Cardano Price Analysis: ADA uptrend to $1.4 in jeopardy as support weakens

- Cardano uptrend at risk of total sabotage due to immense resistance at $0.92.

- Binance is rumored to have increased ADA fees by 400%, adding to the overhead pressure.

- Cardano must hold above the ascending channel’s middle boundary support to ensure market stability.

Cardano appears to be slowing its 460% rally from January 1. The upcoming smart contract token has recently hit a yearly high at $0.98. However, a correction came into the picture before ADA dealt with the seller congestion at $1. The correction is likely to continue if Cardano fails to break above a crucial resistance highlighted by the IOMAP model.

Cardano faces challenging resistance

The IOMAP chart by IntoTheBlock reveals that Cardano has run into a massive resistance that could either delay or sabotage the anticipated upswing to $1.4. This buyer congestion zone runs from $0.92 to $0.94. Here, nearly 38,000 addresses had previously bought approximately 3.7 billion ADA. It is doubtful that bulls will easily slice through the zone to make a higher high towards $1.4.

On the downside, the same IOMAP suggests that support has weakened, which means that Cardano risks a massive breakdown. The most formidable support area rests between $0.81 and $0.84. Here, around 33,700 addresses are profiting from the 1.15 billion ADA previously bought in the range.

Cardano IOMAP chart

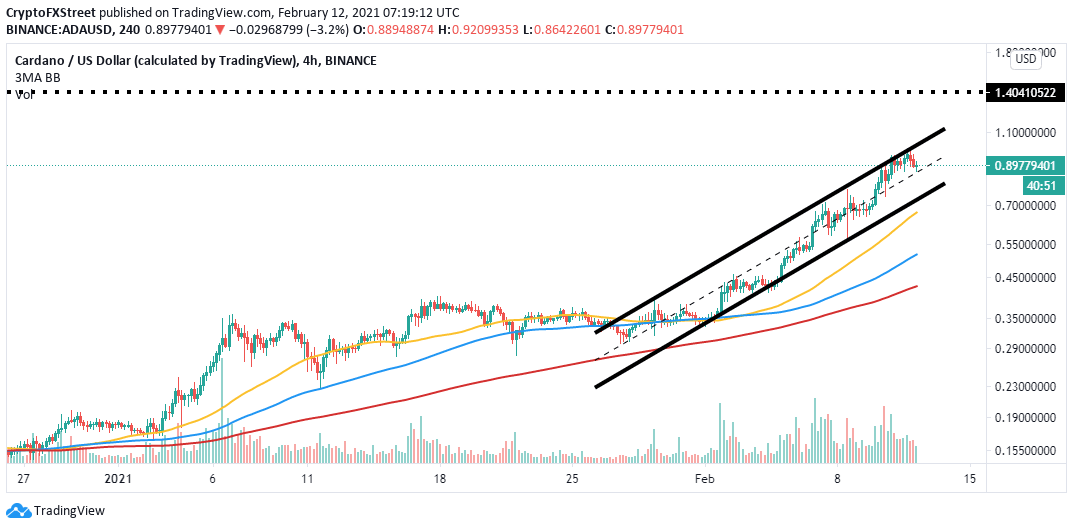

ADA is also trading above the ascending channel’s middle boundary. A reversal may come into the picture if the price fails to hold above this critical level. On the downside, the lower edge will come in handy to stop the declines. However, if push comes to shove, Cardano will be forced to seek refuge at the 50 Simple Moving Average around $0.7.

ADA/USD 4-hour chart

Binance increases ADA withdrawal fees by 400%

A discussion has emerged on Reddit on why Binance may have increased Cardano’s withdrawal fees by 400%. Before the increase, a withdrawal transaction on the platform is said to have cost one ADA token. However, traders on Reddit are lamenting that the fee has shot up to three ADA and up to five ADA tokens.

While the fees have already been reduced to two ADA tokens at the time of writing, this confusion could be adding to the selling pressure. Note that Binance has not confirmed this information.

Looking at the side of the picture

If ADA manages to flip the massive IOMAP barrier into the support, the pessimistic outlook would be thrown out the window. Simultaneously, holding above the ascending parallel channel’s middle boundary will ensure stability prevails, thus avoiding the losses. A spike above $1 would trigger multiple buy orders adding to the force supporting the uptrend toward all-time highs.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren

-637487115462629139.png&w=1536&q=95)