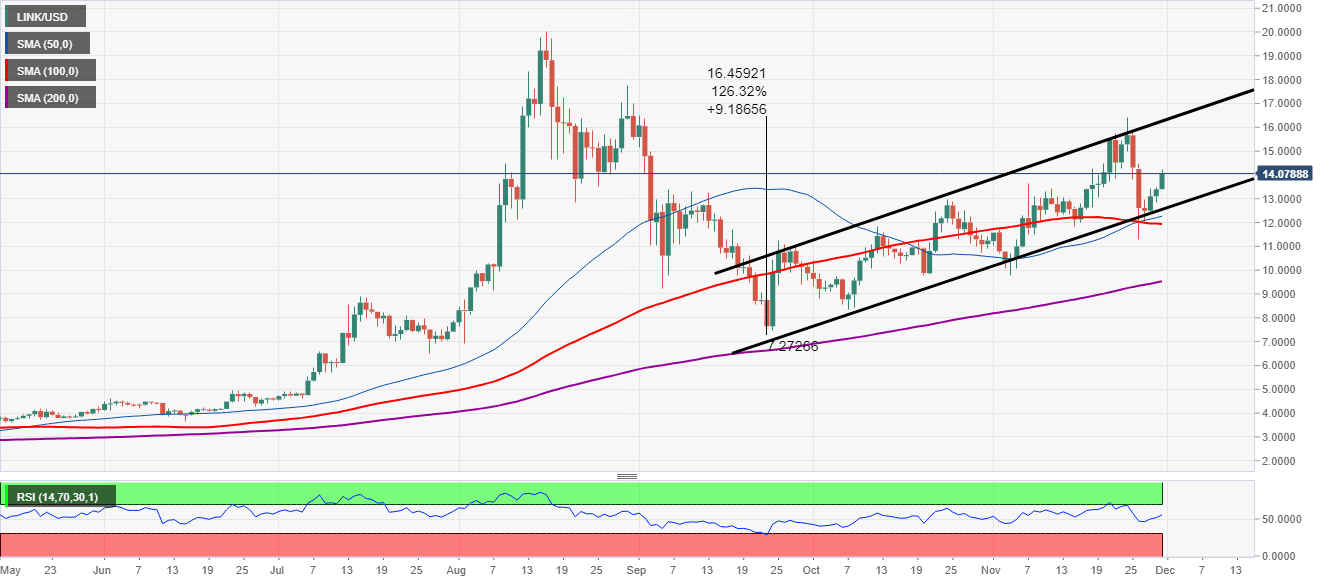

LINK is trading slightly above $14 after recovering from last week’s support near $11. The token is also within the confines of an ascending parallel channel, suggesting that the uptrend is still intact.

Meanwhile, bulls have eyes on $16 but await the ultimate liftoff to $20.A break above the channel’s middle boundary would cement buyers’ position in the market and perhaps create enough volumes for a bullish price action towards $16 and $20, respectively.

A golden cross formed after the 50 Simple Moving Average on the daily chart crossed above the 100 SMA doubles down on the bullish building momentum. Besides, the Relative Strength Index hints at a growing buyers’ grip.

LINK/USD daily chart

IntoTheBlock’s IOMAP model reveals that Chainlink has a clear path to $16 as long as on-chain levels remain unchanged or improve further. However, some subtle resistance is expected between $14.4 and $14.9. Here, roughly 14,500 addresses had previously bought approximately 3.5 million LINK. A break above this range might boost LINK above $16.

Chainlink IOMAP chart

On the downside, immense buyer congestion shows that correction from the current price levels is doubtful. Nearly 12,000 addresses had previously bought around 21 million LINK in the massive support range running from $12.7 to $13.1.

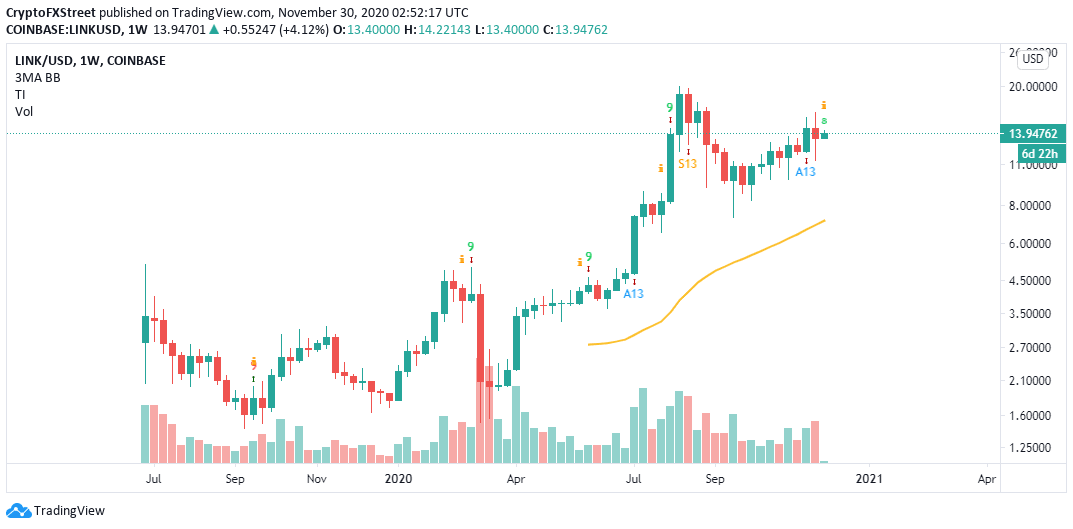

LINK/USD weekly chart

The weekly chart highlights a possibility where the TD Sequential indicator may present a sell signal in the coming sessions or a few days. The call will manifest in a green nine candlestick. The bearish outlook could see enough selling pressure, forcing Chainlink to fall in one to two four daily candlesticks. In other words, the above bullish narrative would be invalidated.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren

-637423020807182971.png&w=1536&q=95)