Cardano Price Forecast: ADA boldly emerges, with higher prices anticipated

- Cardano price logs 33% gain last week, registering best week since the beginning of February.

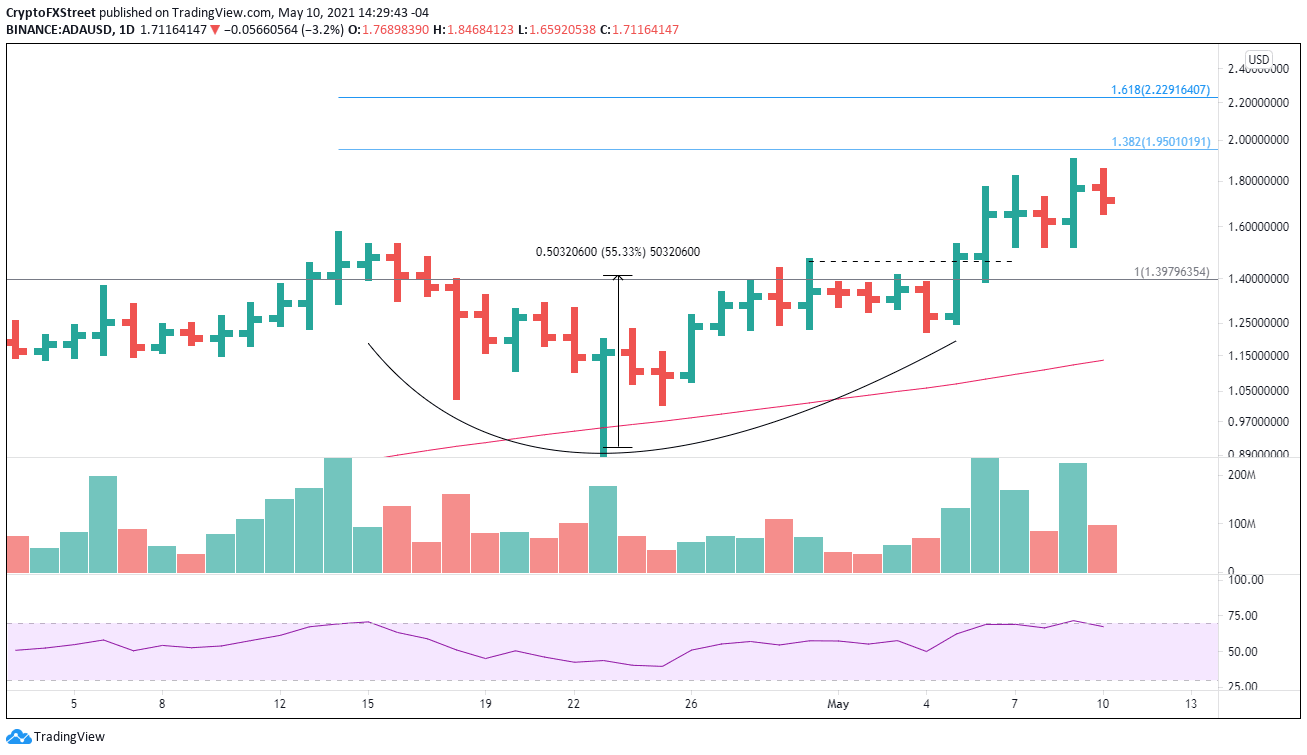

- Extraordinary gain lifts ADA close to the 138.2% Fibonacci extension.

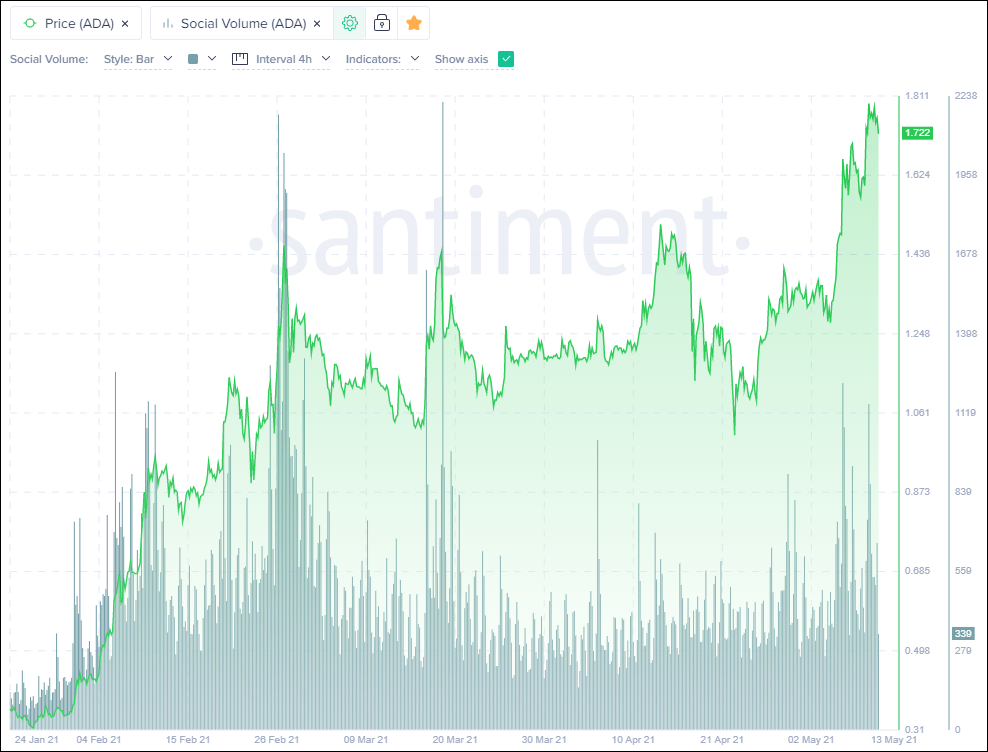

- Social media chatter intensifies but still well below the frenzy levels of March.

Cardano price kickstarted a new rally on May 5 with a breakout from a cup-with-handle base, rising above the longstanding trading range and setting new all-time highs. Since the beginning of February, it was the best week and puts ADA on pace for an additional 30% gain.

Cardano price rewards pattern savvy speculators

Since the breakout from the cup-with-handle base on May 5, Cardano price has rallied incrementally with notable spikes in volume on the positive days, consistent with a bullish scenario.

The measured move target for the base is $2.27, a gain of 55% from the handle high at $1.46 and 30% from the price at the time of writing. The target is slightly higher than the 161.8% extension of the April decline at $2.23.

Cardano price will need to break above the 138.2% Fibonacci extension of the April decline at $1.95 and, of course, the always challenging round numbers, in this case, $2.00.

ADA/USD daily chart

Cardano price could lose support and revert lower. The first necessary level is the 10-week simple moving average (SMA) at $1.30.

Cardano price strength captures social media attention.

According to the data from over 1000 crypto-related channel’s including Telegram groups, crypto reddits, discord groups and private traders chats, Cardano’s daily social volume has jumped during the past week. The increase in ADA mentions illustrates that the bullish price action is captivating the retail investor ranks.

However, it is essential to note that the rise in social mentions for ADA is still well below the feverish levels that accompanied the February and March highs, indicating that the Cardano price gains can continue before networks become saturated with the Cardano story.

Cardano related mentions on crypto social media

Breakouts from sustained trading ranges are prone to profit-taking as traders that bought previously failed range breakouts seek to cover their losses or accrue some profit for their patience. However, as long as the volume accumulation/distribution profile remains bullish, the pullbacks should be limited in percentage and duration.

Author

Sheldon McIntyre, CMT

Independent Analyst

Sheldon has 24 years of investment experience holding various positions in companies based in the United States and Chile. His core competencies include BRIC and G-10 equity markets, swing and position trading and technical analysis.