Bitcoin Weekly Forecast: Elon Musk endorses Bitcoin while the ECB says investors may “lose all their money”

- Tesla CEO, Elon Musk has finally tweeted about Bitcoin sending the digital asset 30% higher.

- Gabriel Makhlouf from the European Central Bank has stated that Bitcoin investors should be prepared to lose everything.

- Despite the warning, the flagship cryptocurrency has continued to rise to new daily highs.

In the past 24 hours, a lot has happened in the cryptocurrency market. First, the WallStreetBets Reddit group announced an upcoming pump on DogeCoin which rallied by more than 1,000%. Shortly after, Elon Musk changed his Twitter bio to #Bitcoin and followed up with the next tweet.

In retrospect, it was inevitable

— Elon Musk (@elonmusk) January 29, 2021

The cryptocurrency market in the past 24 hours

Since the massive pump of Dogecoin followed by Bitcoin’s rally the total market capitalization has increased by more than $100 billion, reaching $1.044 trillion again. Dogecoin was ranked 10th by market capitalization for a while, beating Binance Coin and Stellar.

Elon Musk hasn’t tweeted anything else after changing his bio to #Bitcoin, but Gabriel Makhlouf, governing council of the European Central Bank did make a public statement warning investors that they could lose everything, adding:

Personally, I’m not sure why people invest in those sorts of assets, but they see them as assets clearly. Our role is to make sure that consumers are protected.

Of course, this was received with a ton of criticism from most retail investors who are angry about the most recent events with the trading app Robinhood which stopped retail investors from further buying GameStop stocks.

Bitcoin price could go in either direction, says veteran trader Peter Brandt

In his most recent report about Bitcoin, Peter Brandt states that Bitcoin price could go into many directions. However, thanks to the recent pump from Elon Musk’s tweet, Bitcoin has broken out of several potential patterns on the daily chart.

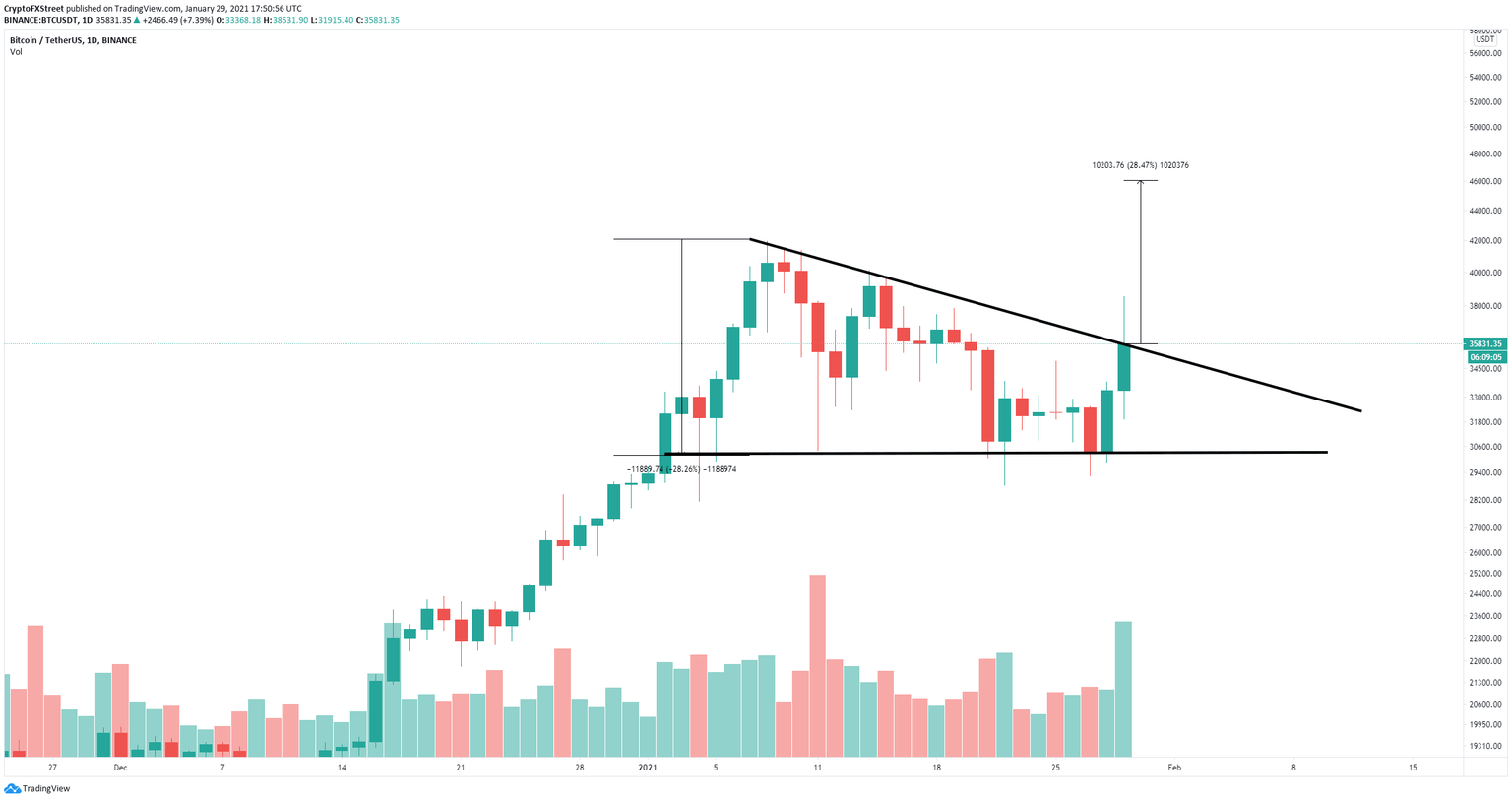

BTC/USD daily chart

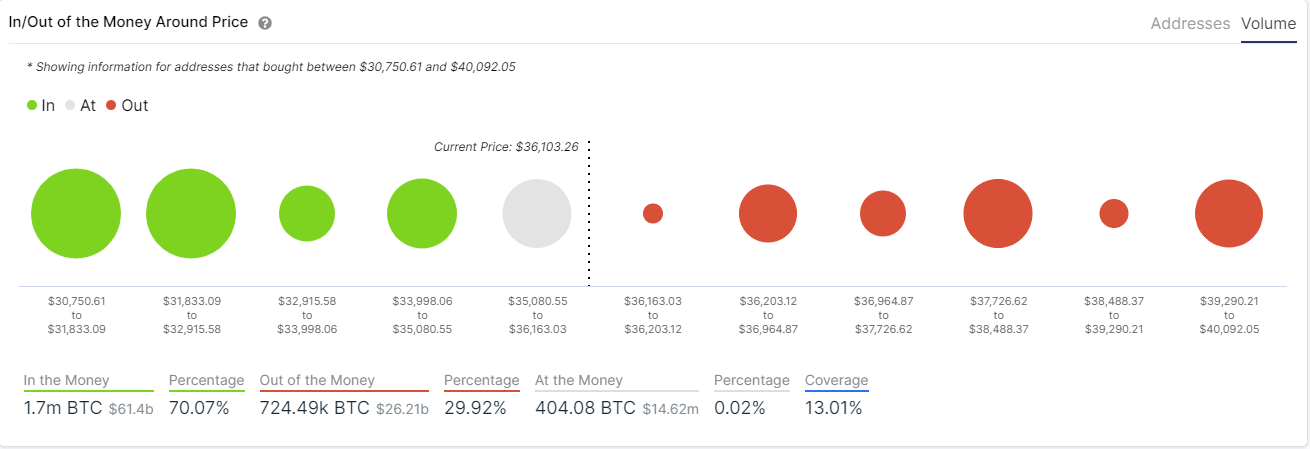

On the daily chart, The descending triangle pattern has broken bullish with a price target of $46,000. According to the In/Out of the Money Around Price (IOMAP) model, the next significant resistance area is located between $37,700 and $38,480 with 248,000 BTC in volume.

BTC IOMAP chart

There is a lot of support below $36,000. If the bulls fail to hold the range between $34,000 and $35,000, Bitcoin price can quickly fall towards $33,000 which is the next most significant support point according to the IOMAP.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.