Cardano Price Prediction: ADA to rally another 175% as resistance weakens

- Cardano price continues its 2,300% bull run becoming the fourth-largest cryptocurrency by market cap.

- ADA has sliced through the $0.75 resistance level hinting at another leg-up on the horizon.

- On-chain metrics note a strong growth in user adoption, supporting the bullish thesis.

Cardano price has risen a whopping 2,300% since the COVID-fuelled market crash in March 2020. The extraordinary bull run pushed the so-called "Ethereum killer" higher in the market capitalization rankings.

Now, ADA is the fourth-largest cryptocurrency in the world as it gains visibility as a contender in the smart contracts industry.

Cardano price aims for higher highs

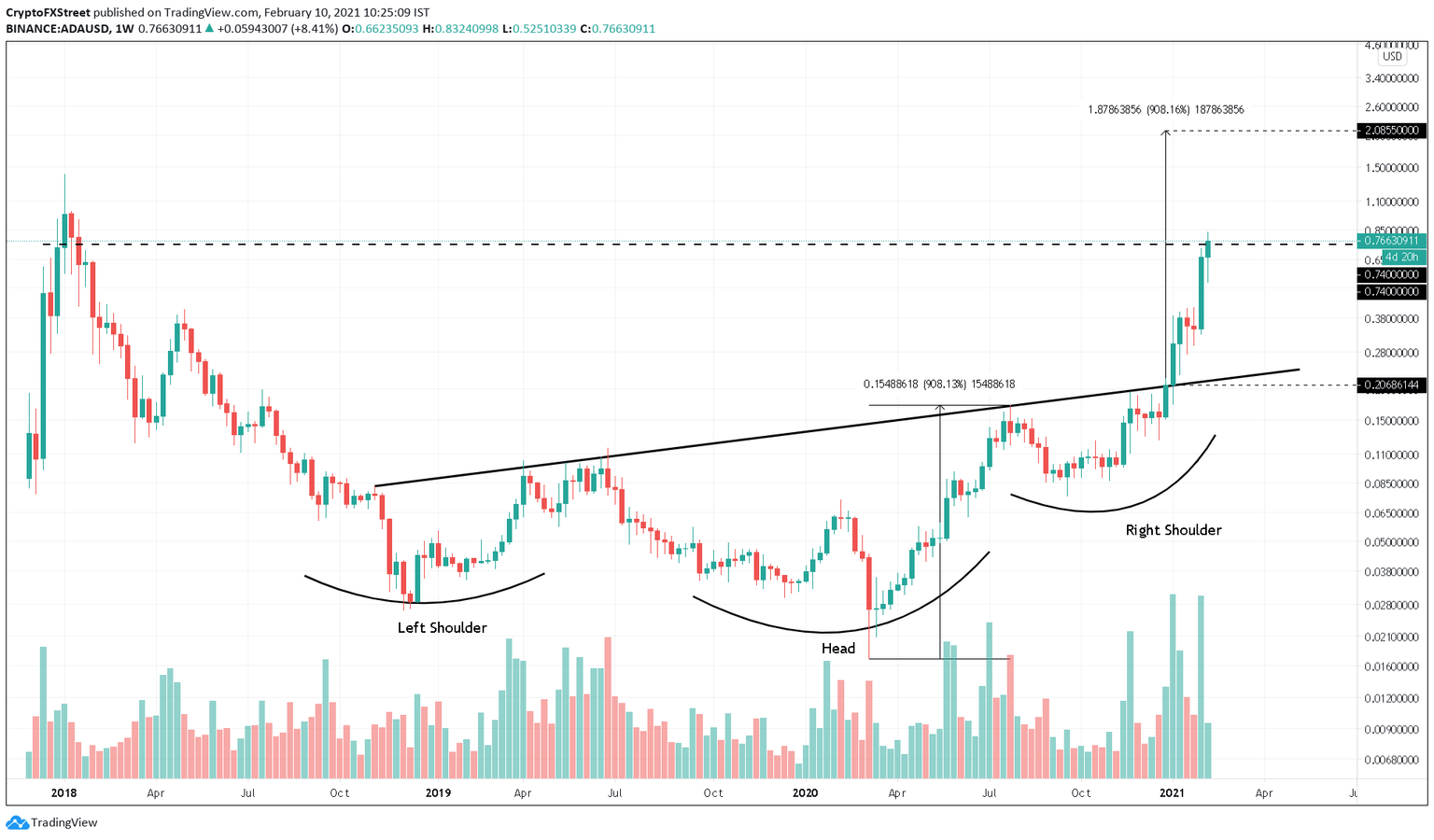

Cardano price confirmed a breakout of an inverse head and shoulder after its close above the pattern’s neckline on January 4. Since then, ADA has witnessed a 275% upswing in less than 35 days.

The reversal pattern forecasts that Cardano price could rise by another 170% to hit a target at $2.00.

ADA/USD 1-week chart

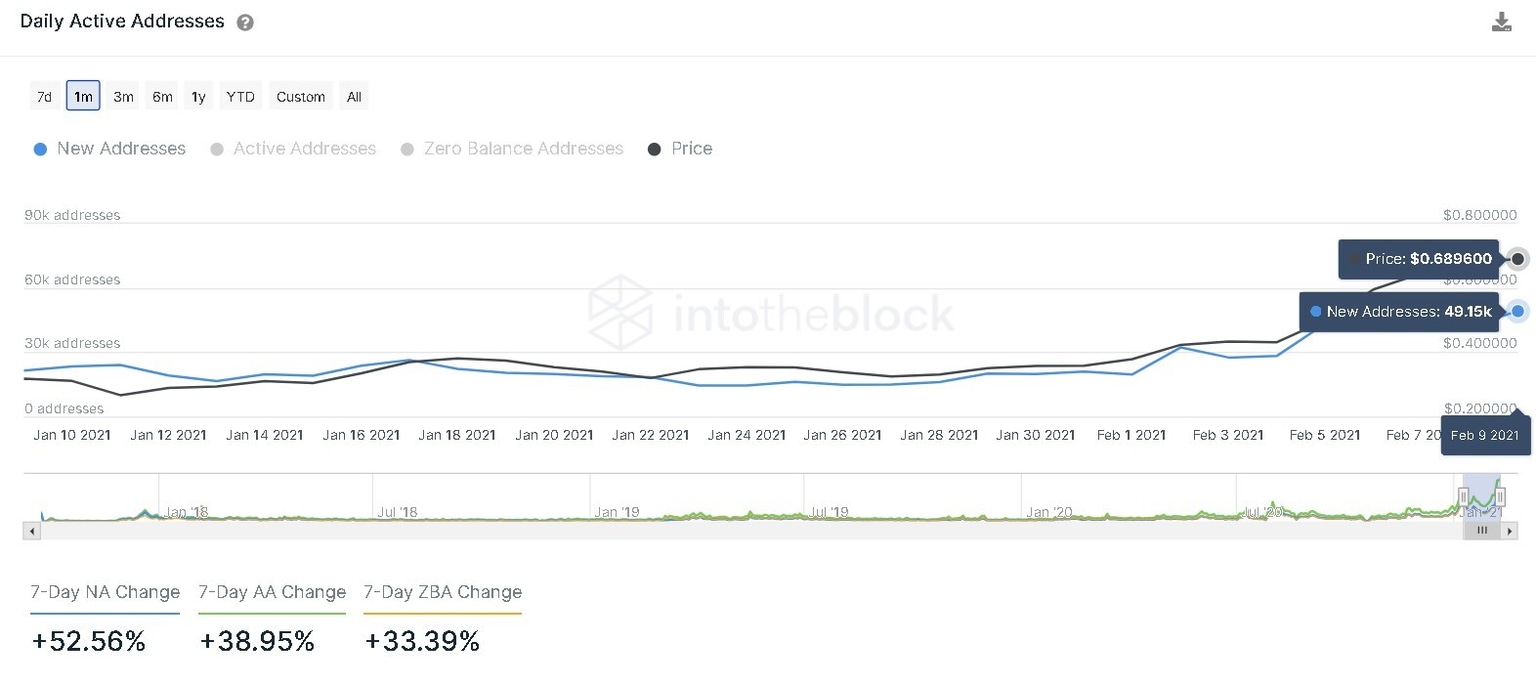

On-chain data adds credence to the bullish thesis. Indeed, Cardano’s network has seen a 130% increase in new users over the last month. Almost 50,000 new ADA addresses were created on February 9 alone.

The sudden spike in network growth indicates market participants are confident in Cardano’s future and don’t mind buying it at the current levels as they expect further growth.

Cardano Daily New Addresses chart

While demand is rampant, IntoTheBlock's In/Out of the Money Around Price (IOMAP) shows little to no resistance barriers ahead of Cardano price that will prevent it from achieving its upside potential.

Instead, the smart contracts token sits on top of stable support at $0.68. Here, 31,000 addresses are holding 3 billion ADA.

Cardano IOMAP chart

It is worth noting that a breach of the $0.68 support barrier could invalidate the bullish outlook. In such a case, investors may expect a drop to $0.42.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.