Can this support level protect Solana price from a 30% crash

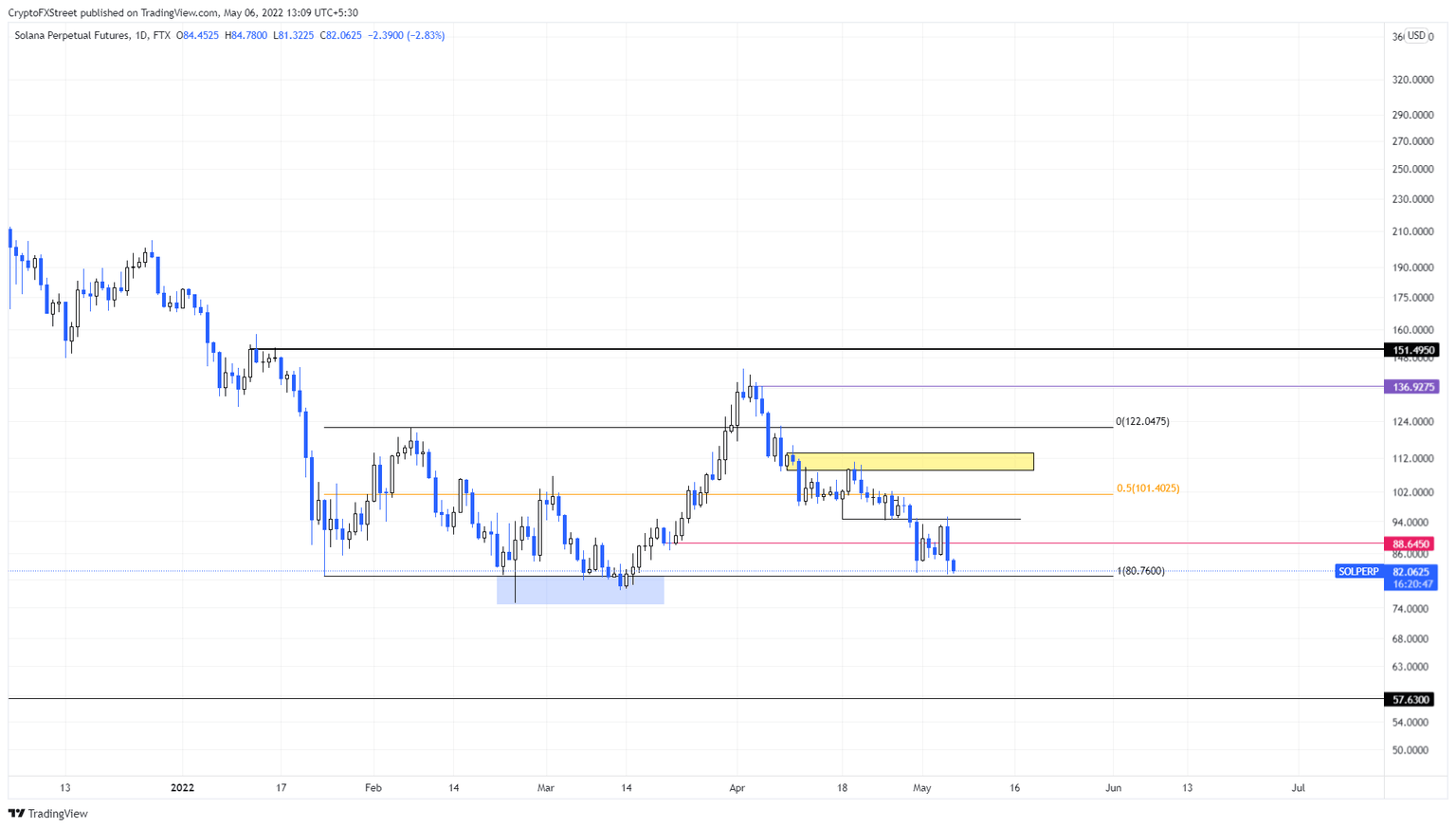

- Solana price is close to touching the range low at $80, a breakdown of which could lead to a steep correction.

- A failure to hold above $80 will lead to a 28% crash to $57.63.

- A daily candlestick close above $94.64 will invalidate the bearish thesis.

Solana price shows that the buyers are struggling due to the recent downswing. A further spike in selling pressure could trigger a downtrend that could push it past an immediate support level and flip it into a hurdle in its path.

Solana price at inflection point

Solana price range, stretching from $80 to $121 is facing another retest. This move comes after the recent sweep above the range high on April 1. Since then, SOL has nosedived roughly 43% and is currently retesting the lower limit at $80.

Although Solana price has tagged this hurdle on January 24 and swept below it on February 24, this downswing comes at a time when Bitcoin and the rest of the market are facing immense selling pressure.

A failure to hold above the $80 support level, therefore, will prove costly for bulls and SOL holders. A breakdown of the said level will trigger a 28% crash to the next foothold at $57. Here, buyers could accumulate SOL at a discount and trigger a new leg–up.

SOL/USDT 1-day chart

On the other hand, a spike in buying pressure that propels SOL to produce a daily candlestick close above $94.64 will create a temporary higher high. This development will skew the odds in the bulls’ favor and invalidate the bearish thesis. In this case, Solana price might make a run for the $108 to $113 supply zone.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.