Bitcoin Price Prediction: BTC tops $97K as Microstrategy, Coinbase kick-off 2025 in green

- Bitcoin price has gained 7% in the last three days, briefly breaching the $97,750 resistance on Thursday.

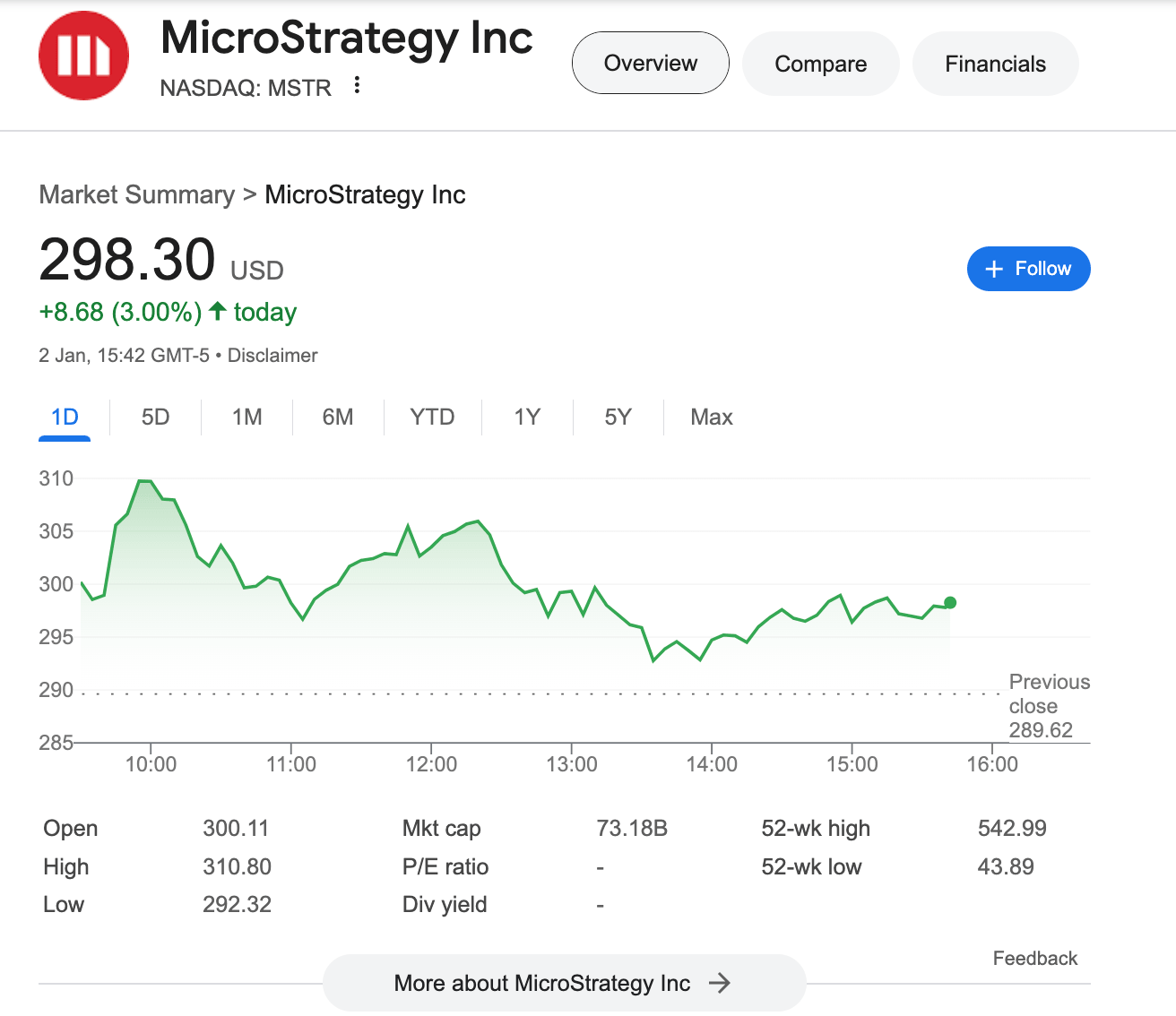

- Crypto stocks attracted investor interest on Thursday, with Coinbase (COIN) and Microstrategy (MSTR) rising 3%.

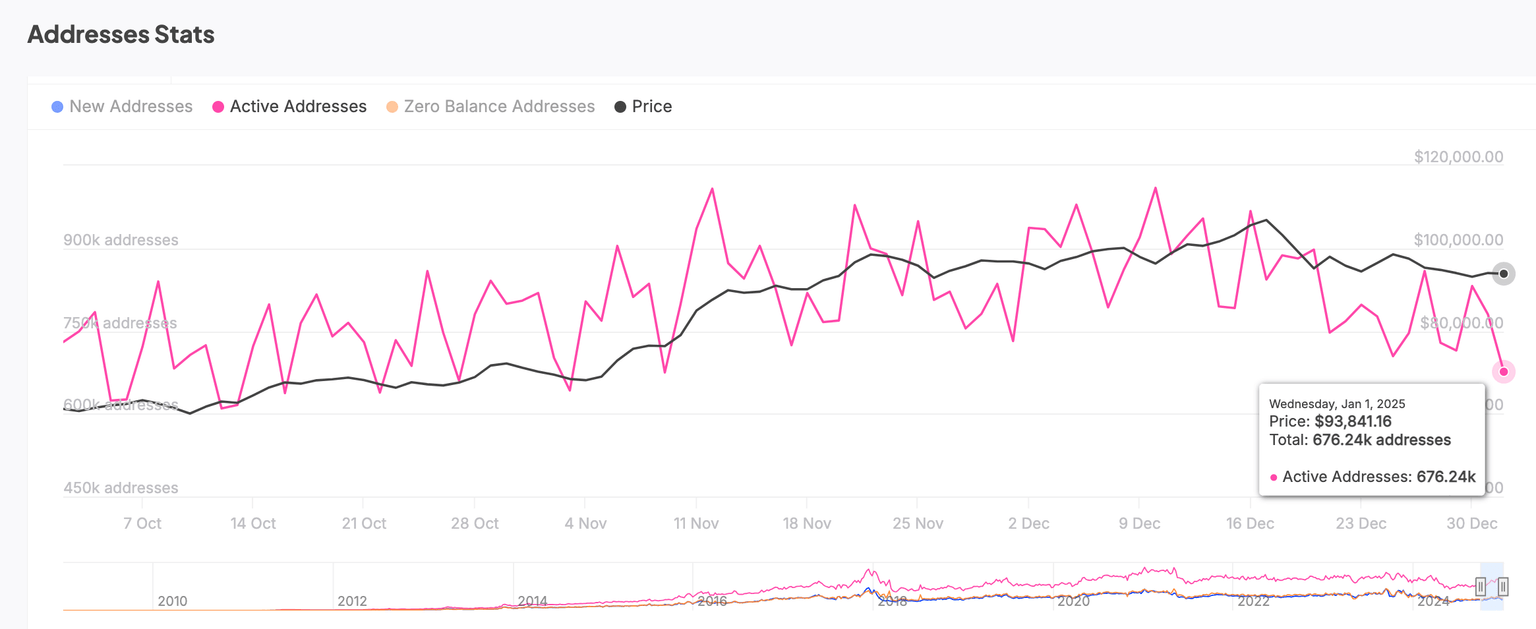

- Bitcoin daily active addresses plunged to a 50-day low of 676,000 wallets on Thursday.

Bitcoin price crossed $97,750 on Thursday, rising 7% since MicroStrategy’s latest BTC $200 million purchase on Monday December 29. On-chain data shows user activity on the Bitcoin network is still trending 30% below last month's peak, signalling potential for more gains ahead.

Bitcoin price crosses $97K as MSTR and COIN performance hint at Crypto market recovery

Bitcoin price along other crypto-related assets experienced intense downward volatility in the second half of December 2024.

The market shake-up was triggered by the US Federal Reserve's hawkish stance, as the regulator hinted at fewer rate cuts in Q1 2025 during the FOMC meeting on December 17.

BTC price rapidly fell 15% in an ensuing two-week-long sell-off, dropping from it's all time high of $108,850 on December 17, to hit the $91,500 mark on Monday.

However, Bitcoin price trends flipped positive on Monday after MicroStrategy extended its weekly BTC buying spree with another $209 million purchase.

Since the announcement on December 30, BTC price has rebounded 6.8% to reclaim the $97,800 level at the time of publication on Thursday.

Despite recent volatility that saw MicroStrategy’s MSTR stock price retrace by more than 30% in the last weeks of December 2024, CEO Michael Saylor doubled down on its company’s audacious target to acquire $42 billion worth of BTC over the next 3 years.

This move appears to have triggered positive sentiment among pre-market speculators.

While US stocks markets remained closed for the yuletide holidays, Crypto related stocks including MSRT, Coinbase (COIN) and TerraWULF (WULF) all recorded more than 3% gains on Thursday, mirroring Bitcoin’s positive performance.

When a sector makes such large upticks in after-market trading, it triggers bullish signals for two key reasons.

First, after-market gains signals heightened interest and optimism among investors.

The rising anticipation often leads to a surge in buy orders when markets reopen as investors aim to capitalize on the momentum.

More so, sustained after-market gains can break key technical levels like resistance points or moving averages.

This could potentially prompt automated trades and stop-loss triggers to accelerate the bullish impact when markets open.

Bitcoin user activity still 30% below last month’s peak

In addition to capital flowing towards crypto-related stocks in US pre-market trading hours, Bitcoin’s current on-chain user activity levels also signals potential for more upside.

Despite the 7% price gains observed in the last 3 days, retail trading activity has remained in decline, a move that could considerably impact short-term BTC price action

IntoTheBlock’s daily active addresses chart tracks the number of unique wallets that execute valid transactions on a given day.

This serves as a proxy for monitoring changes in mass market activity.

The chart above shows only 676,000 addresses conducted transactions on the Bitcoin blockchain on Wednesday, 30% lower than 976,490 addresses recorded at the market top on December 16. Moreover, this represents the lowest Bitcoin user activity recorded in 53 days dating back to November 9.

When prices rise during periods of user activity decline as observed on the Bitcoin network this week, it signals the bullish momentum is being driven by resilient long-term holders and short-term bullish whale speculators.

With US retail trading markets set to open on Friday, an influx of activity from retail traders aping into the rally could potentially drive prices further towards $100,000 in the coming sessions.

However, if the speculating whales opt to dump early, BTC could be at risk of another reversal towards the $95,000 level.

Technical indicators on the BTCUSDT chart below offer insights into critical Bitcoin price support and resistance levels to watch as US markets reopen for 2025 on Friday.

BTC Price Forecast: Whales eyeing first $100,000 rally in 2025?

Bitcoin price is trading above the VWAP ($96,494), which signifies strong bullish momentum.

More so, BTC Volume Delta is trending at its highest since December 15 indicating increased buying pressure.

Bullish Outlook:

- Mid Bollinger Band: Positioned at approximately $97,817, this acts as the first key resistance level.

- Upper Bollinger Band: Estimated at $105,724, this represents the next target if bullish momentum sustains, potentially pushing BTC closer to the psychological $100,000 milestone.

Bearish Risks Ahead

Such spikes in Volume Delta coinciding with decline in on-chain activity are often symptomatic of intense speculative trading activity.

Considering the level of pre-market accumulation observed in MSRT, COIN and WULF this week, there’s a potential risk for speculative whales to dump holdings when markets reopen.

If whales exit their positions early, this could lead to a rapid decline in price, triggering a bearish reversal.

Support Projections:

- Lower Bollinger Band: Positioned at $89,909, this is the critical support level in the event of a market sell-off.

- VWAP Support: The VWAP at $96,494 may act as an initial support zone during minor corrections.

Conclusion

The Bitcoin price forecast appears bullish in the short term, with technical indicators pointing to continued momentum toward $100,000. The price trading above VWAP and the surge in Volume Delta reflect strong demand and investor confidence. However, amid looming risk of whale-driven volatility, support levels at $96,494 and $89,909 are critical to watch in case of a potential downturn.

Author

Ibrahim Ajibade

FXStreet

Ibrahim Ajibade is an accomplished Crypto markets Reporter who began his career in commercial banking. He holds a BSc, Economics, from University of Ibadan.