Cardano Price Prediction: ADA eyes 13% drop before heading to swing highs

- Cardano price shows a slowdown around a crucial supply barrier that ranges from $1.33 to $1.26.

- A 13% retracement to $1.14 would allow the buyers to purchase ADA at a discount for the next leg up.

- If buyers produce a sustained yet decisive close above $1.35, an upswing to $1.48 could ensue.

Cardano price shows the exhaustion of buying pressure as it tries to break out of an area of resistance. A failure to do so will most likely result in a pullback.

Cardano price at inflection point

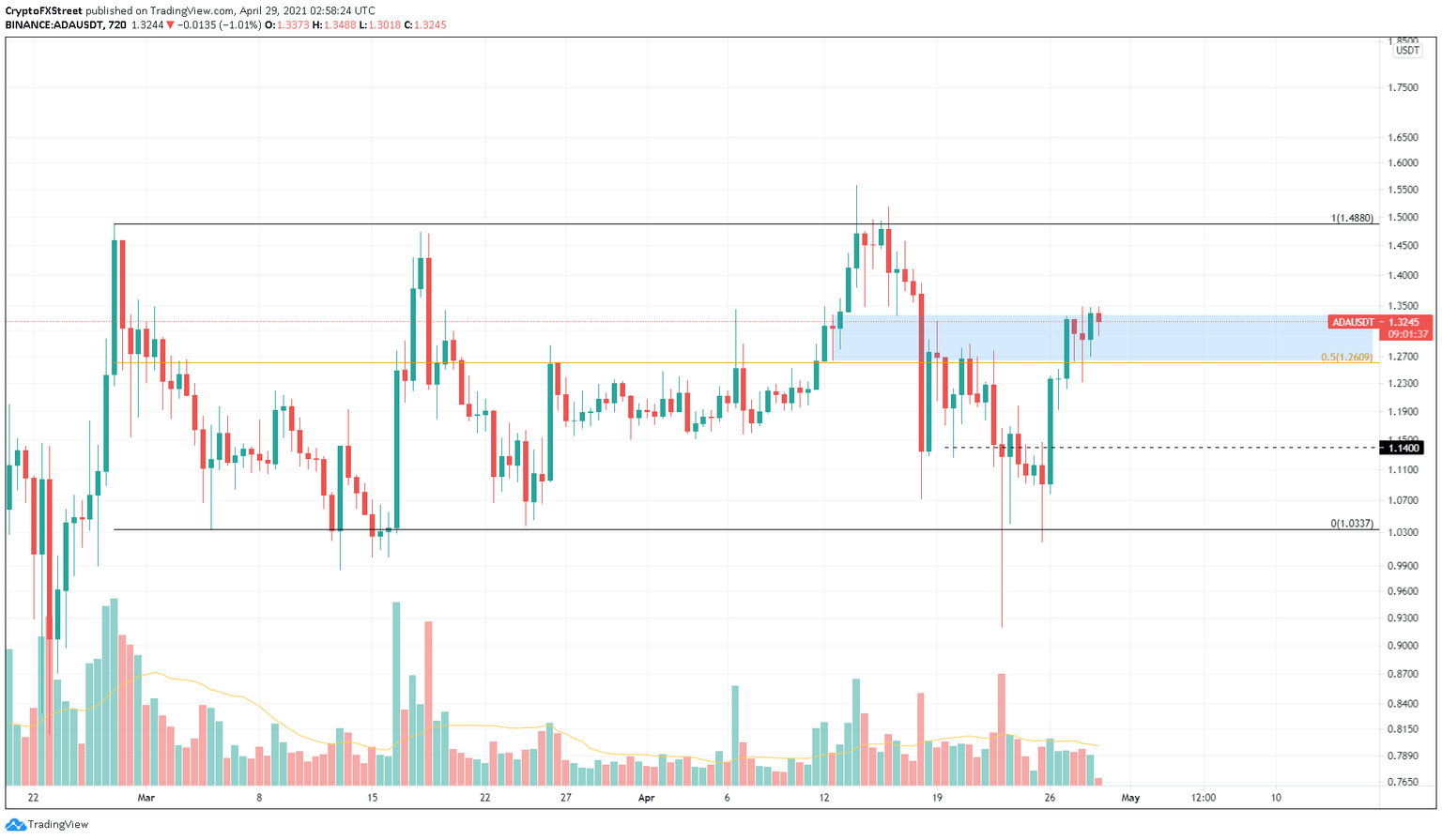

On the 12-hour chart, Cardano price has tried breaching the supply zone’s upper trend line at $1.33 for more than a day. However, sellers in this area have prevented this, leading to a consolidation here.

This indecisiveness might lead to more sideways movement in ADA, at least until one side overwhelms the other. If ADA slices through the 50% Fibonacci retracement level at $1.26, which coincides with the supply barrier’s lower trend line, it will signal the start of a new downtrend.

Under these conditions, investors can expect a pullback to $1.14, which is approximately 13% lower than the current price.

In some cases, this correction could extend up to $1.11.

ADA/USDT 12-hour chart

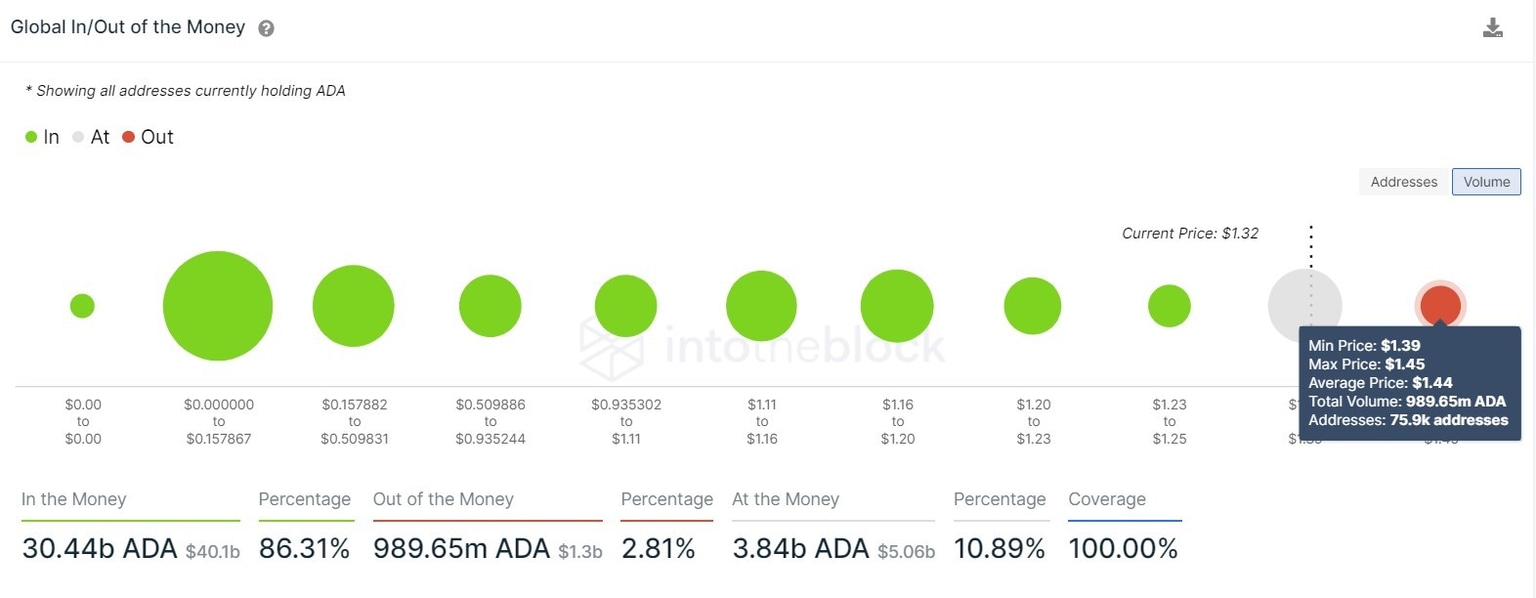

According to IntoTheBlock’s Global In/Out of the Money (GIOM) model, the support levels are stacked below the current Cardano price levels. Hence, a downswing is most likely to be short-lived. Therefore, the bias for ADA is bullish.

Adding credence to this bullish thesis is the presence of only one significant resistance level at $1.44. Here, roughly 76,000 addresses purchased nearly 989 million ADA and might dampen the upswing.

Therefore, clearing this level will provide Cardano price a clear path to retest current all-time highs at $1.5584.

ADA GIOM chart

On the flip side, if the $1.11 support level breaks down and Cardano price spends an extended period below this level, buyers would lose their leverage. Such events could shift the winds toward sellers, leading to a 7% sell-off to the swing low at $1.03.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.