Cardano bulls bleed as they try to catch a falling knife

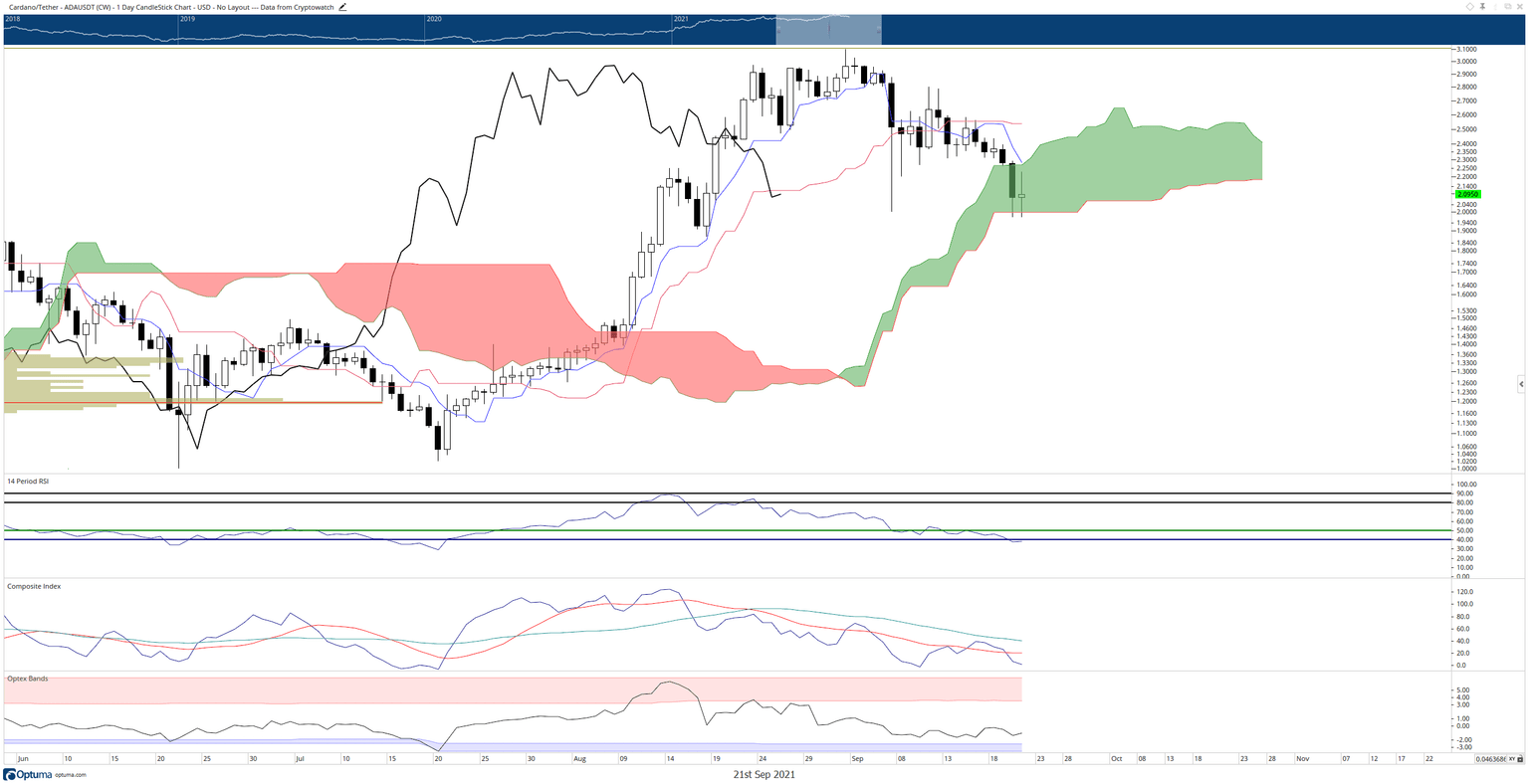

- Cardano price nose dives -13.7% on Monday and drops a further -7.1% on the Tuesday open.

- Bulls buy the dip at a shared support zone: the bottom of the Cloud (Senkou Span B) and the $2.00 psychological level.

- Bulls attempted a +7.2% gain from the Tuesday open but selling pressure returns.

Cardano price is currently trading inside the Cloud within the Ichimoku Kinko Hyo system. This is because the Cloud represents an area of volatility and indecision, conditions that aptly describe the current condition of Cardano.

Cardano price whipsaws bulls with a -13.7% move followed by a +13.1 recovery and then beginning a new -7.1% drop.

Cardano price action shows a textbook case of the trading phrase known as ‘catching a falling knife.’ That phrase describes bulls who enter a market at perceived lows after a violent move south has pushed the price to extremes. Of course, the danger of trying to catch a falling knife is that you can get cut. Bulls who thought the bottom is in for Cardano may find themselves getting sliced here.

There was noticeable relief in the mood of Cardano bull traders when support appeared at the $2.00 value area and then propelled Cardano price up to $2.22 – just $0.08 below the Monday open. After that, however, bulls found resistance just below the Tenkan-Sen ($2.28) and top of the Cloud/Senkou Span A ($1.27).

ADA/USD Daily Ichimoku Chart

Selling pressure has continued throughout the day, and Cardano price is close to trading negative for the day, adding another loss on the daily chart if that occurs. Bears need to push Cardano below the Cloud (Senkou Span B) and close below the Cloud to confirm a solid bearish continuation move below $1.99.

For bulls to counter and invalidate the present bearish momentum, Cardano price will have to close above $2.96 to restore a clear and undeniable bull market.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.