Cardano Price Prediction: ADA needs to reclaim this level to retain bullish outlook

- Cardano price is treading dangerously close to breaching the hypotenuse of an ascending triangle pattern.

- If ADA manages to climb above the 4-hour 200 SMA at $1.15, the bullish scenario will stay alive.

- A decisive close above $1.48 would hint at kickstarting a 46% upswing to $2.15.

Cardano price is showing signs of indecisiveness as it trades along the hypotenuse of an ascending triangle pattern.

Cardano price trudges around a critical level

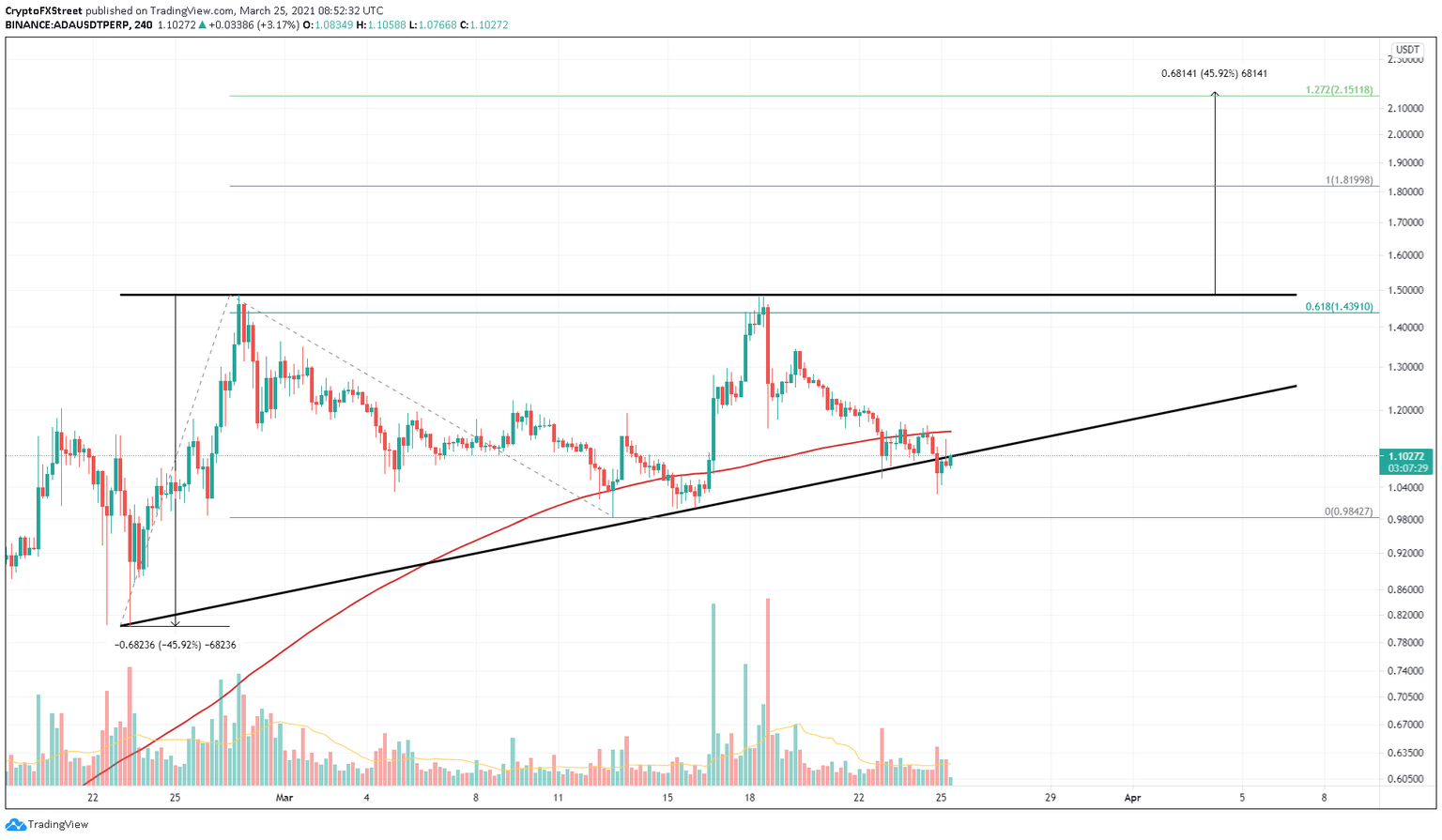

On the 4-hour chart, the Cardano price has created multiple higher lows, showing the presence of aggressive buyers. However, sellers present along the supply barrier at $1.48 have successfully prevented these swings from passing over.

This price action results in an ascending triangle formation, which predicts a 45% bull rally if ADA price convincingly slices through $1.48 with a strong surge in volume.

However, at the time of writing, buyers seem to be seen nowhere, as Cardano price came very close to breaching the pattern’s hypotenuse. If the bulls make a comeback that pushes ADA higher, then a swing high towards the triangle’s base can be expected.

This move would be the result of a 30% pump in ADA’s market value. A confirmation of this bull run will come after Cardano reclaims the 200 Simple Moving Average on the 4-hour chart. Such a development is likely to instill confidence in the sidelined investors triggering a run-up to $1.48.

A decisive close above this level due to the continuation of this upward momentum could result in ADA hitting its intended target at $2.15, coinciding with the 127.2% Fibonacci retracement level.

ADA/USDT 4-hour chart

If Cardano price breaches the hypotenuse at $1.09, leading to a decisive close below the immediate support level at $0.98, it would invalidate the bullish outlook and catalyze a bearish run.

In such a case, ADA could slide 10% toward a demand barrier at $0.88.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.