Cardano Price Prediction: ADA crosses $1 as founder hints 2025 updates

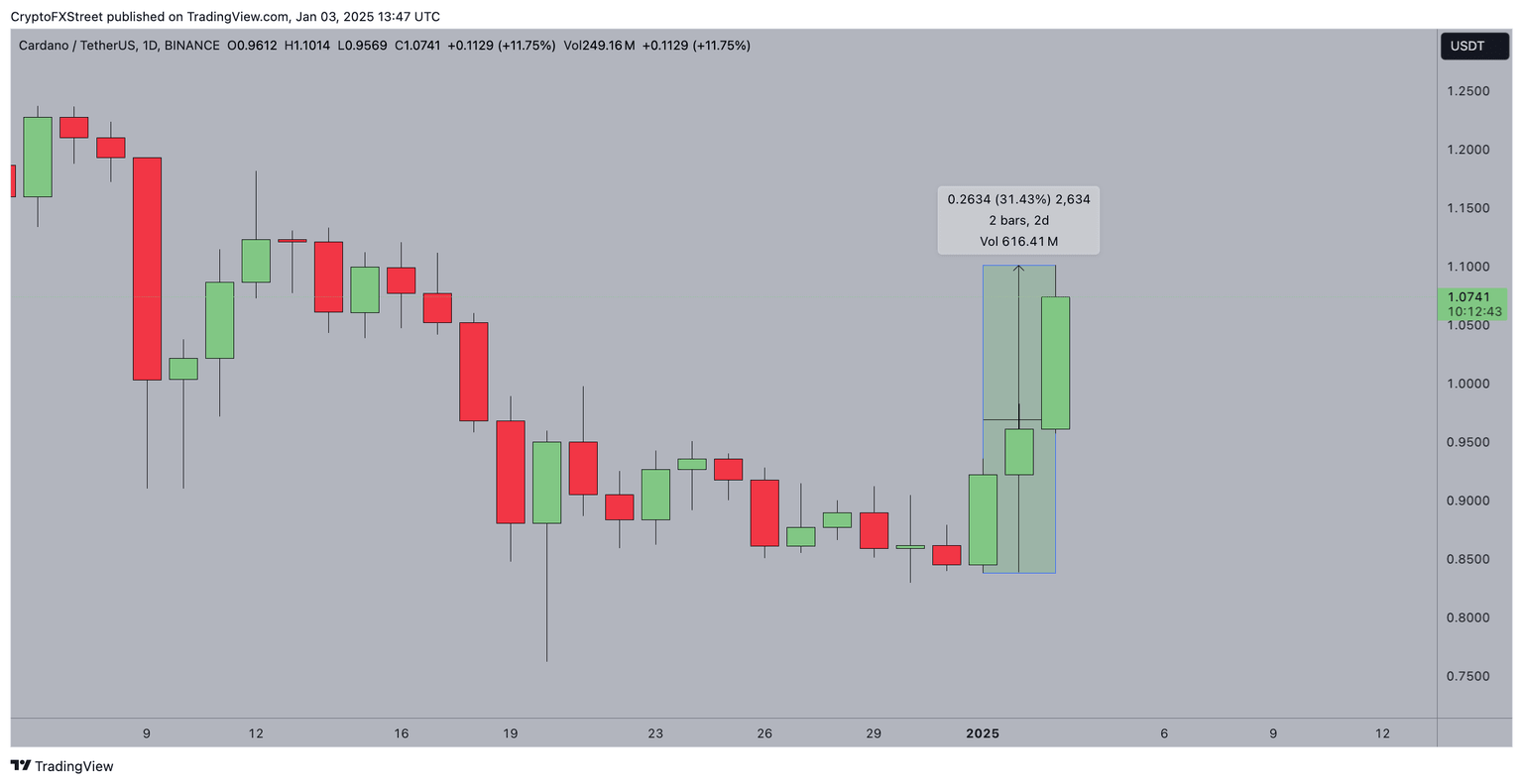

- Cardano’s price hit $1 on Friday, surging 31.4% in the first 3 days of 2025 to become the best-performing top 20 crypto asset.

- The ongoing ADA rally aligns with a recent post by Cardano’s Founder on X, suggesting upcoming product launches in 2025.

- Cardano’s DeFi TVL increased by $140 million, signaling the rally is driven by organic network demand rather than speculation.

Cardano price crossed the $1 mark on Friday, having gained 31.4% in the first 3 days of 2025. Market reports suggest the rally was driven by Founder Charles Hoskinson’s recent post hinting at new product offerings in 2025. Will ADA price flip the $1.50 resistance in the coming days?

Cardano price leads 2025 crypto market recovery

After a volatile close to 2024, Cardano has emerged as the best-performing mega-cap crypto asset in the first week of 2025.

While Bitcoin (BTC) and Ethereum (ETH) rose 7% and 8% respectively since December 31, ADA prices have increased by more than 31%.

Why is Cardano’s price going up?

Cardano's recent price surge can be attributed to a combination of blockchain advancements and broader market optimism ahead of the new year.

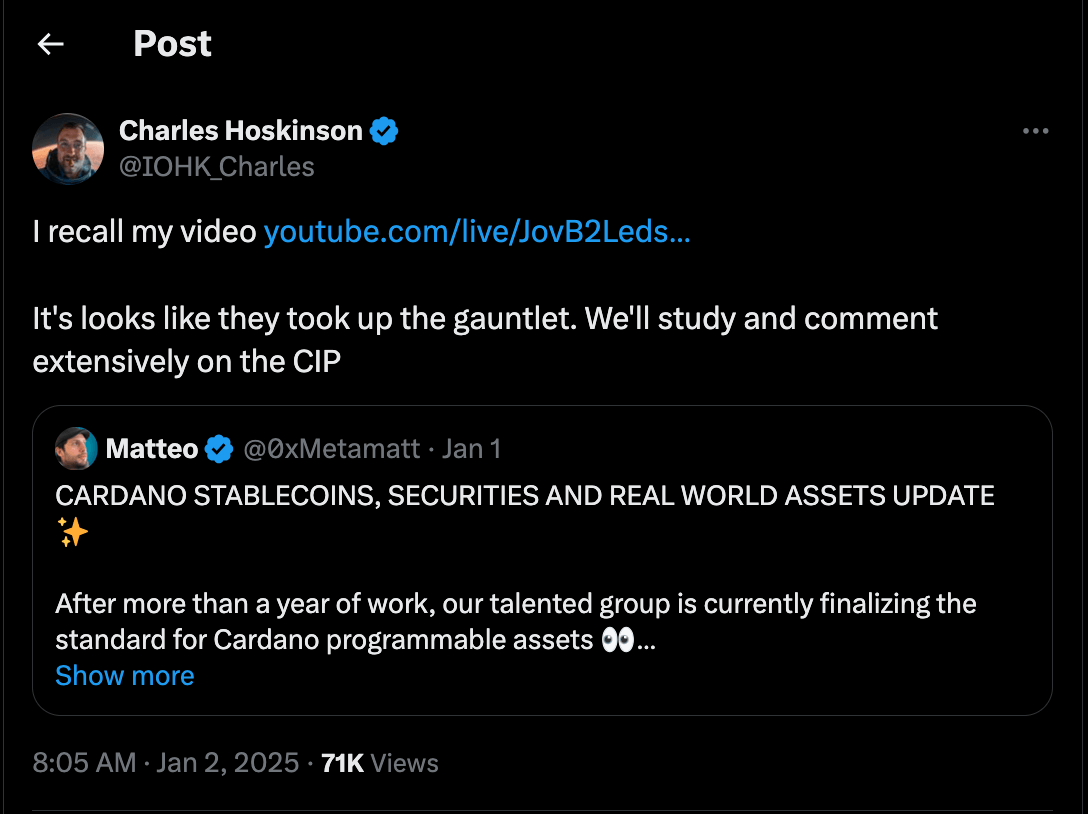

On Thursday, the network introduced its CIP-113 proposal, which focuses on programmable assets, enhanced security features and smart accounts.

According to Matteo Coppola, Cardano Senior Engineer and FluidTokens CEO, this could potentially enable the launch of “stablecoins, securities and real world assets” on the Cardano network.

Recent media updates show that ADA’s ongoing rally has coincided with a recent post by Cardano’s Founder Charles Hoskinson on X, endorsing the proposed CIP-113 network updates.

Within 72 hours of the post, ADA price had climbed by more than 31.4% to hit the $1.1 level at press time on Friday.

Cardano TVL surges by $140M amid positive start to 2025

Despite the recent market-leading 31.4% gains, other vital on-chain indicators suggest ADA prices could potentially advance further.

DeFiLlama’s Total Value Lock chart below tracks daily changes in the value of assets held within the Cardano blockchain network. By monitoring changes in TVL, strategic traders can infer the directional flow of organic capital during key market events.

As depicted in the chart above, Cardano price has increased from $423 million on December 30 to $569.4 million on Friday.

This reflects an increase of 32% in the Cardano DeFi capital base, closely comparable to the 31.4% price rally.

When a cryptocurrency price surge coincides with DeFi TVL inflows as observed this week, it paints a bullish outlook for the coming trading sessions.

First, it re-affirms a positive reaction to the network updates recently endorsed by the Cardano founder.

More so, it also suggests the current rally was supported by organic network demand rather than speculative trading.

With Cardano TVL rising at pace, ADA is likely to hold relatively high support levels and avoid abrupt corrections as it makes its way towards the $1.20 area in the coming trading sessions.

Cardano price forecast: More gains ahead if $1.20 resistance folds

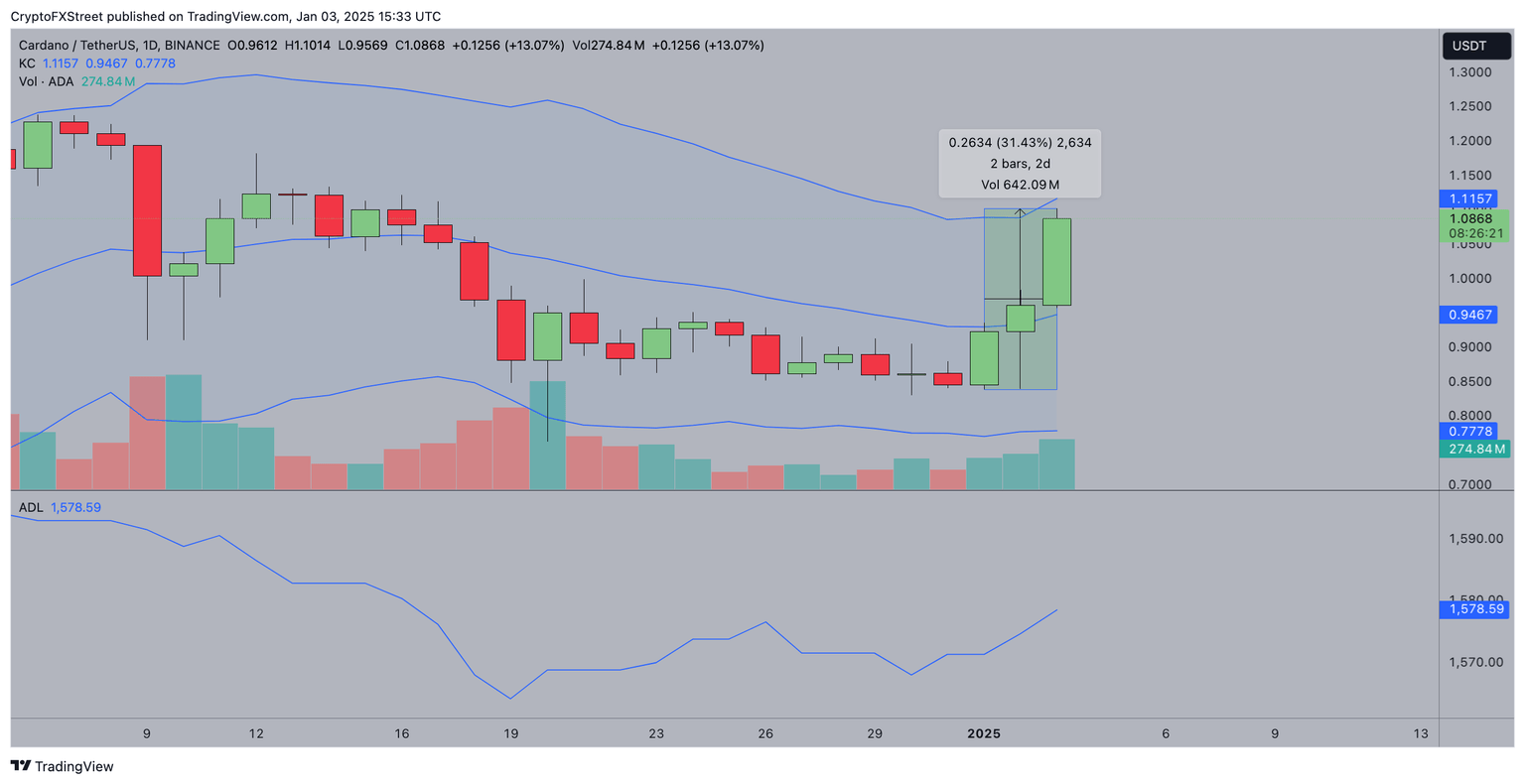

Cardano (ADA) price has demonstrated bullish momentum, closing with a notable 13% gain over two days.

Rising trading volumes suggest renewed investor confidence, aligning with an uptick in the Accumulation/Distribution Line (ADL), which reflects positive accumulation trends.

Current price action indicates a breakout above the $1.1157 upper Keltner Channel boundary could clear the path toward the $1.20 resistance level.

A decisive close above the $1.20 territory could invite further buying pressure, potentially propelling ADA further toward the $1.50 mark.

On the downside, if bullish momentum wanes, immediate support lies at the $0.9467 midpoint Keltner level.

Further declines could see Cardano price test the lower Keltner boundary near $0.7778.

Author

Ibrahim Ajibade

FXStreet

Ibrahim Ajibade is an accomplished Crypto markets Reporter who began his career in commercial banking. He holds a BSc, Economics, from University of Ibadan.