Cardano Price Prediction: ADA bulls saved by historical $1.89 support level

- Cardano price shed 21% of its value this week.

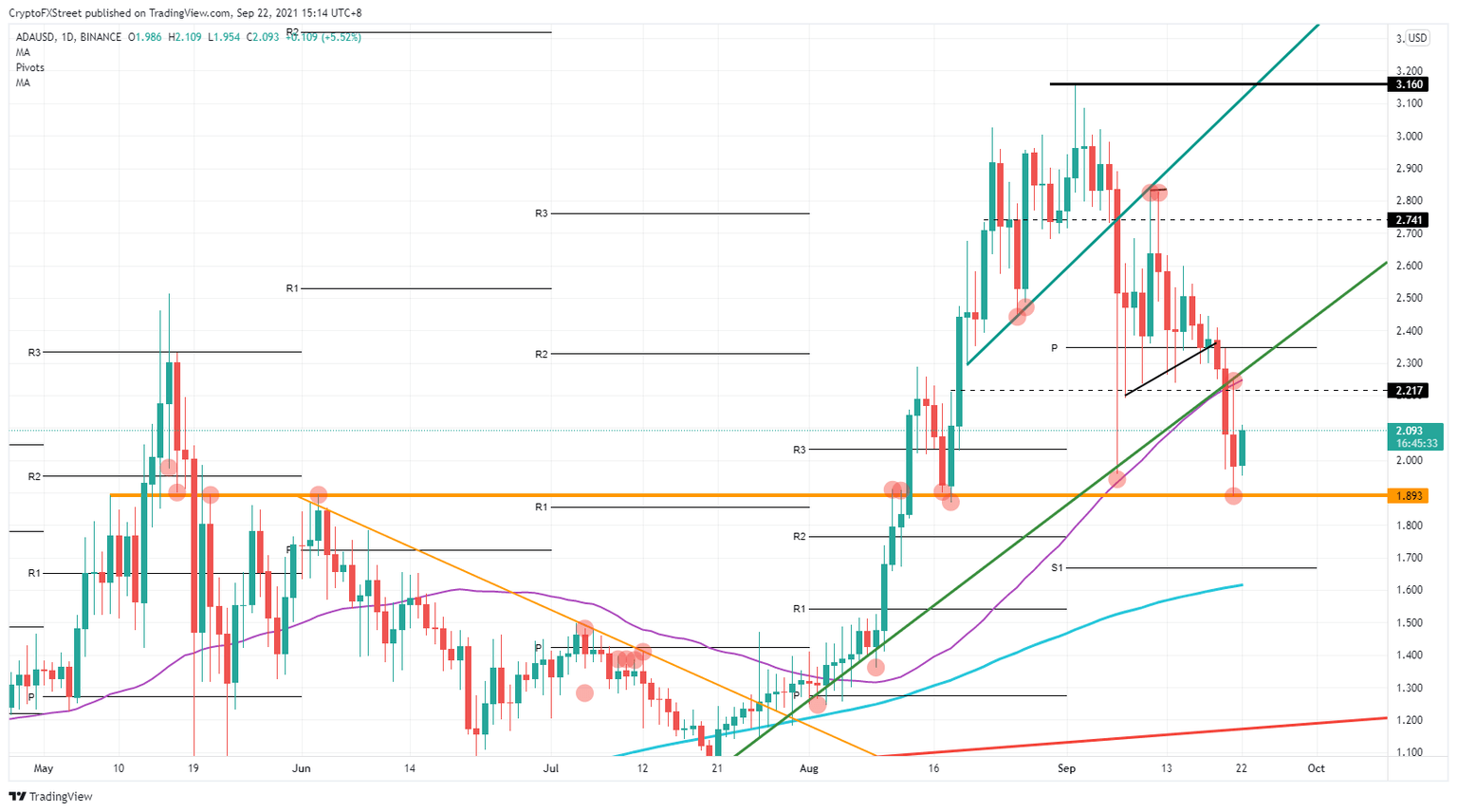

- Bulls stepped in to stop the price correction, using a critical historical level from May 9.

- Price action in ADA looks to have flipped to the upside with a possible 16% profit return.

Cardano (ADA) price has been on a downward trajectory since the beginning of this week after ADA twice broke a supporting ascending trend line. With those two supportive elements so close to each other, sellers had two excellent entries to play out their short positions. Bulls now have caught the correction and are starting to squeeze out sellers as bears book profits on their shorts positions.

Cardano price is caught by bulls and stands to jump 16%

Cardano price in a concise time frame has broken two supporting elements that kept the bull-run in check. As buyers got washed out of their positions, sellers had the upper hand and could efficiently run prices in ADA down with a 21% correction as a result. Bulls, however, stepped in today and are starting to turn the trend as price action in Cardano is lifted from $1.89.

That orange horizontal line has already proven its importance in the past. Before the summer, the level acted as resistance and kept price action limited to the upside. Once after the break on August 13, the resistance factor switched to a support element and returned 68% to the bulls at one point. That level still holds as support, and ADA has been trading slightly higher since.

ADA price looks to turn in favor of the bulls, and with global sentiment returning in favor of risk-on, expect more upside toward $2.30. After that, it starts to get tricky, with the green ascending trend line and the 55-day Simple Moving Average (SMA) acting as resistance. Bulls will have to overcome these two hurdles and need an external catalyst to break above these levels.

ADA/USD daily chart

That catalyst for a higher Cardano price can be the FOMC meeting later this evening. If Powell spells to the markets that financial conditions will not tighten too quickly and US growth has more free room to grow, investors will start buying more risk-on assets on sight. This will be a very favorable tailwind for cryptocurrencies in general and will push ADA price above $2.40.

Should some events take a turn for the worse, like a default in Evergrande or equity markets dipping after a hawkish tone from the FOMC, expect bulls to get squeezed out of their long positions, and sellers will go for a full-blown correction to $1.70, wiping out almost 40% of additional price action in Cardano.

Like this article? Help us with some feedback by answering this survey:

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.