Bitcoin will hit $340K if BTC price repeats 2016 halving cycle pattern

A look at the difference between halving cycle highs, lows and halving prices delivers huge BTC price targets which their creator cautions are “hopium.”

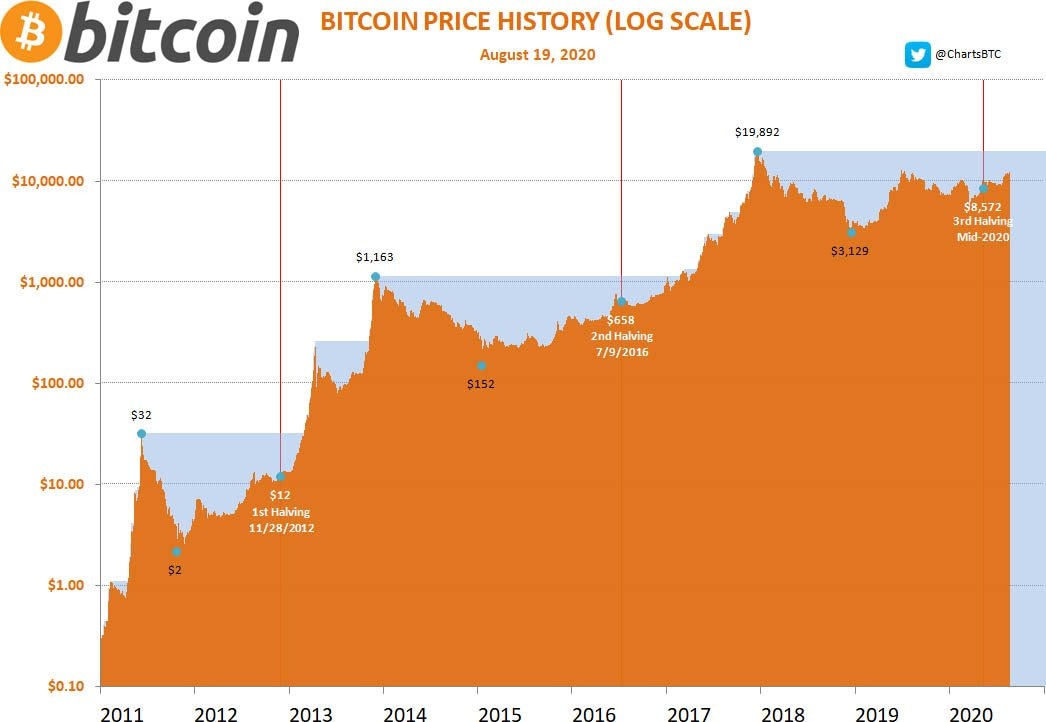

Bitcoin (BTC) needs to hit $340,000 just to match its performance from its last halving cycle, data shows.

In a Twitter series on Aug. 20, popular statistics resource ChartsBTC noted that Bitcoin still has huge room for growth at current levels of $11,700.

Halving multiples give up to $1.6 million BTC price

Comparing lows, highs and halving prices from its two previous halving cycles, ChartsBTC put the difference between peaks at 36x for the 2012 cycle and 17x for the 2016 cycle.

In order to repeat even the more modest cycle’s success, BTC/USD would have to trade at $340,000. 36x from last cycle’s high — Bitcoin’s all-time record of $20,000 — comes to $720,000.

Comparing cycle lows, the results are even more dramatic — the smallest jump of 130x from the previous cycle would deliver a Bitcoin price of $400,000.

Running the same diagnosis for Bitcoin’s price at the time of its halving events, the price target is $250,000.

“The multiples from prior cycles applied to the current one arrive at highs between $250k and $1.6M in the next 18 months,” ChartsBTC summarized.

The account noted that while the math adds up, there is little evidence which demands that such levels really do appear within the given timeframe.

“While this may sound exciting, it's just hopium,” it added.

“The prior highs and lows won't dictate the future.”

Bitcoin price chart with halving data. Source: ChartsBTC/ Twitter

Parabolic numbers abound in bullish Bitcoin market

Bitcoin investors are nonetheless primed for good news in current conditions as 30% monthly gains give bulls the firm upper hand.

As Cointelegraph reported, the outlook seems rosy despite a modest pullback costing hodlers shaky $12,000 support once again.

Previously, Vijay Boyapati, author of “The Memory Pool,” delivered his own halving-based price prognosis. Following the course of the 2016 cycle, which Bitcoin is currently frontronning, a new all-time price high should appear before the end of 2020.

The current third halving cycle should also deliver a peak price similar to what ChartsBTC hypothesized.

“If we were to follow the 2016/17 trajectory (we're ahead of schedule right now), the peak of the cycle would occur on October 19th, 2021 and the peak price would be approximately... $325,000,” Boyapati concluded.

Quant analyst PlanB has argued that an average price of $288,000 and a peak of $576,000 or more is possible between now and 2024, the end of the current halving cycle.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.