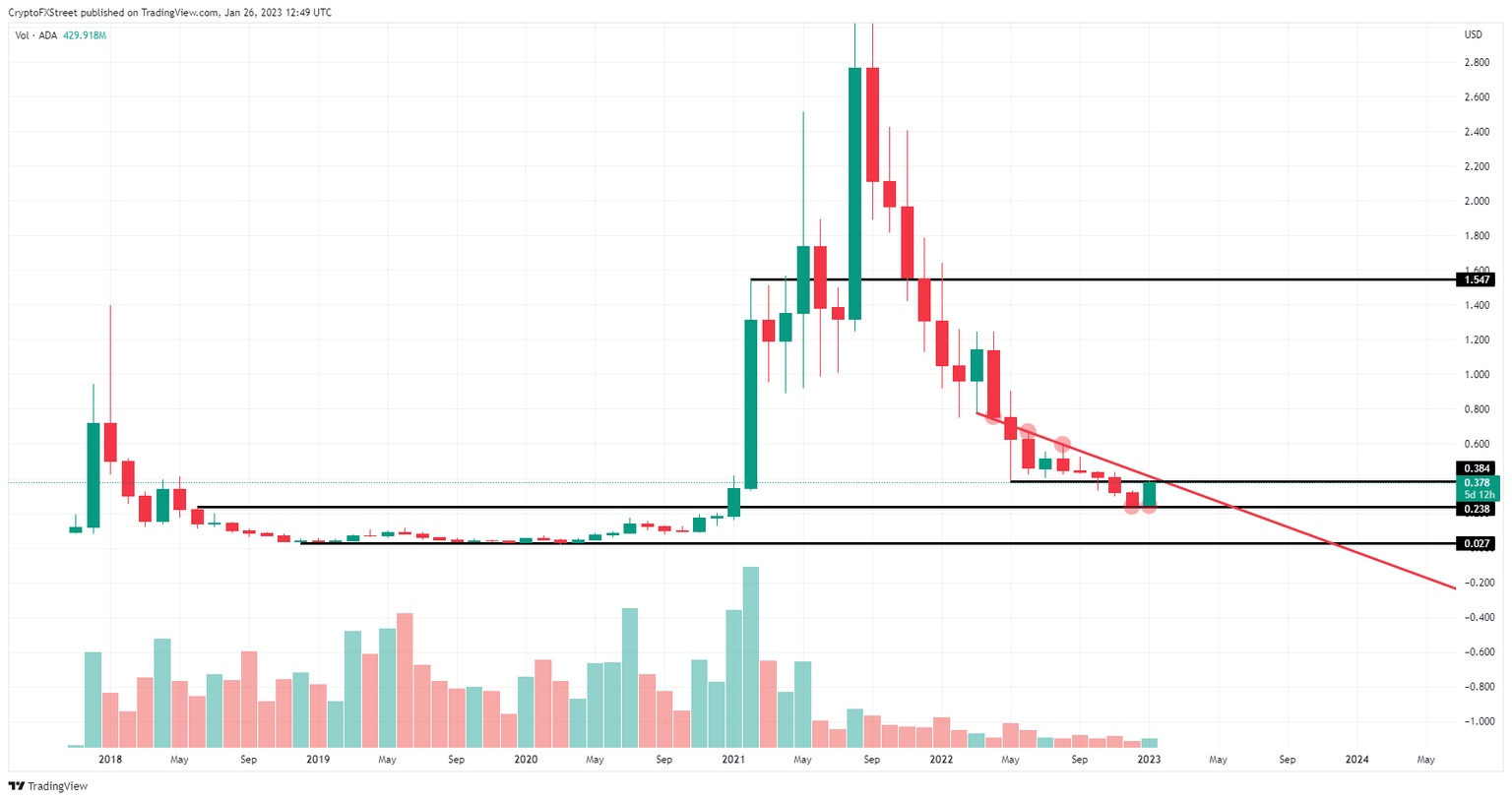

Cardano Price Forecast: If the volume does not return to normal, 2023 could be a lost year for ADA

- Cardano price sees bulls hitting a ceiling that will be hard to break.

- ADA traders have been ignoring several elements that were the cause of the 2022 turmoil and are now getting caught up with reality.

- Until May of this year, expect to see a sideways to lower path as trading volume is still down one-third of what it used to be.

Cardano (ADA) price has been advancing and looks ready to close January in the green. The only big question or caveat for that is if that will be against the two massive bearish caps that are lying above the price action at the moment on a broader time frame. With the underlying trade volume very thin, it can be debatable if that rally is as strong and supported as many traders would think.

Cardano price wants to be a giant with feet of clay

Cardano price is set to snap the losing streak that has been ongoing since August of last year. Elements triggering a constant sell-off were staggering high inflation worldwide and harsh rhetoric from central bankers that this inflation would not go away without pain for the underlying economy. As inflation has been coming down, markets have been rallying a bit too preemptively higher with the idea that inflation will go down in a straight line toward 2%, which would be unusual historically as hiccups along the way are the norm.

ADA price has not seen its volume restored to its normal trading level since 2018. A rally of this magnitude under such slim volume tells us that the rally has been made on loose screws and could break with the littlest shock: for example, a sudden inflation jump instead of a decline. Traders must be aware that with the massive caps at $0.384 and $0.40 and Cardano price up by the pivotal horizontal level and the red descending trend line, any further upside will need ample help from central banks, inflation going further down and geopolitical risks decreasing substantially.

ADA/USD monthly chart

Should volume start to pick up further, grow into February and March, and then break above the levels back to May of 2022, the case can be made that something substantial has changed. The rally is more broadly bought, and with a bigger volume behind it, it will be able to withstand better any market turmoil. The volume buffer would absorb any market shocks better, and it could more easily push price action above $0.84 with the next $1.54 level as the price target to reach for 2023.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.